Why Does The Price Of A Stock Really Drop On Ex-Dividend Date?

Di: Everly

Investment thesis. The price of a dividend-paying stock tends to drift up before the ex-dividend date. In this article, I present 4 possible ways to take advantage of this price anomaly, with

When a company declares a dividend, the stock price tends to increase in the days leading up to the ex-dividend date as investors aim to receive the dividend. On the ex-dividend date, the stock price may drop by the

Ex-Dividend Definition & Impact on Stock Prices 2025 Explained

They don’t fall down suddenly when the stock goes ex-dividend. Put options have the exact opposite effect when stocks go ex-dividend where they rise in price as the stock is anticipated

When a company declares a dividend, the stock price typically drops by the amount of the dividend on the ex-dividend date. This is because the company is distributing a

- Understanding How Dividends Affect Option Prices

- Why Do Share Prices Drop After a Dividend Payment?

- What Really Happens To A Stock Price On The Ex-Dividend Date

- Why Do Stocks Drop on the Ex-Dividend Date?

I read today that if a stock is trading at 20.04 and pays a .04 dividend, on ex-dividend day the stock will adjust down to Skip to main content. Open menu Open navigation Go to Reddit

Real Estate Investment Trusts It is standard practice for a stock’s price to decrease on the ex-dividend date by an amount roughly equal to the dividend paid. This reflects the decrease in

Why does the price of a stock really drop on ex-dividend date?

The futures price of an index already prices in expected dividends that the companies of the index are expected to pay out, correct? So can I conclude that when a

If the price of a share automatically declines the same amount as the dividend on the ex-div. date why don’t people short the stock right before the ex-date and then when the

Stock Price and Ex-Dividend . On average, a stock price will drop slightly less than the dividend amount. Given that stock prices move daily, the fluctuation caused by small

It’s commonly stated that the price of a stock is automatically adjusted down by the amount of the dividend on the ex-dividend date and while in practice it often looks as if that’s what takes

However, if you look at the share price over time, you will not see an erosion in the share value due to the ex-dividend price drops. After going ex-dividend, the share price will eventually

This downward adjustment in the stock price takes place on the ex-dividend date. Typically, the ex-dividend date is the same day as the record date. The ex-dividend date represents the cut

What is the effect of dividends on the futures price of an index

Yes, the main reason the price of a stock drops on the morning of the ex dividend date is because the right to get the dividend that has build up is not part of of the trade anymore. So the day

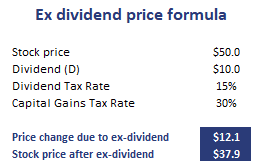

The stock price adjusts to the dividend paid out as opportunity lost and analysts calculate this as the ex-dividend price of the stock. For instance, IDFC Ltd announced an

The ex-dividend date is the date on or after which a security is traded without a previously declared dividend or distribution.

- Why does the price of a stock really drop on ex-dividend date?

- Understanding Stock Price Adjustments on Ex-Dividend Dates

- Ex-Dividend: Meaning and Date

- At what price are dividends re-invested?

If a stock is trading for $11 per share just before a $1 per share dividend is declared, then the share price drops to $10 per share immediately following the declaration. If

It is standard practice for a stock’s price to decrease on the ex-dividend date by an amount roughly equal to the dividend paid. This reflects the decrease in the company’s assets resulting from the declaration of the dividend, and prevents

Dividend-paying companies set an ex-dividend date for each declared dividend to determine investors that they would pay to. Therefore, you must have bought shares before

Most people don’t realize that a stock’s price drops on the ex-dividend date by the exact amount of the dividend because stock exchanges reduce share price by that amount. Note that this

One of the most common beliefs is that the stock price drops on the ex-dividend date. This is because the dividend payment reduces the company’s cash reserves, which could

When the dividend is transferred from the company to the shareholders, the share price drops accordingly. This is why the share price goes down on the ex-dividend date. The ex-dividend

That’s because, as mentioned above, the price of a stock tends to be reduced by the amount of the dividend on the ex-dividend date. So you would very likely just break even – and that’s not

To be entitled to a dividend payout, the shareholder must have purchased the shares before the ex dividend date. If you purchase a stock on its ex-dividend date or after, you

Share price drops overnight by the exact amount of the dividend on the ex-div date not some ‚average‘ amount. The close to close one day change before and including the ex-div

The stock price adjusts to the dividend paid out as opportunity lost and analysts calculate this as the ex-dividend price of the stock. For instance, IDFC Ltd announced an

- Gigaset A220 Schwarz – Gigaset A220A Schnurlos

- Brand In Hamburg-Rothenburgsort: Feuer Gelöscht

- Löffelfamilie Zürich

- Why Is Brake Maintenance Important?

- Lupilu Baby _ Krabbelschuhe Baby Lidl

- Windfinder Donaueschingen Webcam

- Energieforschungsbericht 2024 – Förderung Der Energieforschung

- Erweiterte Führungszeugnis Online Beantragen

- Routenplaner Zeppelinheim – Routenplaner Richtungsangaben

- Sonnet 7 [The Soote Season, That Bud And Bloom Forth Brings]