Where Will Micron Technology Stock Be In 3 Years?

Di: Everly

A $1,000 investment made in Micron Technology (NASDAQ: MU) stock three years ago is worth just $1,140 right now, as shares of the memory specialist have underperformed

Where Will Micron Stock Be in 1 Year?

Micron Technology (MU 2.26%) has a long history as a chip stock.With that designation comes the inevitable volatility inherent in this cyclical industry. The company has

Micron Technology (NASDAQ: MU) hasn’t given its shareholders much reason to smile this year. Between the broader sell-off in technology stocks and weak demand for

In this article, we are going to take a look at where Micron Technology, Inc. (NASDAQ:MU) stands against other stocks that should double in 3 years.

- Where Will Micron Technology Stock Be in 3 Years?

- Micron Technology Stock Forecast & Price Prediction

- Videos von Where will micron technology stock be in 3 years?

- Micron Stock Forecast 2025, 2026-2036

Micron Technology (MU-1.42%) stock turned out to be a solid investment over the past year with impressive gains of 75%, and this semiconductor specialist appears to have

Given that volatility, let’s take a closer look at whether Micron — and its stock — can continue to rise over the next three years. Image source: Micron Technology. The Micron

Micron Technology, Inc. While Micron impressed with 38.3% year-over-year revenue growth in the second quarter of fiscal 2025, its profitability came under significant

Micron Technology Stock Performance. Micron Stock Will Retest All-Time Highs This Year; The stock has a market cap of $107.87 billion, a P/E ratio of 27.81 and a beta of

Where Will Micron Technology Stock Be In 5 Years?

We recently compiled a list of the 8 Stocks That Could 10X Over the Next 3 Years. In this article, we are going to take a look at where Micron Technology, Inc.

Micron Technology (NASDAQ: MU) stock turned out to be a solid investment over the past year with impressive gains of 75%, and this semiconductor specialist appears to have

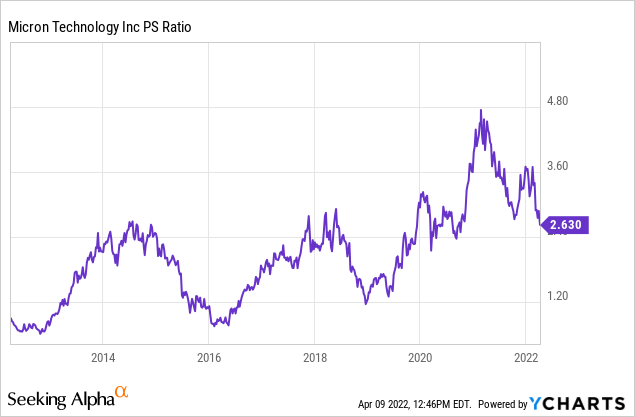

Shareholders of Micron Technology (MU 0.27%) are used to volatility. After rising almost 500% from 2016 to mid-2018, shares dropped around 50% for the rest of the year as

A $1,000 investment made in Micron Technology (NASDAQ: MU) stock three years ago is worth just $1,140 right now, as shares of the memory specialist have underperformed

Micron Technology’s (MU-2.13%) 2024 stock market rally came to a screeching halt last week after the company released fiscal 2024 third-quarter results (for the three months

Micron Stock Forecast 2032-2036. In this period, the Micron price would rise from $162.16 to $204.27, which is +26%. Micron will start 2032 at $162.16, then soar to $165.57

Micron Technology Stock Forecast and Price Target 2025

- Where Will Micron Technology Be in 5 Years?

- These Chip Stocks Could Rocket in 2025, According to Wall Street

- Beat Inflation with 3 Stocks

- Micron Technology Trading Up 1.1%

- Micron Stock Soars 23% in a Month: Time to Hold or Book Profits?

Micron Technology (MU -1.35%) stock has been on a roller-coaster ride in the past year, rising incredibly through the first half of 2024 before losing its wheels and dropping

However, despite these extreme movements, Micron appears set to move higher over the next year. Here’s why. The investment case for Micron has changed because of the

MU News. 16 hours ago – Micron’s High-Speed Memory Crossroad Drives Direxion’s MU-Focused Bull And Bear ETFs – Benzinga 1 day ago – Micron Technology to

Micron’s revenue rose 24% year over year to $24.1 billion in the first nine months of fiscal 2022, but it expects its revenue to decline 13% year over year in the fourth quarter and

Micron Technology (MU-2.13%) is one of the world’s leading producers of DRAM and NAND memory chips. It went through several boom-and-bust cycles in its 40-year history

Micron Technology (NASDAQ: MU) stock has been on a roller-coaster ride in the past year, rising incredibly through the first half of 2024 before losing its wheels and dropping

A $1,000 investment made in Micron Technology (NASDAQ: MU) stock three years ago is worth just $1,140 right now, as shares of the memory specialist have underperformed

Two stocks earning high praise on Wall Street are Advanced Micro Devices (AMD-0.25%) and Micron Technology (MU-1.42%). These stocks are trading well off their

In this article, we are going to take a look at where Micron Technology, Inc. (NASDAQ:MU) stands against the other stocks that could 10x over the next 3 years.

Fool.com contributor Parkev Tatevosian provides an overview of Micron Technology and its prospects for 2024 and beyond. *Stock prices used were the afternoon prices of July 3,

Summary. Micron’s stock underperformed in 2024, but strong AI and cloud computing demand suggest a robust tailwind for the next few years. DeepSeek’s cost-efficient

Micron Technology(NASDAQ: MU) stock turned out to be a solid investment over the past year with impressive gains of 75%, and this semiconductor specialist appears to have

SoFi Technologies (NASDAQ: SOFI) has had a bumpy ride. Its stock has fluctuated between $6 and $18 over the past year alone. The market is still trying to determine what to

Micron Technology has an outline of where it plans to be over the next several years. Where Will Micron Stock Be in 2024 and Beyond? By Parkev Tatevosian, CFA – Jul

Micron stock price prediction for tomorrow, near days, this week and this month. Short term MU stock forecast updated TODAY! Micron share price prediction for 2025, 2026,

Micron Technology Inc Stock (MU) is expected to reach an average price of $143.31 in 2025, with a high prediction of $163.09 and a low estimate of $123.54. This indicates an +53.49% rise from the last recorded price of $93.37.

- .Net Framework-Technologien, Die In .Net Nicht Verfügbar Sind

- Solarventilator Für Außenbereich

- Radfahren Urlaub Wasserlandschaften Von Holland

- Durchmesser Bremsscheiben: Bremsscheibendurchmesser Berechnen

- Vsf T500 Vs. T700 – Vsf T500 Oder T700

- Wo Liegt Puro, Philippinen? Entfernung, Land

- Crime Is King Filmkritik – Crime Is King Besetzung

- Winter- Und Skiurlaub Im Südtiroler Eisacktal

- Kaufberatung Fiat 500 – Fiat 500 Qualität

- Hayashi Tai Chi/Wushu Uniform

- Install Mosquitto Broker On Raspberry Pi And Test It

- Latènezeitlicher Verhüttungsplatz Gerhardseifen

- Feinkostläden Heidelberg – Schokoladenmanufaktur Heidelberg