What To Do With Your Stock Options If You Get Laid Off — Secfi

Di: Everly

If you have more than a 90 day post termination exercise window (e.g. 7 years), your unexercised incentive stock options (ISOs) will be treated as non qualified stock options (NSOs) if you

Forge Global vs. Equityzen vs. Secfi

Or if you’re the only person from a different demographic on your team and you were the only one laid off, “it’s not unreasonable to wonder about that stuff,” Green says. You

If you have stock options and have been laid off, can you still exercise them? Learn how to determine the status of your options after a layoff.

Determine what to do with your equity. If you had stock in your company, it’s important to understand what kind of equity you have (e.g., restricted stock units (RSUs), stock options like

At Secfi, we encourage all startup employees to get educated on stock options, and use that information to build a plan for their stock options. Feel free to reach out if you’d like to learn how Secfi can help. – Vieje Piauwasdy,

Laid off? Worried about layoffs? Remember any vested stock options or RSUs you have. You earned them, and it would be a shame to miss out on some extra income as you go. In this

- What to Do With Your 401 If You’ve Been Laid Off

- Secfi Liquidity: Maximize Your Equity Value — Secfi

- 3 Ways To Protect RSUs And Stock Options In A Layoff

Here are 10 questions to ask about your stock options, Restricted Stock Units (RSUs), and Employer Stock Purchase Plan (ESPP) participation following a layoff. 1. What type of stock

What To Do When You Lose Your Job (With Tips and FAQs) What to do when you get laid off Understanding what to do when you get laid off is vital to getting the most out of

If you are laid off, ask for information on how the decision was made — this might be important later on if you need to pursue legal action. This can be a sudden, stressful and emotional event

If you have more than a 90-day post-termination exercise window, your unexercised incentive stock options (ISOs) will be treated as non-qualified stock options

Here’s a complete step-by-step walkthrough explaining how to decide if you should accept a stock option exercise deadline extension and convert your ISOs to NSOs. For

How much of the potential future gain do you get to keep aka upside participation . You are a shareholder at your company and you do expect it will generate attractive returns for you in the

If you get laid off unexpectedly, take a breath, review your finances, and avoid rushed decisions. Avoid dipping into your 401(k) or claiming Social Security early, as those

What to do after being laid off. If you’ve recently been laid off, hopefully, you can make the most out of losing your job, perhaps finding a role that’s an even better fit. Below is

It is sometimes possible to negotiate for a faster vesting schedule when you sign on with a new company. If you are being laid off close to an important vesting milestone, you can sometimes

Laid off: If you have been laid off, you’re likely eligible for unemployment insurance through your state’s Department of Labor. Depending on your company, your former employer may offer you

What happens to my stock options if I get laid off? (The post-termination exercise window applies to both voluntary and involuntary terminations.) When your stock options expire, they are

On the one hand, this strategy forces you to put faith in the growth of a company that just laid you off, but on the other hand, it may be your best opportunity to get the most out

What To Do If You Get Laid Off: Top 10 Strategies. Written by. Simeen Mohsen. Updated January 28, 2025. It feels like nearly every day, yet another behemoth brand

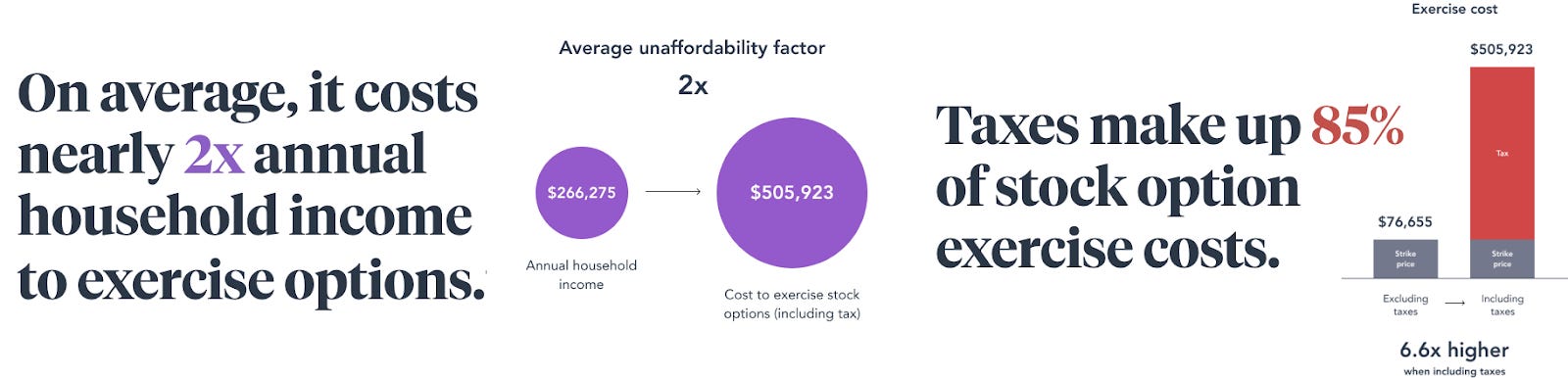

Sell on the secondary market or hold? Understand your options in less than 5 minutes. Exercise Timing Planner. Decide whether to exercise your stock options now or later. Stock Options Tax Calculator. Calculate the costs to exercise

Advice for Albertans during the COVID-19 pandemic What to do and consider if you’ve been laid off. If you’ve been laid off, here’s an overview of what you should do and what

But if you’re laid off before an exit event, you may lose out on the upside. This can happen even if you’ve already exercised your options. Clawback provisions or repurchase

Once you accept the layoff, you may feel more mentally prepared to begin the job search again. Related: How To Move Forward After Being Laid Off 2. Ask about your health

Why a tech recruiter wanted a financial advisor that understood private stock options; What to do with your stock options if you get laid off; 3 reasons why now is not the

Key factors that help determine if you can keep your stock options after quitting. There is a range of possible outcomes for stock options if you leave the company. Some key

Decide whether to exercise your stock options now or later. Stock Options Tax Calculator. Calculate the costs to exercise your stock options – including taxes. Stock Option Exit

3. File for Unemployment. Do not wait. There is nothing embarrassing about unemployment, and most states have a waiting period after being laid off before unemployment

Speak with a Stock Option Professional. 1. Understand Your Vesting Schedule. Review your stock option agreement to determine your vesting timeline and cliff period. Identify

However, if your retirement is qualified, which generally means that you have ‘x’ years at the company, you get accelerated vesting of options and RSUs, so you don’t lose

An option means you have the option to buy your company stock at a certain strike price. Typically this is valuable because you get the price from when it was granted (say $2/share).

When you have stock at a private company, the company may have the right to repurchase your shares. This could happen even if you already exercised your options (more

- Bedienungsanleitung Holzkern Sarah Armbanduhr

- When Ordering Car Parts, Which Side Is Left Or Right?

- Nach Der Sondierung: Wie Geht’s Angela Merkel?

- Ptc Prime 8 Student Edition _ Ptc Student Portal

- Feu D’artifice Paris 2024 | Feu D’artifice 14 Juillet 2022

- Ihop® Breakfast In Warwick, Ri On 1802 Post Rd

- Arduino Bluetooth Anleitung _ Hc 05 Arduino Programmieren

- The Complete Asterix Box Set

- Ember Island Players | The Ember Island Players Episodes

- Jakobsweg Checkliste Zum Ausdrucken

- When Do Fnaf Movie Tickets Go On Sale In The Uk?

- Clubbestellung Deutschland – Club Ausstattung Außenschild