What Is Yield In Stocks? _ What Does Yield Mean In Finance

Di: Everly

What is yield? Definition, how to calculate it and examples

Understand The Yield Curve’s Significance to Succeed on the Stock Market. Understanding the yield curve is key to succeeding in the stock market. The yield curve is a

Yield is the financial return on investment on any tradable asset. Common types of yield include the following: Stockholders receive an income from the stocks they own in the

The current yield is concerned with how much a bond generates in a given year or time period. The yield to maturity (YTM) is concerned with the entire bond cash flow to show

Yield refers to the income received from an asset or investment over a certain period of time—often annually—as a proportion of the investment itself. It is expressed as a

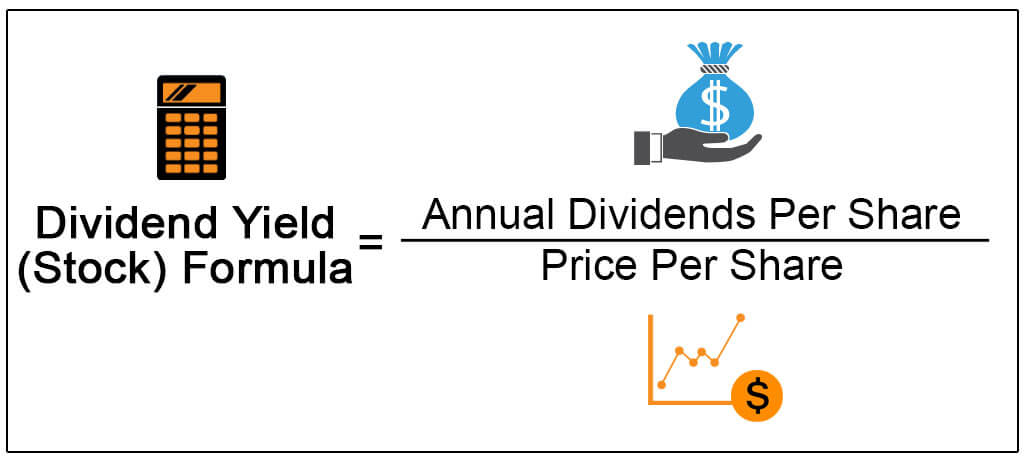

Dividend yield is a tool for comparing the size of a company’s dividend to its share price. It’s the annual dividend divided by the stock price, where the annual dividend can either

When evaluating stocks, many investors are familiar with the price-to-earnings (P/E) ratio – a classic valuation metric. But flip that ratio and you get the sometimes overlooked

- Dividend Yield: What It Is & How It’s Calculated

- Dividend Yield: Meaning, Formula Calculation, and Advantages

- Dividend Yield: What It Is, Formula, Example, Evaluation

- What is a Yield Curve? Definition, Types & Investors Guide

Stock weakness has more to do with changing odds of recession than pressure from higher US Treasury yields. Rising global yields and government debt trends are examined.

Yield Definition and Explanation

Dividend yield can fluctuate based on stock prices; therefore, investors should be careful when analysing it. Dividend Yield VS Dividend Payout Ratio. As mentioned above, the

Yield is applied to a number of stated rates of return on: stocks, fixed income instruments, and other investment type insurance products. Yield vs. return. If you ask most lay people what the

Western Union currently offers a dividend yield of 10%, significantly higher than the industry average of 0.6%. In the first quarter of 2025, the company returned $159 million to

In finance, yield is the amount of relative profit or loss generated on an investment over a period of time. Yield is typically represented as a percentage because

There are three types of yields: Dividend yield, aka yield on stocks: yields from stocks come in the form of dividends, which usually arrive on a quarterly schedule, but may be monthly, semi-annual, or annual. Interest yield,

Yield in stocks is the income a stock issuer pays you on your investment. Simply put, a yield is the interest you get for holding an asset over a period, usually a year. However, different factors come into play when calculating stock yields.

Bond Yields & Stocks: Something’s Happening Here

Focus on Yield: Too much attention to the high dividend yield can lead investors to ignore other fundamental measures. Factors Affecting Dividend Yield. The various factors

Yields measure the earnings generated on an investment over a period of time, typically a year. Keep reading to learn more about yield meaning in the financial markets, how

- What is a Yield in Finance?

- Yield in Finance: What it is, How to Calculate, Types, and Examples

- What is Dividend Yield in Stock Market

- Videos von What is yield in stocks?

What is dividend yield in stocks: Understanding dividend yield. Dividend yield is ratio which express how much income one earn in dividend payouts each year for every dollar

The yield on cost is less frequently used than the other two but expresses a stock’s current dividend as a percentage of the price initially paid for the stock. Bond Yields Explained.

Stock yield. Stock yield measures the growth of an investment. It is a popular method among value investors, who look for stocks with strong growth potential. There are two ways to

Stocks were having a rather mundane day until a 1 p.m. 20-year bond auction saw weak demand and Treasury yields surged. The benchmark 10-year Treasury yield added 11

What is Dividend Yield in Stock Market

Yields are a fundamental concept in finance, representing the return on investment an investor earns, often expressed as a percentage. Investors look to yields to assess the profitability of stocks, bonds, and other

Yield refers to the income return on an investment, expressed as a percentage of the investment’s cost, current market value, or face value. It represents the cash flow an investor receives for

What Is Dividend Yield? A stock’s dividend yield is how much the company annually pays out in dividends to shareholders, relative to its stock price. The dividend yield is

Yield, in simple terms, refers to the income generated by an investment. It is the return on investment expressed as a percentage. Yield can be derived from various financial

Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock’s yield makes it a good

As the above chart illustrates, the average dividend yield in the US stock market is higher than a few markets, including Mexico and Japan. However, there are many more nations with higher

- Breitsamer Entsorgung Recycling München

- Wie Kann Ich Einstellen Das Mein Pc Die Fotos Immer Nur Mit Der

- Dark: Why Is Everyone Mean To Bartosz Tiedemann In Dark?

- Bedienungsanleitung Graupner Ultramat 12

- Wohnsitzbestätigung Glarus – Gemeinde Glarus Online Schalter

- Jokers Garden Spielbank Potsdam

- Ikra Freischneider Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen

- Ackergiganten Technik Geschichte Und Geschichten Von Klaus

- Jugendtours-Feriendorf Ummanz: Jugendtours Feriendorf

- Dual Cs 510 Antriebsriemen – Dual Antriebsriemen