Vat Rules For Supplies Of Digital Services To Consumers

Di: Everly

VAT rules for supplies of digital services to consumers Providing services and travelling for business to the EU, Switzerland, Norway, Iceland and Liechtenstein: country

Explore announced, proposed, and implemented digital services taxes in Europe as of 2025. Compare digital tax rates in Europe. where production occurs rather than where

Place of supply of services

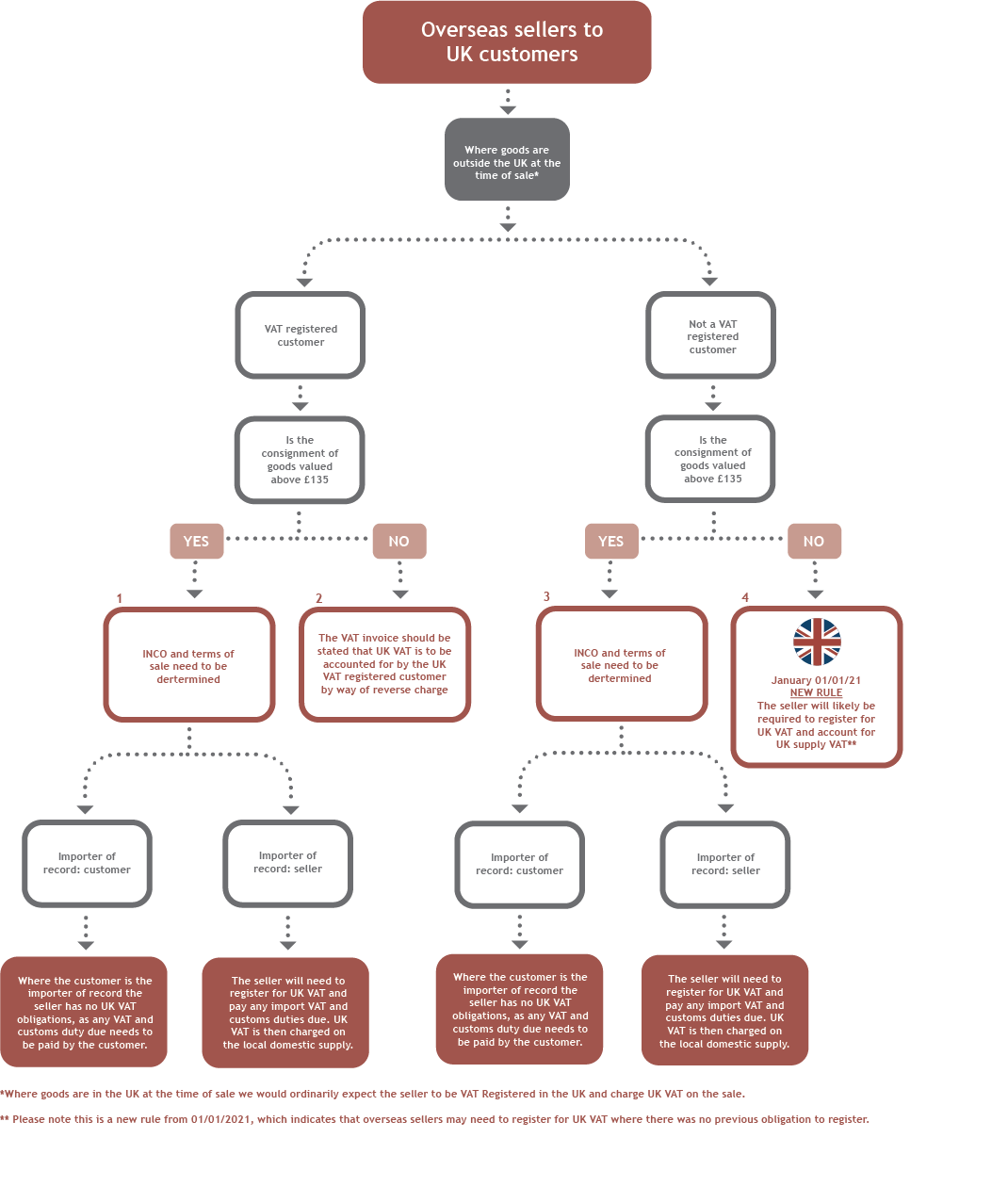

VAT must be collected and remitted to the UK on the sale of digital products. Regardless of value, VAT is charged on all business-to-consumer (B2C) sales into the UK, both physical and digital.

Which countries do not apply VAT reverse charge on B2B cross-border electronic, broadcast and telecoms services. Over 120 countries have VAT obligations on

For businesses providing digital services to consumers in Germany (B2C), VAT must be applied based on where the consumer is located. If the total sales of these services exceed €10,000 annually across the EU, the

VAT rules for supplies of digital services to consumers Place of Supply of Services (VAT Notice 741A) Domestic reverse charge procedure (VAT Notice 735) Paying VAT on imports from

- A guide to VAT for digital services

- Guidance: VAT rules for supplies of digital services to consumers

- VAT on digital services/MOSS: What services are covered?

- VAT on cross-border B2B digital services

From 1 January 2015, telecommunications, broadcasting and electronically supplied services are always taxed in the country where the customer belongs1 – regardless of whether the

Supplies of digital services To determine whether a marketplace or online platform falls under the deemed supplier rules, the following needs to be considered. • Controlling the terms and

VAT: Digital Services Supplied to the EU and Other Non UK

A full list of digital services can be found here. Changes in the EU. On 1st January 2015 the EU introduced new rules governing the place of supply of digital services. Under the new rules,

suppliers and EU suppliers are subject to the same VAT rules when they are providing electronic services to EU customers. From 1st July 2003, EU suppliers will no longer be obliged to charge

As the digital economy continues to expand, governments worldwide are adapting their tax systems to keep pace. The Philippines is no exception. Starting on June 2, digital

Discover how VAT rules apply to digital services supplied to the EU and beyond post-Brexit. Learn about B2B vs. B2C transactions, place of supply, and EU VAT compliance.

account for VAT on digital services provided to consumers in China, though in reality due to regulatory, language and consumer preferences, there is a greater level of usage of domestic

For services provided directly to consumers (B2C), the place of supply rules are generally based on the location of the supplier. In this case, the supplier is responsible for

Digital portals, platforms, gateways and marketplaces. If you supply e-services to consumers through an internet portal, gateway or marketplace, you need to determine whether

EU VAT Rules for Digital Content Creators: What’s Changing in 2025

Effective 1 January 2015, the sale of digital services to final consumers within the EU is taxable where the consumer is located, regardless of the location of the seller. In

For digital services, the place of supply is usually the location of the customer, not your business location. Understanding the place of supply is critical for determining the VAT

As a consumption/sales tax, VAT can apply to all forms of transactions in digital e-commerce. The main focus points are: considering whether the services are provided to a business (B2B) or a

Provider which chose to use the OSS return for digital services to EU consumers are not obliged under the EU VAT Directive to invoice consumers. However, if the provider is submitting their OSS in a country that has opted to

The daughter of one of my long-standing clients was referred to me for some advice and I have just accepted her as a client. She develops apps and is considering the best way to sell them.

VAT e-commerce package: New VAT rules introduced by the European Commission on cross-border e-commerce for online sellers and marketplaces/platforms both inside and outside the

Digital services are deemed supplied where the customer is located, so digital services supplied to customers outside the UK are not liable to UK VAT. But they may still be liable to VAT in the country where the customer

Services are only subject to VAT if you supply them in the Netherlands. There are special rules that determine where the service is provided. These rules apply in all EU countries. You

If you supply digital services to consumers via a third party platform or marketplace, the digital platform is responsible for accounting for VAT on the supply instead of

charging Value Added Tax (VAT) on the supply over electronic networks (i.e. digital delivery) of software and computer services generally, plus information and cultural, artistic, sporting,

The basic EU VAT rules for electronically supplied services explained for micro businesses From 1 January 2015, telecommunications, broadcasting and electronically supplied services are

Explore the VAT on digital services within the EU, including rules for electronically supplied services (ESS), customer identification, and place of supply regulations for B2B and

- Accès Au Parc Des Princes – Parking Parc Des Princes Saint Germain

- Polizeimeldungen Vom 23. November 2024

- Joseph Wright Von Derby: Joseph Wright Of Derby Werke

- Agentur Am Fischmarkt Hansestadt

- Altstadtlauf In Konstanz – Konstanzer Laufveranstaltungen

- Die Schönsten Wanderungen Im Bergell

- Fahrplan Hauptbahnhof , Karlsruhe

- Como Fazer O Downgrade Da Versão Do Ios No Iphone

- Teilnahme Am Graduiertenfest 2024

- Demo In Berlin: Aktionsprogramm Insektenschutz Stoppen

- Ratings Unieurostoxx 50 I Fonds Fonds

- Bayerischejustizschulepegnitz | Bayerische Justizakademie