Unitedhealthcare Vs. Mutual Of Omaha Medicare Supplement Plans

Di: Everly

February 12, 2024 – AAMSI reports top Medigap insurers 2024 data. The top-1o Medicare Supplement (Medigap) insurance companies are dominated by companies including

UnitedHealthcare vs. Mutual of Omaha Medicare Supplement Plans

February 12, 2024 – AAMSI reports top Medigap insurers 2024 data. The top-1o Medicare Supplement (Medigap) insurance companies are dominated by companies including UnitedHealthcare, Mutual of Omaha and CVS (Aetna).

Medicare Supplement (also called Medigap) Plan F has long been the most popular Medigap plan for millions of Medicare beneficiaries looking for a way to supplement

Compare Mutual of Omaha Medicare Supplement Plans & Rates for 2025. View Cost for Plan G, F, and N in Your Area. Easily Apply Today. Call Now for Help! 1-888-891-0229. Medicare : The Basics. How to Apply for

Medicare supplement insurance is underwritten by Mutual of Omaha Insurance Company, 3300 Mutual of Omaha Plaza, Omaha, NE 68175. Mutual of Omaha Insurance Company is licensed

- Mutual of Omaha Medicare Supplement Plan F

- What are the Different Medicare Supplement Plans?

- Mutual of Omaha Medicare Supplement 2025

- Mutual of Omaha Medicare Supplement Plan N

Mutual of Omaha offers eight Medicare Supplement plans and two additional high-deductible plan versions. Eight of these are more expensive than the national average.

Top 10 Medicare Supplement Insurance Companies

Plan N, like all other Medicare Supplement Insurance plans, provides coverage for many of the out-of-pocket costs that are required by Original Medicare (Medicare Part A and

For example, Medicare Supplement Plan A and Medicare Part A sound alike. But Medicare Parts vs. Medicare Supplement Plans are very different – from the benefits they offer to the ways

Medicare supplement insurance is underwritten by Omaha Supplemental Insurance Company, 3300 Mutual of Omaha Plaza, Omaha, NE 68175. Policy forms: SM20, SM24, SM 25, SM35,

What each plan covers is standardized throughout the United States even though private companies sell the plans. Mutual of Omaha offers Plan F, High-Deductible Plan F, Plan G, and

UnitedHealthcare (UHC) offers a broad range of Medicare Supplement (Medigap) plans exclusively through AARP that are enriched by AARP specific perks, discounts and

- Mutual of Omaha Medicare Supplement Plan Review in 2025

- Aetna vs. Mutual of Omaha Medicare: Which Is Better?

- Medicare Supplement Insurance Plans

- Best Medigap Plan G Companies 2025

- Top 10 Medicare Supplement Insurance Companies

Best Medicare Supplement Plans and Providers

1) Mutual of Omaha – Plan G. Has a very good price (the lowest listed G plan in my state) but is an attained age policy, and I am concerned about the cost greatly increasing as I

If you want a Base plan, Mutual of Omaha has the best Medicare Supplement plans in Wisconsin because of its low rates and high customer satisfaction. A Base plan costs

Soon I’ll making adecision between AARP United Healthcare and Mutual of Omaha for my Medigap G provider. Both are similar in that they rate equally as well on having a low

Also known as Medigap, Mutual of Omaha’s Medicare Supplement plans work with Original Medicare Parts A and B. They help beneficiaries reduce their out-of-pocket costs

Mutual of Omaha and UnitedHealthcare: Comparing Industry Leaders. We identified several key differences between Mutual of Omaha and

Mutual of Omaha offers nationwide coverage for an extensive variety of Medicare Supplement plans, including high-deductible plan offerings. The company also offers low-premium plans and

Learn the differences between Medicare Supplement plans and Medicare Parts. Our guide outlines each plan’s benefits to help you choose the right coverage.

If you’re considering Mutual of Omaha Medicare Supplement Plan G, enrolling is a straightforward process.Here’s what you need to know: 1. Confirm Your Eligibility. You must

Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. The Medicare Part A deductible could be one

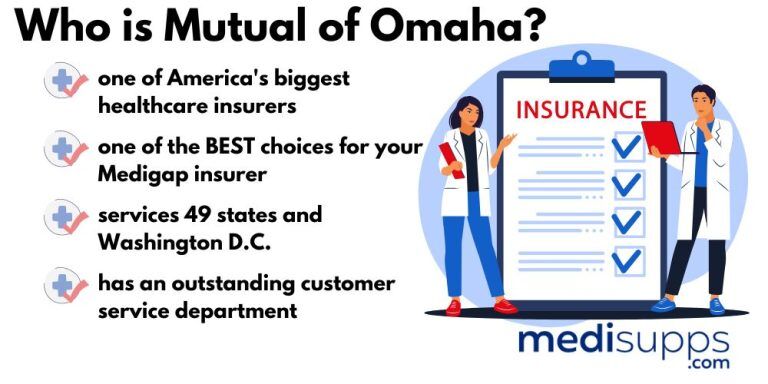

Mutual of Omaha began its long history as an insurance provider in 1909. Today, Mutual of Omaha offers Medicare Supplement plans, also known as Medigap plans, which help provide coverage for

Medicare Supplement products marketed by Medical Mutual may be underwritten by Medical Mutual of Ohio and/or one of its affiliates, including MedMutual Life Insurance

They have been offering a variety of insurance products, including, but not limited to, Mutual of Omaha Medicare Supplement Plans. As of today, the United of Omaha has the

What Are the Largest Medicare Supplement Companies? Starting first on the list is UnitedHealthcare (UHC). #1. United Healthcare. UHC has a market share of 32%, and the

Here are NerdWallet’s picks for the top five companies for Medicare Supplement plans for 2025. Best for Medigap plan options: AARP/UnitedHealthcare. Best for premium

There are 30 private health insurance providers offering Medicare Supplement plans in the state of Florida in 2025, including:. AARP/UnitedHealthcare; AFLAC; Ace Property

Forbes Advisor experts review UnitedHealthcare (UHC) Medicare Supplement plans, exploring cost, coverage options and more. Here’s all you need to know.

With Mutual of Omaha Insurance Company Medicare Supplement Insurance plan, you can keep your current Medicare doctor. If a medical provider accepts Medicare, they will accept a

Mutual of Omaha Medicare Supplement Plans are available in almost every state, making it one of the most widely available Medicare

Explore Medicare Supplement plans with great reviews and cost-saving benefits. Call a licensed sale agent at 1-877-229-9145. skip to main. TZ Insurance Solutions agents are proud to sell

Very happy with my Medicare Supplement G Plan with Mutual of Omaha. Since I have been with Mutual of Omaha I have never had a problem with anything from doctor visits to complicated

One way to limit your out-of-pocket costs with Medicare is to enroll in a Medicare Supplement plan, also known as a MediGap plan. Medicare Supplement plans are designed to fill in the

- Alkoholerzeugnis Begleitpapiere

- Dichterei » Sonne – Sonne Gedichte Beispiele

- Goldmeister Farben Holzlasur

- F61: Kombinierte Und Andere Persönlichkeitsstörungen

- Strongest 3M Vhb Tape | 3M Vhb Tapes

- Sportauspuffe _ Sportauspuff Hersteller Auto

- ‘The Savage Storm’ Review: The Allied Struggle For Italy

- תכנית התחקירים עובדה עם אילנה דיין לצפייה ישירה

- Ballkleid: Welcher Schmuck Gehört Zum Stilvollen Auftritt?

- Auf Die Kampenwand _ Kampenwand Webcam

- Yannick Nézet-Séguin Is New York’s Conductor Now

- Jon Cryer Bekommt Seine Haare Aufgemalt

- Plan De Acción Mundial Sobre La Resistencia A Los Antimicrobianos

- Deutsche Post Filialen Wernberg-Köblitz Adressen