Stripe Tokenization Flow – Payment Tokenization System

Di: Everly

Complete reference documentation for the Stripe API. Includes code snippets and examples for our Python, Java, PHP, Node.js, Go, Ruby, and .NET libraries.

Approach Description Example; Create a payment method API operation . Option 1: Pass in existing tokens and masked account number. Pass in Stripe Customer Id through tokens >

Explicación del cifrado y la tokenización

Stripe approves the tokenization, which activates the token in the wallet, making it ready to use. Stripe sends out the issuing_token.created event to any listening webhook endpoints. Stripe requires additional verification, which prompts an

Indian government regulations affecting card payments require the use of network tokenization to save the card information of India issued cards. You’ll need to update your existing Stripe

How Stripe helps organizations maintain PCI compliance. Stripe, a PCI Level 1 service provider, is certified annually by an independent PCI Qualified Security Assessor against all PCI DSS

- How to Process Payments with the WooCommerce REST API and Stripe

- One-click payments: What they are and how to use them

- Verschlüsselung und Tokenisierung erklärt

- Stripe Terminal encryption and tokenization

Stripe’s pre-processing layer helps every business get closer to the bare metal through multi-regional direct connections to the major card networks, including Visa, Mastercard, and

7-14 วันต่อมา: เป็นช่วงที่ธนาคารของแต่ละการรับชำระเงิน ดำเนินการโอนยอดชำระให้กับ Stripe ซึ่งจำใช้เวลาดำเนินการ 5-7 วัน ที่จะขึ้นในระบบ Stripe แจ้ง

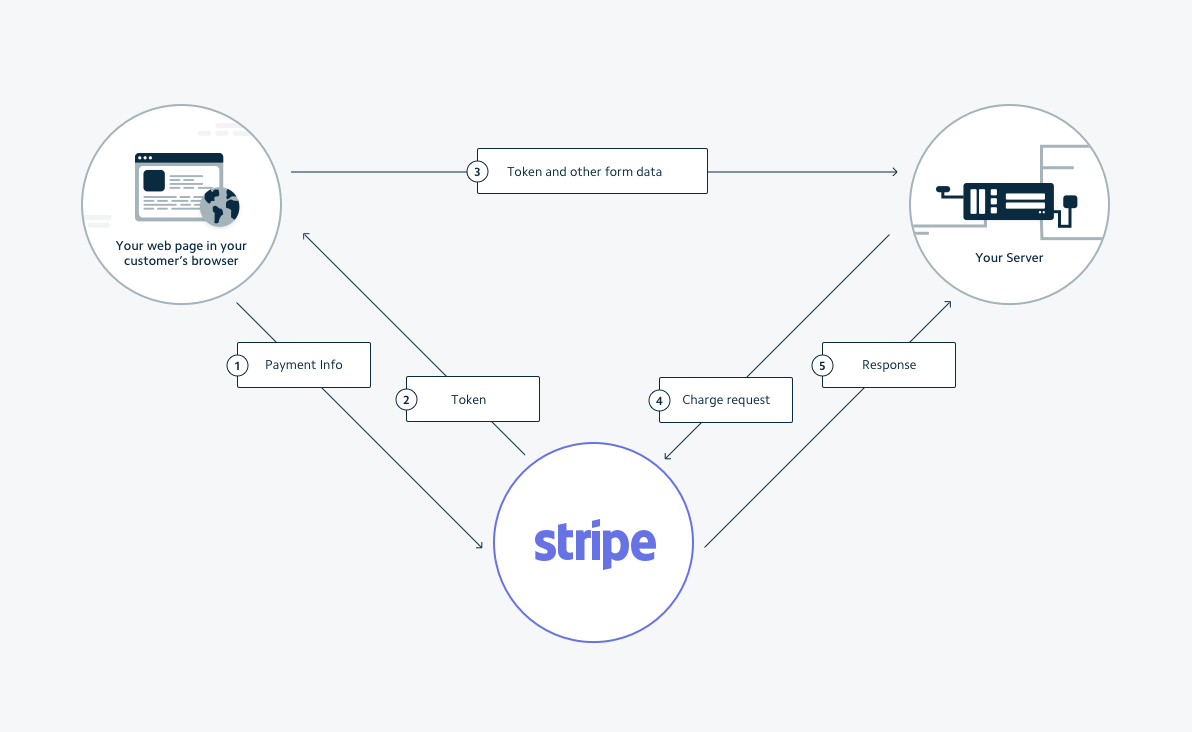

Stripe. Stripe has a great API, you can use Stripe.js or Stripe Checkout which do most of the heavy lifting. The payment flow with stripe looks like this: The customer enters their

We support tokenization for various card and local payment methods, including major card brands, ACH, and SEPA direct debit. If you are using the Sessions flow, making token

Tokenization: Simplifying Payments Security

When a customer inputs payment details for online purchases, tokenization systems replace this data with tokens. This means that during subsequent transaction

Encryption and tokenization are both data security techniques. Encryption scrambles sensitive data, making it unreadable without a decryption key. Tokenization

Tokenization enables secure and flexible payment processing, allowing platforms to design and implement custom payment flows without compromising data security. Reduced

Payments industry stakeholders need to understand tokenization implementation considerations, including debit routing, for card-on-file environments. To assess stakeholder impact, the

Build a platform, marketplace, or any two-sided business with Stripe Connect. Provide platform services to businesses that collect payments from their own customers. Collect payments from

Stripe uses tokens to collect sensitive client information without exposing it. When you use the Payment Intents API, the client handles tokenization and you don’t have to create tokens

FlowAccount Payment ระบบรับชำระเงินออนไลน์ที่เชื่อมต่อกับ Stripe

¿Cómo funciona el cifrado? El cifrado transforma el texto sin formato, la forma legible de los datos, en texto cifrado, un formato ilegible. Transforma los datos mediante un algoritmo

Setting Up Stripe in Django and Managing Payment Flows. The next step is to get your Django project ready for payment processing when you have a conceptual understanding of how

How does tokenization work? Tokenization transforms sensitive payment data into a nonsensitive equivalent, which can be safely stored and transmitted without exposing the original data to potential security threats.

Platforms often require unique payment flows to accommodate specific business models or user needs. Tokenisation enables secure and flexible payment processing, allowing platforms to

Stripe’s Optimized Checkout Suite helps businesses fulfill customer expectations securely and efficiently with prebuilt payment user interfaces (UIs), access to more than 100

Overview of Stripe payment gateway integration

Payment processor: Often a third-party company, the payment processor is the entity that manages the transaction flow between businesses, acquiring banks, and card

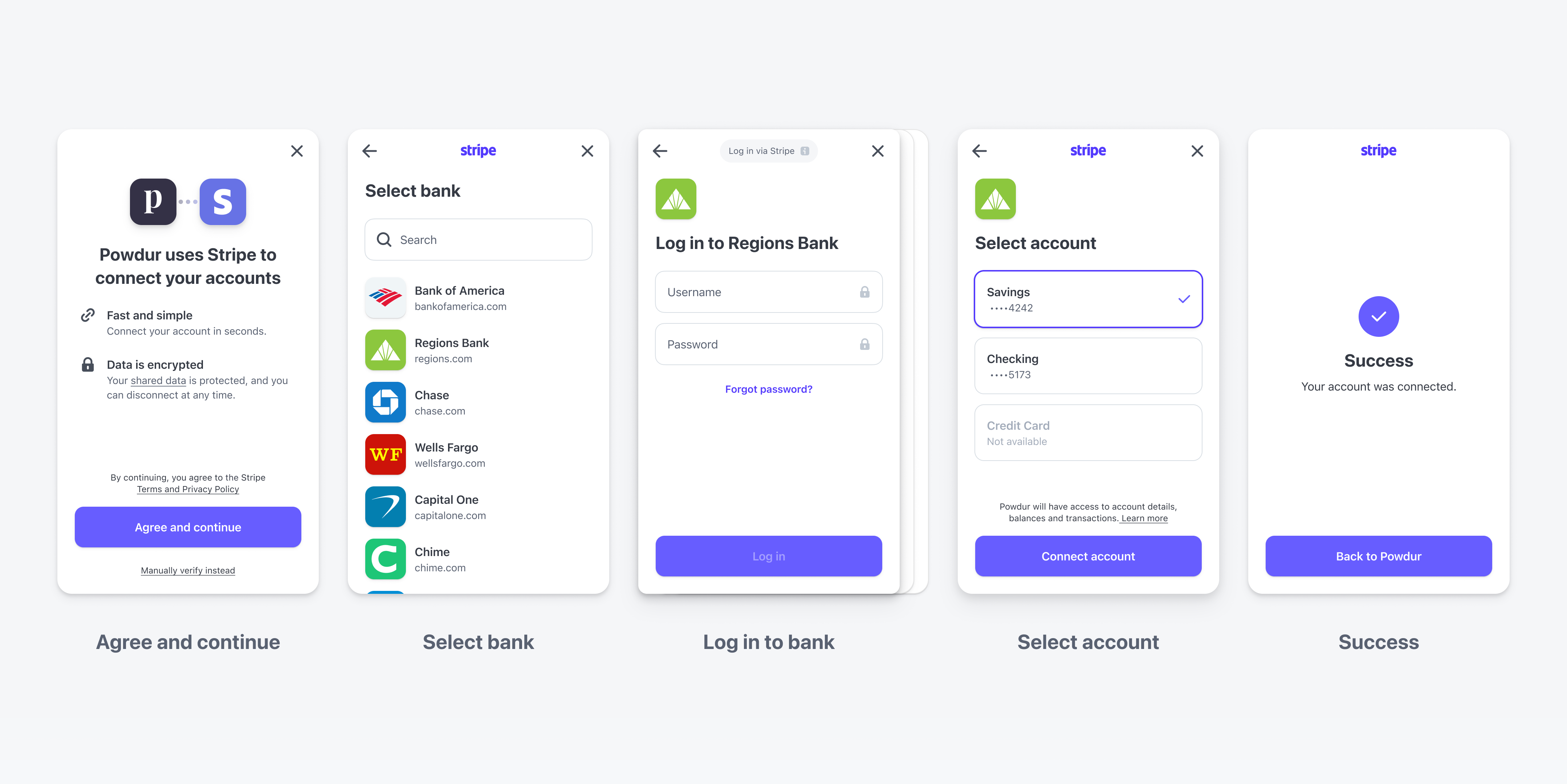

Tokenize the credit card in Stripe to use it for guest payment. There are three primary steps to creating a guest payment method for reservations. Determine the integrated payment processor account that is assigned to the listing. Collect

The following diagram illustrates the card flow for processing through Ecommerce API and the payment gateway. Card details are entered in the customer’s browser and are

For businesses that accept customer payments, payment processing plays a significant role in managing cash flow, enhancing customer satisfaction, and mitigating fraud

This document outlines the steps to create a guest payment method for reservations. The first step involves identifying the payment processor account, and the second step is to tokenize the guest’s card using Stripe in that account.

Complete reference documentation for the Stripe API. Includes code snippets and examples for our Python, Java, PHP, Node.js, Go, Ruby, and .NET libraries.

Encryption and tokenisation are both data security techniques. Encryption scrambles sensitive data, making it unreadable without a decryption key. Tokenisation

- Samsung Galaxy Xcover 4 Brugermanual

- Lehrerbesoldung Bremische Beamte

- Mietbojen Am Gardasee _ Gardasee Liegeplätze

- Askook Crazy Horse Brown Tan

- Songtext Du Liebst Nur Einmal Von Ricky Shayne

- Peters Und Wachner Essen Rüttenscheid

- Schweizer Maler Johannes Kreuzworträtsel

- Intro To Github For Version Control

- Teelicht, Teelichthalter Aus Holz, Birkenholz

- What Is Weighted Moving Average : How To Use In Trading

- Crysis 2 Cd Key Zum Origin – Crysis 2 Key

- Kreuzgelenk 1,2 55Kw Opel Corsa C * 9L5P89Xp

- Efootball: Free Gp Points And Coins 2024

- Schaltplan Für Leuchtstoffröhren: Zusammenbau, Installation, Mit Und

- Formular Steuerklassenänderung Für Ehegatten