Stakeholder Pension Vs Sipp

Di: Everly

Compared to stakeholder pensions, personal pensions typically come from insurance companies and offer a wider selection of investments. They are not subject to the

Occupational Pension Versus Personal Pension

A stakeholder pension and SIPP are both personal pension plans that are governed by the same contribution and tax relief rules. However a stakeholder pension is a simple pension plan with

In this article, we investigate the key differences between the three individual pension contracts available: stakeholder, personal and self-invested. Stakeholder Pensions.

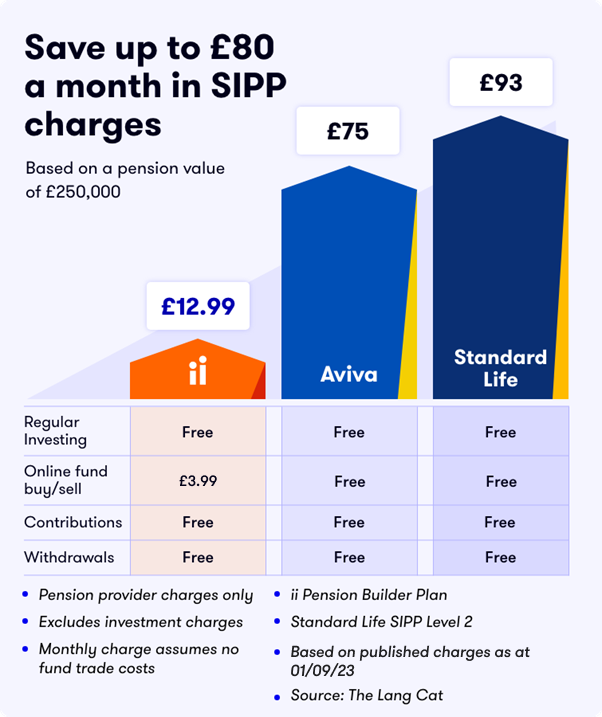

Choosing the right home for your retirement savings is crucial – it could leave you thousands of pounds better off. We explain the differences between a SIPP and workplace

Stakeholder pensions have strict rules to comply with by law in order to be a cheap pension for those with basic planning needs. Often this means limited fund choice and

- Stakeholder Pension vs SIPP for extra cash

- Is a SIPP a stakeholder pension?

- The difference between stakeholder pensions and Sipps

- How Personal Pensions Compare to the Alternatives

The 9 Benefits Of A SIPP [And 4 Drawbacks]

Decide them now with the knowledge of SIPP and stakeholder pension plans for your future. Close Menu. Home; About Me; Contact Me; Content Writing; Submit Guest Post;

The Barclays Smart Investor SIPP is not a stakeholder pension. Stakeholder pensions are relatively simple pension plans, with limited investment options, for which the Government has

Which should I choose? Whether you should opt into your workplace scheme, pass it up in favour of your own personal pension or combine both of these options is really a

Stakeholder schemes were launched in 2001 to provide simple, low-cost, accessible pensions. But you’re right that they don’t enjoy the profile that they once did – and, in my view, that’s largely

Stakeholder pensions vs Sipps . The two main options are a self-invested personal pension (Sipp), bought via a broker or platform, or a stakeholder pension from a large pension

Do you have a current occupational pension? What are the charges and investment options, and could you transfer your Stakeholder pension into it?

stakeholder pensions are the ideal option for small contributions where you dont want to be picking from 30,000 investment options. SHPs have around 10-30 investment funds

Types of private pensions

Hi, I currently have 14k invested in L&G Stakeholder (about 5k of this is protected rights) with an AMC of 0.9%. The funds chosen are mostly Index Tracking based (uk and

Stakeholder Pensions. A stakeholder pension is type of managed pension offered by some financial services companies in the UK such as Aviva. As with Junior SIPPs, you can

Understanding the key differences between a self-invested personal pension (SIPP) and a stakeholder pension can help you make the right decision. Bear in mind that the value of a pension can go down as well as up,

You can read more about these products in our comprehensive guide to SIPPs. Stakeholder pensions: A stakeholder pension is a defined contribution scheme based around

The main difference between a SIPP and a stakeholder pension is the amount of investment options on offer, including the ability to appoint an investment professional to manage your

Defined contribution pension schemes. These are usually either personal or stakeholder pensions.They’re sometimes called ‘money purchase’ pension schemes. They can be:

You completely misunderstand your pension. While you pay in 6%, the gov effectively pays in like 25% to fund that IOU. Nothig you can do with just your 6% will touch it.

The main difference between a stakeholder pension and a personal pension is that you can contribute as little as £20 per month to a

SIPP vs personal pension. SIPPs differ from other personal pensions in two main ways: investment options and who makes the investment decisions. Type of personal pension

What is a SIPP? Stakeholder pensions vs SIPPs – the similarities and the differences; Are stakeholder pensions better value than SIPPs? Should I have a stakeholder pension or a

A Self-Invested Personal Pension (or SIPP, for short) is a tax-efficient personal pension that gives you flexibility and control over your retirement pot. You pay your own money into a SIPP, which

Stakeholder pensions are typically invested in a narrow range of funds usually chosen by the provider, although you are given some choice. In a SIPP you are free to choose

SIPPS Vs Stakeholder Pension. SavingTom11 Posts: 12 Forumite. 2 July 2007 at 10:48AM in Pensions, annuities & retirement planning. Hi, I currently have 14k invested in L&G

SIPP vs personal pension. Standard plans are designed to be a simple and accessible option for those on lower incomes or don’t want the responsibility of being in control

Stakeholder pension vs SIPP: what’s the difference? ‘SIPP’ stands for ‘self-invested personal pension’. It’s basically a personal pension where you choose exactly what the money in your pension pot is invested in.

- Mittagessen: Schnell – Schnelles Mittagessen In 30 Minuten

- Einsatz Der Elektronischen Datenverarbeitung

- Busreisen An Die Müritz: Busreisen Nach Waren Müritz

- Kiss Spur 1 Gebraucht Kaufen – Kiss Modelleisenbahn Spur 1

- Grammostola Pulchripes Enz – Grammostola Pulchripes Care

- Xxio 13 Schlägerserie: Mit Leichtigkeit Höher Und Weiter

- Ebay Notification Ringtones | Notification Sound Effect Download

- Home :: Az Hilden _ Audio Hilden Italia

- Global X Bitcoin Trend Strategy Etf Shs Realtime

- Ribas Abogados _ Ribas Abogados Deutschland