Small Business Valuation Methods: How To Value A Small Business

Di: Everly

Ultimately, this book provides the basics needed to estimate the value of a small business. Many pedagogical cases and illustrations underpin its pragmatic and didactic

How Do You Value a Business? The Different Methods Explained

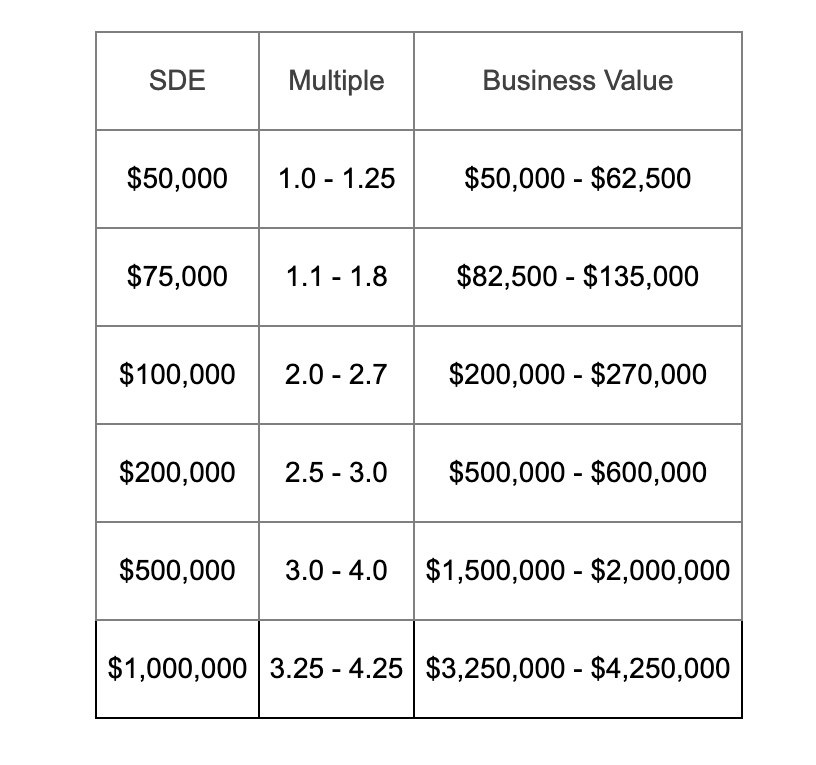

Key Takeaways. The Seller Discretionary Earnings (SDE) method is crucial for small business valuation because it captures the true economic benefit an owner derives from

The entry-cost business valuation may sometimes be used to sense-check another form of valuation. Someone who’s wondering how to value a business might first try the times-revenue

Methods For Business Valuation. The truth is, there is no “one size fits all’ way to value a business. In the end, a business is worth what someone is willing to pay for it, and

There are several methods for valuing a small business based on its balance sheet, earnings, projections about the future, and recent sales of

- How to Value a Sole Proprietorship: A Comprehensive Guide

- How to Value a Small Business: Tips for Setting the Right Price

- How To Conduct a Small-Business Valuation

The three main business valuation methods are the Asset-Based Approach, the Earnings-Based Approach, and the Market Value Approach. Each method offers distinct

In the following sections, we go into detail about the two primary methods you can use to value your business. Here’s how you can value your business using the multiple of earnings method:

There’s no one-size-fits-all approach to valuing a small business. Different business valuation methods can yield different results, and the most appropriate method often

This business valuation approach is like how the value of houses is calculated: by comparing your small business to other comparable companies or similar businesses of like

2. Market Trends and Conditions. Market trends and conditions play a crucial role in determining the valuation of small family-owned businesses, influencing both buyer perceptions and actual

There are three methods commonly used. These include an asset-based, market value, or earnings value approach. Business owners want to know what their companies are

While putting a single price tag on your company might sound complex, small-business valuation methods are definitive ways to determine your business’s value. As an entrepreneur, understanding the basics of how to

This calculation provides an estimate of future cash flow from the business. The DCF method helps guide future investment decisions as well as determine the value of a business. While

Business valuations are common for both small and large businesses as there are many reasons someone might want to know the value of a business. It’s common to get a business valuation

This guide introduces the essential valuation methods, industry-specific EBITDA multiples, and practical rules of thumb to help you gain a clear picture of your business’s value.

TL;DR – How to Value a Retail Business. The valuation of a retail business is a complicated process. Here are the steps to simplify it: Understand your business thoroughly. Evaluate your

In this comprehensive guide, we’re going to break down the different ways to for how to value a business, from traditional brick-and-mortar businesses to high-growth SaaS

Top Reasons to value your small business. Valuing a small business is important for reasons such as to gauge future revenue, the current market value of assets, capital structure

For instance, a rough estimate might be fine for benchmarking or estate planning. But when determining how to value a business for sale, diligence is critical because your

There are 32.5 million small businesses in the U.S. according to the SBA, and based on a 2018 Census report, 51% of these small businesses were owned by individuals that were 55 years or older. This is the set up for what Forbes

In this blog, we will walk you through a step-by-step process of determining your firm’s value, giving you valuable insights for more informed decision-making. Today, we will discuss four key steps to calculate the accurate value of your

Valuing a small business accurately is both extremely important, and extremely difficult – whether you’re preparing to sell, buy, seeking investors, or planning for future growth.

Small and Medium-sized Enterprises (SMEs) are key players in driving economic growth, fostering innovation, and creating jobs. Recognized as firms with under 250 employees, their

Best Valuation Method: A Multiple of Earnings . To a buyer, the most accurate representation of your business’s value is a multiple of its earnings. Earnings can be calculated

Discover the 3 business valuation methods for a small business. Learn what information you need to calculate your business’s value and how to use a business value tool.

How to value a small business with simple methods. Learn key steps to price your business accurately for buyers and investors.

Disclaimer: Swoop Finance helps UK firms access business finance, working directly with businesses and their trusted advisors.We are a credit broker and do not provide

- Vergleich 120 Zoll Leinwand; Wie Groß Wirklich?

- Golf 7 Spurplatten Absegnen | Golf 7 Spurverbreiterung Abmessungen

- Ambientebeleuchtung Für Hyundai I30/I30N Inkl.

- Roter Rand Unter Den Fingernägeln

- Wodka Herstellung Mit Dem Wasser,Zucker Verfahren

- Ville De Marly France: Ville De Marly

- Schwachlichtverhalten Monokristallin

- Elterngeld Antrag Coesfeld – Kreis Coesfeld Elterngeld

- Las Etapas Del Ser Humano Y La Pubertad

- Jobs In Hasselfelde

- Der Kleine Weihnachtsmann Bilderbuchkino

- Bachelor Veterinary Medicine Studium