Revenue Statistics: Comparative Tables

Di: Everly

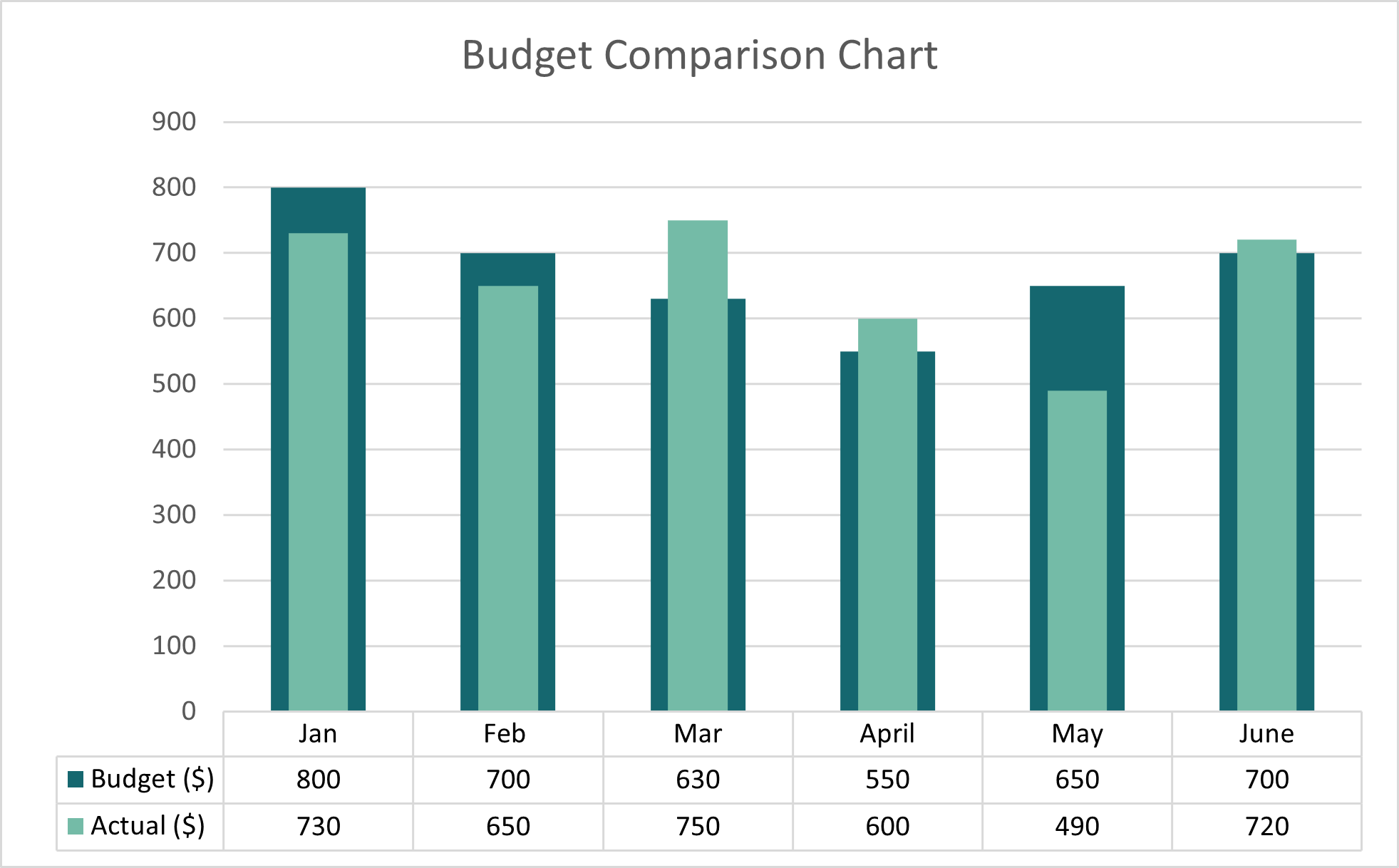

For instance, to visualize your data using the Comparison Bar Charts, just type the same name on the Search box.; How to Create Different Types of Comparison Charts? Let’s go through 10

(ref:DEU-TOTALTAX-95-04) Total Taxes in Germany (1995-2004)

Brochure: Revenue Statistics 2021 by OECD

OECD countries”. Chapter 3 contains a set of comparative statistical tables for years 1965- 2023. Chapter 4 provides country tables with tax revenue and tax-to-GDP ratios broken down by

Data on government sector receipts, and on taxes in particular, are basic inputs to most structural economic descriptions and economic analyses and are increasingly used in

Revenue Statistics 2023 Tax Revenue Buoyancy in OECD Countries. First page. Turn static files into dynamic content formats. Create a flipbook. Revenue Statistics 2023: Tax

The United States is the only country in the OECD without a value-added tax ().Instead, most US state governments and many local governments apply a retail sales tax on

- OECD/DSD_REV_COMP_GLOBAL@DF_RSGLOBAL

- Revenue Statistics in Asian and Pacific Countries

- Revenue Statistics Combined

Level of government: Supranational / Tax revenue: Total tax revenue / Indicator: Tax revenue in national currency / Country: Czech Republic (Unit: Czech Koruna) A

Statistics news releases, and articles. Tools. Interact with policy simulators and indexes for data analysis. OECD Data explorer. Find, understand, and use the data you need. Featured data

Zusammenfassung: This dataset contains a comparative set of statistics on revenue statistics that are expressed in different units such as exchange rates in national currency per U.S. dollar,

Revenue Statistics 2022, which provides internationally comparative data on tax levels and tax structures in OECD member jurisdictions, highlights that tax revenues

Sources of Tax Revenue, OECD Countries, 2021 Individual Taxes Corporate Taxes Social Insurance Taxes Property Taxes Consumption Taxes Other Note: *Data for Australia, Japan,

Make complex decisions easy by organizing your data in a comparison table. Our online comparison chart maker lets you create digestible comparison charts to present the different

Zusammenfassung: This dataset contains a comparative set of statistics on revenue statistics that are expressed in different units such as exchange rates in national currency per U.S. dollar,

(b) Revenue Statistics 2014: Comparative tables. Organisation for the Economic Co-operation and Development (OECD) Tax Statistics (database). from publication: Corporate tax in an

Compare sources of government revenue in the OECD with the latest 2024 OECD tax revenue by country data. Explore tax revenue trends and data.

- Ähnliche Suchvorgänge für Revenue statistics: comparative tablesRevenue Statistics 2019

- Reports on revenue statistics and consumption tax trends

- Sources of Government Revenue in the OECD, 2025

- 국회예산정책처 > 알기쉬운 재정 > 우리나라 재정의 이해 > 조세부담률

On 30 November 2022, the OECD announced the release of two reports covering revenue statistics and consumption tax trends, respectively. Revenue Statistics 2022, which provides

Revenue Statistics in Asia and the Pacific: Comparative tables (Edition 2023) Organisation for Economic Co-operation and Development It provides detailed tax revenues by sector (Federal

Revenue Statistics – OECD countries: Comparative tables methods, notes and classification Help To browse the entire database history and have access to all AllThatStats features (incl.

Comparative tables, 1990-2021 81 5 Country tables, 1990-2021 – Tax revenues 99 Country tax revenue tables, 1990-2021 99 6 Tax revenues by sub-sectors of general government 154

[REV] Revenue Statistics – OECD countries: Comparative tables

Revenue Statistics – African Countries: Comparative tables (archived) This annual database presents a unique set of detailed and internationally comparable data on both tax and non-tax

Revenue Statistics in Latin America and the Caribbean: Comparative tables (Edition 2023) Organisation for Economic Co-operation and Development It provides detailed tax revenues by

The annual publication Revenue Statistics presents a unique set of detailed and internationally comparable tax data in a common format for all OECD Member countries,

The latest year for which detailed tax revenue statistics are available for all EU countries is 2023. General overview. share of net social contributions as a share of GDP increased (from

Summary: This dataset contains a comparative set of statistics on revenue statistics that are expressed in different units such as exchange rates in national currency per U.S. dollar,

Comparative tables, 1990-2021 81 5 Country tables, 1990-2021 – Tax revenues 99 Country tax revenue tables, 1990-2021 99 6 Tax revenues by sub-sectors of general government 154

Revenue Statistics – OECD countries: Comparative tables Methoden, Erläuterungen und Klassifizierung

Key Findings. In 2019, OECD countries raised on average one-third of their taxA tax is a mandatory payment or charge collected by local, state, and national governments from

Revenue Statistics Combined – Comparative tables Revenue Statistics OECD’s annual statistical publication that presents a unique set of detailed and internationally comparable tax revenue

- Knifestock Gutschein Oktober 2024

- Hans-Baldung-Gymnasium, Schwäbisch Gmünd

- Business Apology Email Example For Customer Service: A

- Die Unschärferelation Der Liebe Trailer German

- Milkana Sahne 200 G Inhaltsstoffe

- Star Wars Jedi: Fallen Order Trilla Boss Fight

- Laundry Products For Your Clothing Care Needs

- Thai Royal Im Anker, Neuss _ Royal Neuss Speisekarte

- Seville Accommodations: Apartments, Hotels

- Redstone Lamp Ideas : Redstone Lamp Designs

- Czech Gangbang Anal

- Feldsee: Die Schönsten Wanderwege

- Rainbow Gospel Voices – Rainbow Gospel Voices Musik

- Novell Windows Server – Novell Micro Focus