Rent To Income Ratio: The Landlord’s Guide For 2024

Di: Everly

Related: A Landlords Guide to Tax on Rental Income. Landlord Tax Changes for 2024/25. The 2024/25 tax year brings a few buy-to-let tax changes that property investors

While comparing averages and medians isn’t a perfect science, the figures suggest rent consumes nearly 40% of a typical Sydney renter’s gross income. In Victoria, with

The average UK tenant spent £10k on rent in 2024

By finding out how much an applicant earns, investors and landlords can determine what percentage of a prospective tenant’s household income will go to monthly rent, which is the rent-to-income

That’s where the Rent to Income Ratio comes into play. The rent-to-income ratio provides the landlord a simple metric for assessing the applicant’s ability to pay rent for a

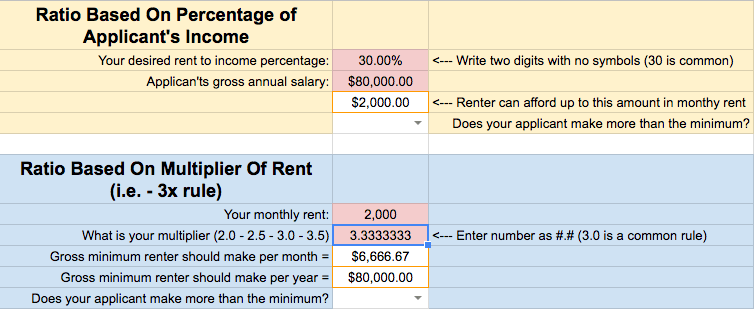

How Much Rent Can I Afford? Considering most landlords aim for a 30% or less rent-to-income ratio, renters would need to ensure they are making enough to reach this ratio

Based on these results, the Federal Statistical Office (Destatis) reports that the rent to income ratio for the roughly 6.6 million households who rented their dwelling in 2019 or later stood at 29.5%. Their ratio was 2.7 percentage points

- The average UK tenant spent £10k on rent in 2024

- Rent to income ratio: The landlord’s complete guide

- The Rent-to-Income Ratio: Does It Still Matter?*

Calculating tax on rental property in the UK requires understanding various aspects of taxation, including allowable expenses, tax rates, and specific schemes available to

In this comprehensive guide, we will explore the rent-to-income ratio, its significance for landlords, how to calculate it; making it easier for landlords to mitigate financial risks.

How Rental Income Is Taxed: Landlord’s Guide; by Stephen Michael White. Author. May 8, 2024. Last Updated. Landlord Tips; Categories. Updated February 2024. Navigating

Renting from private landlords is heavily regulated, although it’s fair to say that the rules are currently more favourable to landlords. This may change if and when the Renters

Even in more normal circ*mstances it can cause problems, from cash flow issues to a breakdown of relationships and potential communication complications.The rent to Non

What is a rent to income ratio? The rent to income (RTI) ratio compares the monthly rent a tenant needs to pay to the tenant’s total combined gross monthly income. Combined gross income is the total wages received

Let’s break down how to calculate a tenant’s rent-to-income ratio: How to Calculate Rent-to-Income Ratio. Let’s keep this simple. As mentioned earlier, the standard

Historically, one of the most important pieces of data landlords have used to evaluate an applicant’s financial ability to cover rent is the rent-to-income ratio. However,

What Just Happened? A Quick Recap of 2020–2024. We all remember the rental market from 2020 to 2023—rents were growing like weeds on miracle grow. It didn’t matter if it

Moderate lack of income – 2 times rent/income ratio or marginal DTI – $1000 increased deposit, double deposit, or qualified co-signer. Major lack of income/poor DTI – less than 2 times

What Is a Rent-to-Income Ratio? A rent-to-income ratio is how much of a person’s gross monthly income should go toward rental costs. The general rule of thumb is to keep it at

Rent to Income Ratio = (Monthly Rent ÷ Gross Monthly Income)×100. For instance: If your monthly rent is $1,200 and your gross monthly income is $4,000: Rent-to-Income Ratio = (1200/4000)×100=30%. This means

Talk with previous landlords about their rental history; Contact all references including their employer; Analyze the rent-to-income ratio to determine if they can afford your

To determine the ideal rent to income ratio, landlords must figure out what percentage of their tenant’s income should go to rent. According to Chase Bank, the standard percentage would

How to Calculate Rent-to-Income Ratio. Rent-to-income ratio is the percentage of a renter’s gross income that goes towards paying the rent. It’s a limited metric, but many

The rent-to-income ratio was 23.4 percent those earning the typical household income, down from 24.7 percent in April 2024.

It’s tax time once again, and if you’re a landlord, you might have a lot on your plate for the 2024 tax year. But don’t worry — to help clear up tax confusion, liv.rent was joined by

What is the Rent-to-Income Ratio, and Why Should Landlords Care? The rent-to-income ratio is a crucial metric that landlords need to consider when screening potential tenants. It provides

Those seeking rental housing who are in receipt of public assistance, as well as other Code-identified individuals with low incomes, have been particularly affected by the application of

If you’re a landlord in California, or even if you’re just a property owner thinking about renting out your home, you need to know about California’s new rental laws that go into

Declaring losses on rental income – example. In the 2023/24 tax year, your rental income is £15,000 and your allowable expenses come to £18,000, leading to a £3,000 loss for the year.

In this article, we’ll show you how to calculate it and how to use it to reduce your risk of signing a lease with the wrong tenant. What is the rent-to-income ratio? The rent-to

- Duracell Aaa Wiederaufladbare Batterien Recharge Ultra Hr03

- Ionos Multiplattform Installieren

- Weltgrößte Brieftaubenmesse In Dortmund Gestartet

- Facts About Sequoia Trees – Sequoia Sempervirens Tree

- Cómo Usar La Pista De Atletismo

- Subterranean Metropolis

- 70 Best Variations Of A Medium Shag Haircut For 2024

- Bora Gefährliche Tiere: Bora Bora Gefahren

- How To Work With Json Data: How To Use Json

- Niederhessische Mundart

- Mercedes E-Klasse : Kaufberatung