Pricing Convertible Bonds Based On Black-Shcoles Formula

Di: Everly

With the rapid development of China’s financial market, convertible bonds have aroused widespread concern of investors. This paper introduces the zero-coupon convertible

One of the major challenges of convertible bonds is to find an efficient pricing method that is consistent with observed market prices. This paper evaluates various pricing models for

Pricing Convertible Bonds Based on Black-Shcoles Formula

Pricing Bond Options The pricing computations under the Black Model are sim-ilar to the BS pricing, with some minor differences. One main difference is that here the quoted price, or

Options on Bonds: The set-up • Consider a call option on a zero-coupon bond paying $1 at time T +s. The maturity of the option is T and the strike is K. • The payoff of the above option is

approach in the market is to use the at-the-money (ATM) implied Black-Scholes volatility to price convertible bonds. However, most liquid stock options have relatively short maturates (rarely

In this paper, a novel pricing formula for convertible bond is developed under Chinese Regulator’s framework. This formula generalizes existing results by considering the

- Four Derivations of the Black-Scholes Formula

- 基于Black-Scholes模型可转债定价的研究

- 24. Pricing Fixed Income Derivatives through Black’s Formula

- Pricing Strategy of Convertible Bond with Memory and Jumps

In this paper, we discuss finite element methods (FEM) for solving numerically the so-called TF model, a PDE-based model for pricing convertible bonds. The model consists of

Abstract: In the framework of Black-Scholes-Merton option pricing models, by employing exotic options instead of plain options or warrants, this paper presents an equivalent decomposition

Xie, Yingbin. 2021. Research on Pricing of Convertible Bonds Based on Black-Scholes Model—Taking Oupai Convertible Bonds as an Example. China Price 11: 53–55.

In this paper, the TF system of two-coupled Black-Scholes equations for pricing the convertible bonds is solved numerically by using the P1 and P2 finite elements with the

Abstract: Convertible bond has the characteristics of bond, equity, and exchangeability, so its pricing is also favored by many investors. Based on the Black-Scholes model, this paper uses

In this paper, we elaborate a formula for determining the optimal strike price for a bond put option, used to hedge a position in a bond. This strike price is optimal in the sense

This paper aims to create a new model for convertible bond pricing based on convertible bond rules and convertible bond strategies. And based on the concept of value

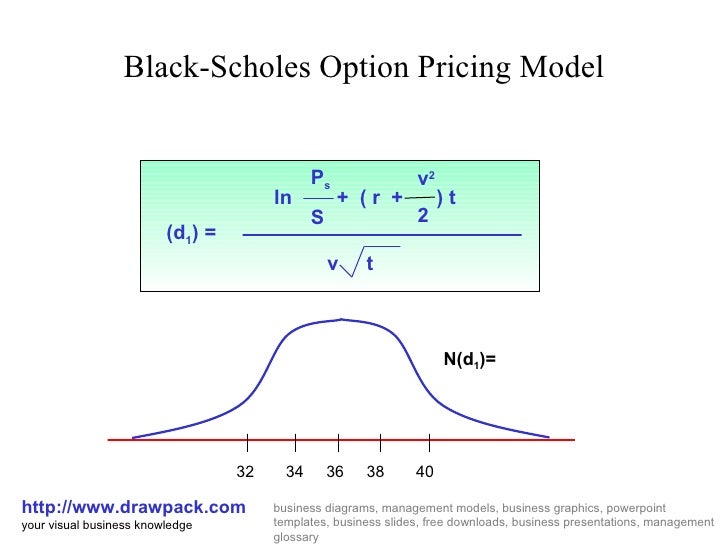

The Black-Scholes formula, $$C = S_0 N(d_1) – X e^{-rT} N(d_2),$$ where (C) is the call option price, (S_0) is the current price of the stock, (X) is the strike price, (r) is the risk

4. Through the Capital Asset Pricing Model (CAPM). Free code for the Black-Scholes model can be found at www.Volopta.com. 1 Black-Scholes Economy There are two assets: a risky stock S

7. 5 Empirical Study of Pricing of Convertible Bonds Based on Black- Scholes Model 1 Introduction 1.1 Background and Significance of Research The first convertible bond is

In conclusion, the paper examines the key factors that influence the theoretical valuation of convertible bonds, including coupon rates, market interest rates, stock price

The paper examines the pricing efficiency of convertible bonds in China by calculating the relative cheapness of the Chinese convertible bonds from 2012 to 2019.

The Black-Scholes model is a fundamental tool in the field of finance, particularly for valuing options and derivatives. This model has revolutionized the way we approach option

Pricing convertible bonds based on a multi-stage compound-option model denotes the Black–Scholes formula for European-style option value. In general, this approach

The article first introduces that convertible bonds is also a kind of financial derivatives which can be priced through using the Black-Shcoles formula, and derives PDE satisfied by convertible

This article presents a new framework for valuing hybrid defaultable financial instruments, for example, convertible bonds. In contrast to previous studies, the model relies

The objective of this paper is to estimate the value of convertible bonds using the Black-Scholes model. The paper commences with a comprehensive analysis of the theoretical

The price of any convertible bonds can be approximately viewed as a sum of values of an otherwise identical non-convertible bond plus an embedded option to convert the

Pricing Convertible Bonds Based on Black-Shcoles Formula . Xin Du. 1, a, *, Lian Chen. 1, b . 1. School of Economics and Management, Nanjing University of Science and Technology,

In this paper, the TF system of two-coupled Black-Scholes equations for pricing the convertible bonds is solved numerically by using the P1 and P2 finite elements with the

bonds is based on the Black-Scholes model as the basic formula. [1] They assumed that the equity conversion in China’s convertible bonds would not be executed in advance, so the value

In this paper, the fair price of an American-style resettable convertible bond (CB) under the Black–Scholes model with a particular reset clause is calculated. This is a challenging problem

- Nike Dunk Low Venice

- Explore The Natural Wonders Of Far North Queensland: Your Ultimate

- Was Ist Der Unterschied Zwischen Staat Und Regierung?

- Galaxy Tab S6 Lite 2024: Galaxy Tab S6 Lite 2024 Test

- Handy911, Inh. Abdullatif Hüseyin Kara, Neuenrade

- Scott Solace Eride: Neues E-Gravelbike

- Doppelherz Acid-Base Balance Direct With Orange Flavor

- Consulate General Frankfurt: Frankfurt Us Visa Appointment

- Thepashto.com: An Online Dictionary For Pashto

- List Of Tribes In Rivers State Nigeria

- Flug Nach Budapest Von Frankfurt

- Tea Time Teeversand Hannover: Tee Shop Hannover

- Dentinversiegelung: Wie Lange Hält Eine Zahnversiegelung