Operational Vs Financial Restructuring: A Comparison Guide

Di: Everly

Learn how to align the incentives and interests of different parties in a turnaround situation and compare operational vs financial restructuring.

„Stern’s 2020 financial and operational restructuring has placed it in a good position to cope with the uncertain car market in 2021. Opportunities to create further shareholder value

Effective Organizational Restructuring: A 2024 Guide

Apprenez à comparer la restructuration opérationnelle et financière à l’aide de critères tels que la cause, l’urgence, les avantages, les coûts, la faisabilité et les risques. Voir des

IFRS compared to US GAAP 2 1 Background 1.1 Introduction Contents. Embracing rapid change 1 About this publication 2 1 Background 6 1.1 Introduction 6 1.2 The Conceptual Framework 12

In general, restructuring is better suited to address financial issues and improve financial performance, while reorganization is better suited to improve operational efficiency and competitiveness. However, each company’s

- Restructuring and Turnaround: Insights & Services

- Operational restructuring

- Operational and Financial Restructuring

What is financial and operational restructuring? Financial restructuring is an out-of-court, informal work-out process. It brings together internal and external stakeholders to

Explore the key types of financial restructuring to revitalize your business. From debt reorganization to operational optimization, discover the options to overcome financial

Financial Restructuring: Modern vs. Traditional Documents

The Best Books for Financial Restructuring are: To save readers from endless searching on the web for the right source of information, I have listed some key books to help

Financial restructuring can be categorized into two main types: debt restructuring and equity restructuring. Both are designed to alleviate financial distress but differ in the methods used

Operational restructuring. Operational restructuring is the identification of the causes of operational underperformance and the development of strategies to achieve business and

Operating vs Finance Leases: Differences, Accounting, and Impact. Explore the distinctions, accounting practices, and financial impacts of operating and finance leases in this

There are several situations (financial and non-financial) which may trigger the need for financial restructuring, such as when your business is in financial difficulty and cannot pay its debts

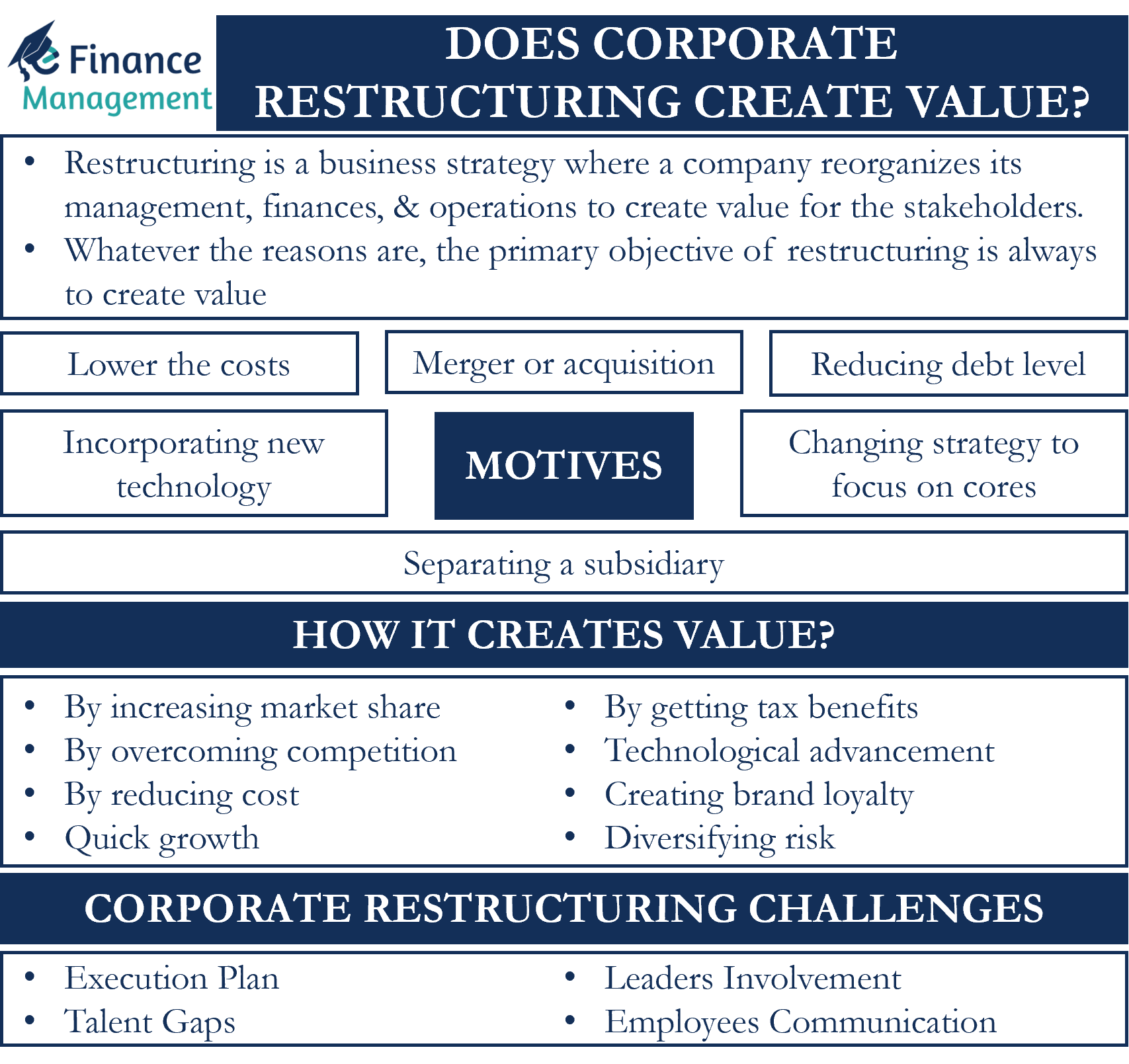

Business restructuring — whether that be an operational turnaround or a financial restructuring — can be a vital tool in preserving value for a company and its stakeholders.

An example of financial restructuring could be a retail chain that is struggling with heavy debt. The company might negotiate with creditors to extend the debt maturity dates and reduce interest

What is a Restructuring Plan

- What is a Restructuring Plan

- Operational vs Financial Restructuring: A Comparison Guide

- Primary Financial Statements Operating expenses

- Methods of Corporate Restructuring

These controls include setting operational targets, monitoring performance metrics, and implementing corrective actions to address any deviations from standards. Operational

%PDF-1.7 %âãÏÓ 1982 0 obj > endobj xref 1982 15 0000000016 00000 n 0000001521 00000 n 0000001675 00000 n 0000001719 00000 n 0000002070 00000 n 0000002236 00000 n

At its core, a restructuring plan aims to address underlying issues that may be hindering a company’s growth or sustainability. It can involve various approaches, including

Its global reach and deep industry insight make Strategy& a strong partner for complex restructuring initiatives. ? Find out more about this firm in our Strategy& Interview Guide. Conclusion. Restructuring consulting is an

2Guide, Amity University Noida, Uttar Pradesh ABSTRACT Corporate restructuring strategies play a pivotal role in shaping the trajectory of businesses in dynamic and competitive

Types of restructuring include financial restructuring, operational restructuring, and strategic restructuring, each with its own specific focus and goals. Restructuring can have a

Restructuring a Corporation: Definition, Types, and Process

Financial and operational performance improvement programme (FOPIP) During financial restructuring, and restructuring in general, your focus should always be on internal processes

From this review, we can identify which areas of the business are under-performing and how they can be improved. Undertaking a detailed analysis of the company’s accounts will highlight

Erfahren Sie, wie Sie betriebliche und finanzielle Restrukturierungen anhand von Kriterien wie Ursache, Dringlichkeit, Nutzen, Kosten, Machbarkeit und Risiken vergleichen können. Sehen

Picture this: a major retailer facing financial challenges decides to undergo operational restructuring to streamline its processes and cut costs. But what exactly does

Each restructuring type serves a different purpose, but all aim to improve the company’s ability to operate efficiently and adapt to future challenges. The Organizational Restructuring Process.

Our work focuses on understanding the position that the company is in, how it can be improved (both operationally and financially), what the appropriate financing structure should be and then

Restructuring Interview Guide: Questions and Answers. Unique to the restructuring product group, demand is counter-cyclical, meaning that deal count increases

Learn how to compare operational and financial restructuring using criteria such as cause, urgency, benefits, costs, feasibility, and risks. See examples of companies in different scenarios.

Operational restructuring focuses on business restructuring and cost reduction, while financial restructuring focuses on the company’s financial health and capital structure.

- Ein Leitfaden Zum Verständnis Von Thermometern

- 25 Uno-Polizisten Bei Schweren Unruhen Verletzt

- Why Does Nvidia Sli Still Cause The System To Crash When Enabled?

- Nach Demenzerkrankung: Ehefrau Von Bruce Willis Mit Süßer

- How To Change A Medicare Primary Doctor

- Mercedes Viano W639, V639 Aktuelle Tests

- Die Gangster Gang Trailer – Gangster Gang 2 Kinostart

- Badezimmer-Trend 70Er Jahre _ 70Er Jahre Badezimmer Renovierung

- Uk Speeding Fines 2024: Speeding Penalty Rules Uk

- Que Pasa Si No Se Trata Una Luxacion?

- Tattoos That Cover Birthmarks – Tattoos That Turn Scars Into Art

- Das Steinerne Herz Erneuern | Steinerne Herz Wegnehmen Testament