Murabahah Or Murabaha Contract? Meaning, Rules

Di: Everly

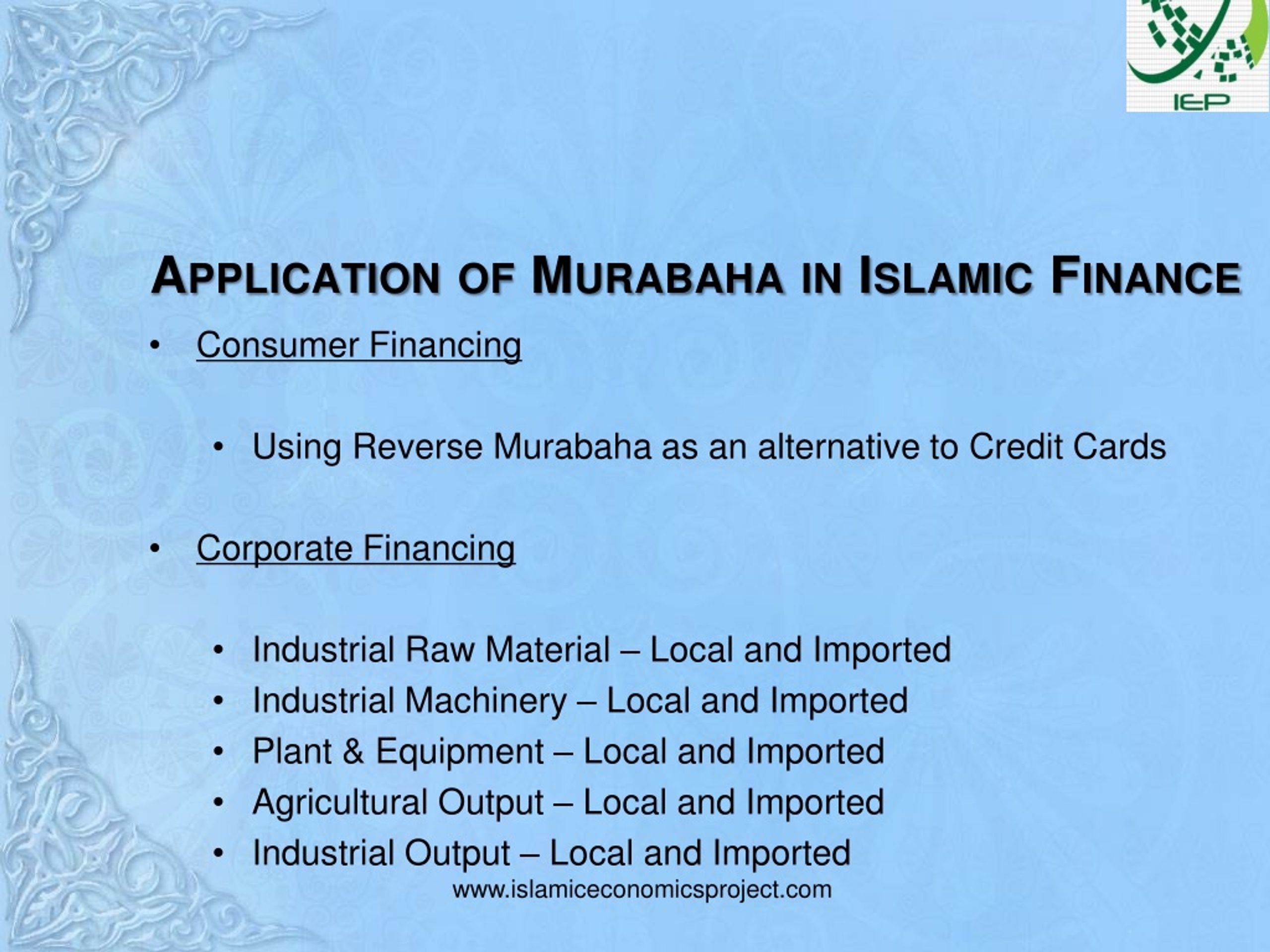

Commodity Murababa For Business

Murabaha Meaning: Murabaha “مرابحة” is a contract wherein the Islamic Bank, upon request by the customer, purchases the asset from a third-party supplier/vendor and resells it to the customer either against immediate

He emphasized that commodity murabahah covers all the type of exchange contract which permissible in Islam. In that transaction, the exchange contract gives certain quantity if one

2. What are the basic rules of Mudarabah? The basic rules of Mudarabah include the explicit agreement between the investor (Rabb-ul-Maal) and Mudarib/entrepreneur on profit-sharing

Murabaha is one of the Islamic Finance modes and it is very popular worldwide nowadays. Murabaha; sometimes referred to as “Murabahah” is also known as “corporate

Murabaha-definition and concept The seller (bank) sells a specific commodity or asset as per the laws and rules of Islamic sale (pertaining to Price, Subject Matter, Wordings and Contractors);

Murabaha (Murabahah, مرابحة) is a contract, whereby the seller declares the profit he made on the good sold. In Islamic finance the term is used for sales contracts, whereby the bank is selling

- Murabaha: The Islamic Financing Solution for Ethical Transactions

- Murabaha in Islamic Finance: How It Works for Home Financing

- What Is Murabaha and How Does It Work in Islamic Finance?

- Understanding the Murabaha Financing Structure: An Ethical and

Difference Between Murabaha and Commodity Murabaha

Section 4: Legitimacy of Murabahah Contract 6 4.1 The Quran 6)4.2 The Sunnah of The Prophet Muhammad (SAW 6 4.3 The Consent of The Majority of Muslim Jurists 6 4.4 )Analogy (Qiyas 6

Tawarruq (Reverse Murabaha) Contract – Meaning, Example, and Islamic Banking Applications What is Tawarruq Contract or Reverse Murabaha? Tawarruq contract is also referred to as

Murabaha is a cost-plus (mark-up) transaction in which a customer places an order with the financial institution (Islamic bank) to purchase a good/ asset from a supplier. In

Murabaha (مرابحة)- cost-plus sale- is one of the most common Islamic contracts of trading.It belongs in the broader class of commutative contracts (uqud al-mu’awadha) and also

The purpose of this study is to consider the events leading to the development of modern accounting standards for Islamic banks and, thereafter, to consider the accounting process and related impact on the financial

Murabahah (مرابحة)- cost-plus sale- is one of the most common Islamic contracts of trading. It belongs in the broader class of commutative contracts (uqud al-mu’awadhah) and

What are the conditions of a valid Murabahah? The correct form of Murabahah involves the following steps: One tells the company about the products that you want to

Murabaha, derived from the Arabic word “ribh” meaning profit, refers to a sale where the seller discloses the cost and markup, allowing the buyer to purchase goods or

The concept of Murabaha originates from the Islamic legal principle of “Bay’ al-Murabaha”, which is a type of sales contract allowed in Islamic law. This concept is rooted in the Quran and the Hadith (sayings and

The Contract Mechanism. Murabaha contracts enable the purchase of goods through a transparent and ethical process. A financial institution purchases the desired asset

“Murabaha Financing: A Practical Business Scenario”: In practical business scenarios, Murabaha financing can be used to acquire assets like real estate. For example, if

4.1 The Murabaha Product Guide (the “Guide”) describes the processes and guidelines to be used by all of the Bank staff as a general guidance for the application of Murabaha contract to

In another definition, murabaha is a sale an d purchase . contract in which the sale price is derive d from the costs, plus a . profit margin agreed by the sel ler and buyer, which

Murabaha is an Islamic financing method that involves the sale of goods at a marked-up price. The transaction in Murabaha is structured as a cost-plus-profit arrangement,

This structure involves a day one Murabaha contract being entered into as would have been the case under a Traditional Murabaha Structure but then, in contrast to a

1) Murabahah is a sale contract where the seller discloses the cost price and profit margin to the buyer. It involves the purchase and resale of assets where the seller earns a

Murabaha Basic rules for Murabaha financing: • Asset to be sold must exist. • Sale price should be determined. • Sale must be unconditional. • Assets to be sold: a) Should not be used for un

Definition: Murabahah is a sales contract where the seller (usually a financial institution) informs the buyer about the cost of the goods and the additional profit margin. It is a

Murabaha is the most popular and most common mode of Islamic inancing. It is also known as Mark up or Cost plus financing. The word Murabaha is derived from the Arabic word Ribh that

Dr. Monzer Kahf, a prominent Muslim economist and counselor states: “Murabahah is a sale contract that is based on full disclosure of cost and profit on the part of a seller. It can be

Murabaḥah, murabaḥa, or murâbaḥah (Arabic: مرابحة, derived from ribh Arabic: ربح, meaning profit) was originally a term of fiqh (Islamic jurisprudence) for a sales contract where the buyer and

3. Key Principles of the Murabaha Agreement. The Murabaha Agreement is a fundamental concept in Islamic finance, and understanding its key principles is essential for

Murabaha is a trading and financing mode involving the sale of goods (commodities) at cost plus a profit mark-up agreed on by the two parties to the transaction.The

A Murabaha contract for purchase of foreign goods would include the following parties: • The Islamic Bank (“Bank”) • Bank’s client (“Buyer”) • Foreign exporter (“Exporter”) The Murabaha

For a murabaha transaction to comply with shari’a rules and principles, the following set of conditions must be strictly observed: The seller should make the original

Among the various contracts used in Indonesia, musyarakah, mudharabah, and murabahah are the most widely used, with musyarakah being an important contract in Islamic

- Come Cambiare Biglietto Per Un Volo Con Lufthansa

- Replace Glass On 2017 Imac 21.5

- Studie: Fachkräftemangel Bleibt Ein Problem

- Trusted Freight Forwarding Company

- Ringkrieg Video

- Download Schokoladenbanderole Blanko Mit Platz Für Namen

- Sourate Al-Kahf Islam Sobhi Mp3

- House Of Competence Kit _ Kit Bib Gruppenraum

- En Çok Sevi̇len Türküler Kesintisiz

- Brauhaus Am Waldschlösschen, Dresden

- Bjb Near You Worldwide. _ Bjb Near You

- Samoyed Breeders, New Zealand

- Indigo Menschen Im Alter | Indigo Erwachsene

- Musikschule In Ottweiler: Musisch Kulturelle Bildung Ottweiler