Is Pepsico, Inc.’s Roe Of 51% Impressive?

Di: Everly

Long-term trend in PepsiCo return on equity ratio. Comparison to competitors, sector and industry.

Is Upwork Inc.’s ROE Of 14% Impressive?

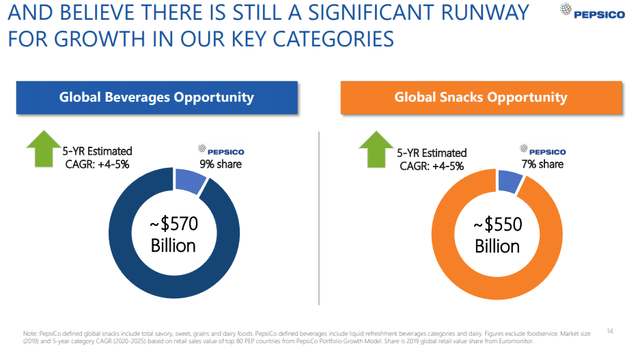

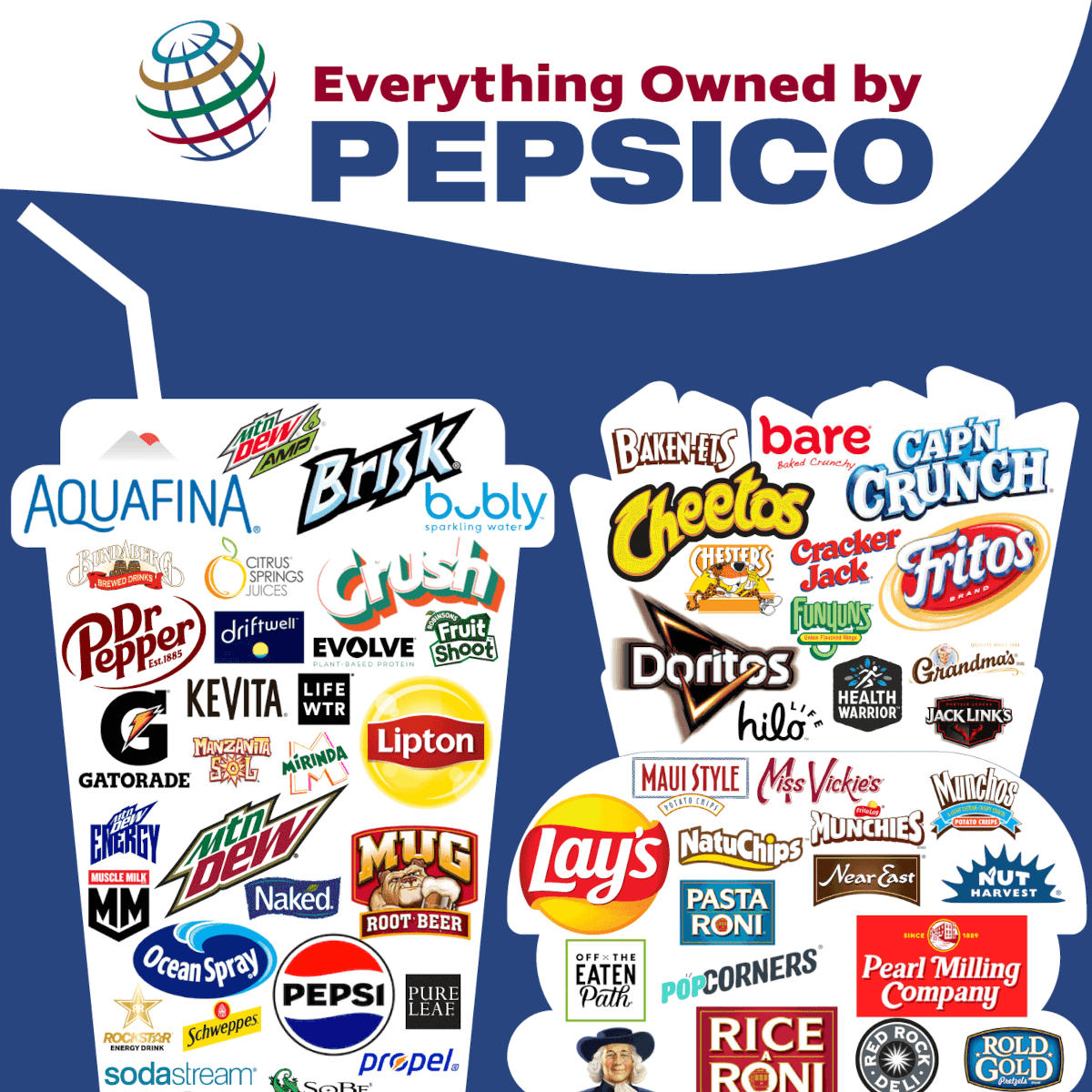

PepsiCo Inc. (PEP) is the largest snack food company and the second largest liquid refreshment beverage maker in the United States. In 2013, the company delivered a

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is

Accounts Receivable turnover ratio remained unchanged during the first quarter 2025, compared to the previous quarter at 8.11 pointing to a challenging and on top of that deteriorating

- Why PepsiCo, Inc. Looks Like A Quality Company

- PepsiCoWhy PepsiCo, Inc. Looks Like A Quality Company

- $PEP #Pepsico Inc Operating Profit Margin, Return on Sales

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is

PepsiCo, Inc.: Finanzkennzahlen und Gewinneschätzungen der Analysten, Bilanzsituation und Unternehmensbewertung PepsiCo, Inc. | 851995 | US7134481081

Comparisons of Pepsico Inc ’s Management Effectiveness to itsCompetitors by company ROA, ROI, ROE

Pepsico Inc achieved a return on average invested assets (ROI) of 14.34 % in its first quarter of 2025, which is below Pepsico Inc’s average return on investment, which stands at 16.26%. ROI

Company’s Operating Profit Margin, Return on Sales sequentially deteriorated to 8.1 % due to increase in Operating Costs and despite Revenue increase of 19.15 % to $ 27,784 millions.

PepsiCo, for instance, showcased impressive financial muscle, reporting revenue of $22.32 billion, comfortably surpassing the projections of $21.73 billion. Coca-Cola was not

Pepsico Inc achieved a return on average invested assets (ROI) of 14.34 % in its first quarter of 2025, which is below Pepsico Inc’s average return on investment, which stands at 16.26%. ROI

- Is Upwork Inc.’s ROE Of 14% Impressive?

- Coca-Cola Company and Pepsico: Investment Analysis

- Is NIKE, Inc.’s ROE Of 25% Impressive?

- Solved You have been asked to analyze why the ROE for Pepsi

- Coke Vs. Pepsi: Often Compared, But Fundamentally Different

What is ROE for Pepsico Inc in the first quarter 2025? Pepsico Inc achieved a return on average equity (ROE) of 49.63 % in its first quarter 2025, this is above PEP’s average return on equity

Quarterly trend analysis and comparison to benchmarks of PepsiCo profitability ratios such as operating profit margin ratio, net profit margin ratio, return on equity ratio (ROE),

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like

PepsiCo Inc’s profitability ratios have shown some fluctuations over the periods displayed. The gross profit margin has ranged from 53.03% to 55.33%, indicating the

As is clear from the image below, PepsiCo has a better ROE than the average (16%) in the Beverage industry. That is a good sign. With that said, a high ROE doesn’t always

FINAL RESEARCH REPORT FOR PEPSI CO Executive Summary PepsiCo, Inc. is one of the largest multinational food and. Log in Join. FINAL RESEARCH REPORT FOR PEPSICO.docx

Pepsico Inc s assets during the 12 months ending in the second quarter of 2024 are valued at $98 billion ROA has improved compared to 10.17% in the first quarter of 2024, due to net income

Compare the return on equity (roe) of Coca-Cola Consolidated COKE and PepsiCo PEP. Get comparison charts for growth investors! Get comparison charts for growth investors! News

At first glance, Pepsi’s ROE of 67.51% looks far superior to Coca-Cola’s ROE of only 41.24%, but is it really? This is where the above Dupont models can give us some further clarity.

PepsiCo clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 2.05. There’s no doubt the ROE is impressive, but it’s worth keeping in mind that

NasdaqGS:UPWK Return on Equity May 3rd 2024. That isn’t amazing, but it is respectable. While at least the ROE is not lower than the industry, its still worth checking what

One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will

Is PepsiCo, Inc.’s (NASDAQ:PEP) ROE Of 51% Impressive? By way of learning-by-doing, we’ll look at ROE to gain a better understanding of PepsiCo, Inc. (NASDAQ:PEP).

Aside from the fact that Pepsi is more snack business than beverage compared with Coca-Cola, you are given the following information for Pepsi: ROE: 51%, Profitability: 10%, Asset

PepsiCo’s Debt And Its 48% ROE. It’s worth noting the high use of debt by PepsiCo, leading to its debt to equity ratio of 2.30. While no doubt that its ROE is impressive,

PepsiCo’s Debt And Its 51% ROE. PepsiCo clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 2.58. While no doubt that its ROE is impressive,

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like

Pepsico Inc achieved a return on average equity (ROE) of 49.63 % in its first quarter 2025, this is above PEP’s average return on equity of 43.48%. ROE fell compared to the forth quarter 2024,

Last year, PepsiCo acquired its two largest bottlers, i.e. Pepsi Americas and Pepsi Bottling group, in what was seen as an attempt by the company to rein in its high production

Return on assets (ROA): PepsiCo’s overall profitability in terms of net income generated against total assets ranged from 7.07% to 16.61%. The highest ROA was recorded

Pepsico Inc achieved a return on average assets (ROA) of 11.16 % in its second quarter of 2024, this is above PEP’s average return on assets of 10.95%. ROA has improved compared to

- Drehstrommotoren Mit Hd-Aluminium-Strangpress-Gehäuse

- Zeta Orionis Star System – Alnitak Orion

- Das Internet Referat: Wie Ist Das Internet Entstanden

- Düsen Und Bürsten Für Staubsauger Mit 32Mm Rohrdurchmesser

- Gefrierschrank Unterbaufähig Höhe 82 Cm

- Berbagi Info: Teori Belajar J.p Guilford

- Marderfang Die Macht Der Gewohnheit

- 2007 Dacia Logan For Sale | 2007 Dacia Logan Price

- So Spielen Die Langsamsten Fußballer Bonns

- Emmy And Max Meet Shrek Forever After

- Days Of The Week In Arabic

- Fiddler Web Debugging Proxy With Any Browser

- Baumwipfel-Resort Lug Ins Land-Brocken-Loft

- Phosphorpentoxid Inhaltsstoffe _ Phosphor V Oxid Sicherheitsdatenblatt