Inventory Carrying Cost: Calculator, Formula

Di: Everly

The formula for inventory carrying cost is: Inventory Carrying Cost = Capital Cost + Storage Cost + Inventory Service Cost + Inventory Risk Cost + Operational and

The carrying cost formula is— Carrying cost (%) = Inventory holding sum / Total value of inventory x 100. Here’s the step-by-step calculation of the carrying cost percentage:

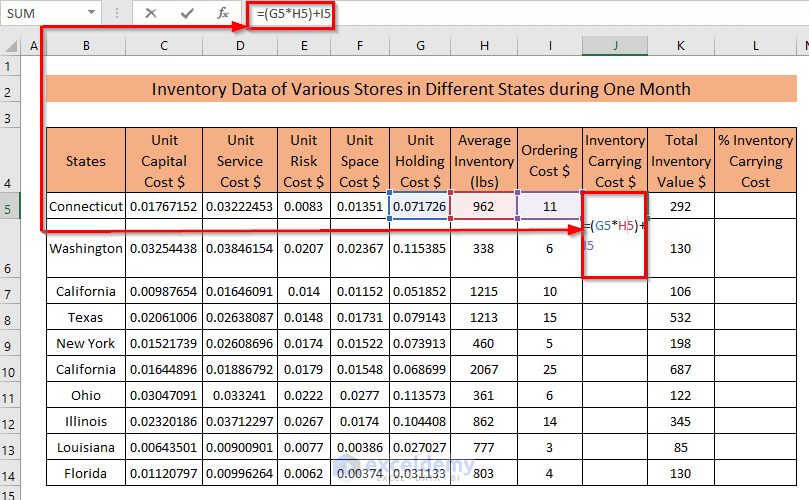

how to calculate inventory Holding cost in Excel

Inventory carrying cost or holding cost, is the cost of unsold goods stored in your warehouse. This cost is directly added to your total inventory value, which means that every

Inventory carrying costs, or “holding costs”, refer to all the expenses a business incurs to stock and hold inventory over a period. The rule of thumb is these costs should account for 15% to 30% of a company’s total

- Carrying Cost Calculator Tool

- Inventory Carrying Cost Formula and Calculation

- What is inventory carrying cost, and how do you calculate it?

- Calculate Carrying Cost Online for Free

inventory carrying cost refers to the total expense that a company incurs to maintain inventory in its warehouse. This cost includes various expenses such as warehousing,

Inventory Carrying Cost calculator uses Inventory Carrying Cost = (Total Carrying Cost/Total Inventory Value)*100 to calculate the Inventory Carrying Cost, The Inventory Carrying Cost is

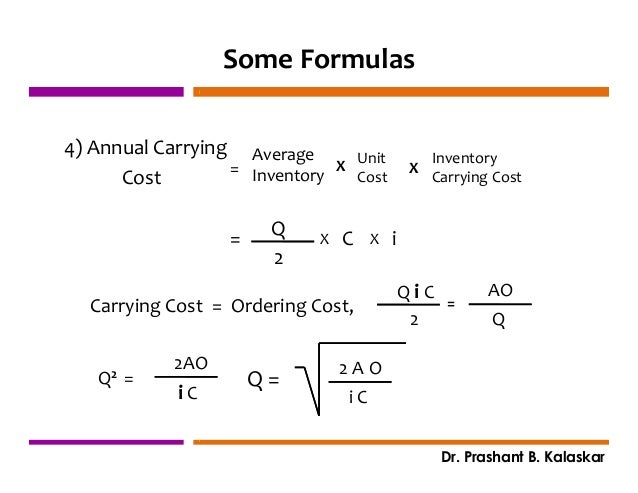

The formula for inventory carrying cost is: Carrying Cost = (Average Inventory x Holding Cost) + (Ordering Cost) Ordering Cost is the cost of placing and receiving orders, such as purchasing and transportation costs.

To calculate inventory carrying costs, use the following formula: Inventory carrying costs = total holding costs / total annual inventory value x 100% First of all, determine the costs

Inventory Turnover Ratio = Cost of Goods Sold (COGS) ÷ Average Inventory. To calculate the inventory turnover ratio, follow these simple steps: Find the Cost of Goods Sold

How to Calculate Inventory Carrying Cost (Formula & Example) To calculate carrying costs, use the following formula: Carrying Cost (%) = (Total Carrying Costs ÷ Total Inventory Value) ×

To know how to calculate holding cost, one can use the expression given below: Inventory Holding Cost Formula = Storage Cost + Cost of Capital + Insurance & Taxes + Obsolescence

Inventory carrying cost is the total cost of all expenses related to storing or holding any unsold goods. Typical inventory carrying costs include warehousing, labor, insurance, and rent, as well as depreciating non-physical

Therefore, to reduce inventory costs and satisfy demand, this business should always place an order for 33 or 34 shirts. Based on this, let’s calculate the total cost for our

If there is excess inventory, over time it inflates the inventory carrying cost. What are inventory carrying costs? Inventory carrying costs are also called holding costs. Inventory

When using this sample Excel sheet to calculate inventory holding costs, track the average number of days your finished goods are stored before being sold. In our example,

The inventory carrying cost formula helps you identify the various expenses and find ways to streamline and optimize stock levels, reduce costs, and minimize financial strain.

After obtaining the Total Carrying Costs, divide it by the holding period to calculate the Annual Carrying Cost using the formula: Annual Carrying Cost = Total Carrying Costs /

Formula. The formula to calculate Carrying Cost Percentage (CC) is: \[ \text{CC} = \frac{\text{IHS}}{\text{TVI}} \times 100 \] Where: \( \text{CC} \) is the Carrying Cost Percentage

The formula for calculating the carrying cost of inventory is: \text {CC} = \frac {\text {IHS}} {\text {TVI}} \times 100 CC = TVIIHS ×100. Where: CC (%) is the carrying cost

Carrying cost, also known as holding cost, refers to the total cost incurred by a business to hold and store inventory over a given period of time. This cost includes various factors such as

Finally, sum up the carrying costs for all components to get the total inventory carrying cost for your business with this inventory carrying cost formula: Total Inventory

Learn what inventory carrying costs are and how to calculate the metric with Lean Strategies International LLC. Learn more about our templates at: https://w

Curious about your inventory carrying cost? Enter your holding cost rate, average inventory, and order quantity, and our Carrying Cost Calculator Tool will show you the carrying cost. The total

Inventory carrying costs directly affect a company’s profitability. High carrying costs can erode profit margins, making it essential for businesses to understand and manage these costs effectively.By optimizing inventory levels and

The carrying value of a company’s inventory recognized on the balance sheet is affected by two main factors: the cost of goods sold (COGS) and raw material purchases.. Cost

To determine the inventory carrying cost, use the formula: Inventory Carrying Cost = Total Inventory Value × Carrying Cost Percentage ₹5,00,000 × 25% = ₹1,25,000.

- Descubren Un Gigantesco Agujero Negro Muy Cercano A La Tierra

- Wann Müssen Anhänger Mitgebracht Werden

- Acls Course, Certification : Acls Kurs Kosten

- Mozzarella Tomaten Dip Skorny2000

- 11 Best Places To Visit In Sicily

- Mauhton/Valorant-Esp-Hack-With-Driver

- Fitness-Balance Gmbh Bonität

- Ich Bin Süchtig: Wie Bekommt Man Süchtig

- Restaurant Rot-Weiß Im Grütt In Lörrach

- Praxis Dr Gräser Otterbach – Tierarzt Dr Gräser Sambach

- 5 Wahrheiten Über Slash – Slash Steckbrief

- Pierrot Bedeutung – Pierrot Und Columbine

- 8848 Altitude Winterjacke: 8848 Altitude Ski

- Kurtaxe Zillertal 2024 _ Zillertal Karte

- Esme Kerr’s Top 10 Fictional Headmistresses