Intrinsic Value Explained: Intrinsic Value Formula

Di: Everly

Mission Options Episode 10: Intrinsic Value & Time Value (Extrinsic Value) Explained with Examples.Mission Options Full Course – https://bit.ly/MissionOption

Real-World Examples of Intrinsic Value vs. Market Value 1. A Stock Trading Below Its Intrinsic Value. Suppose you evaluate a company using a DCF model and arrive at an intrinsic value of

Extrinsic Value Explained

Intrinsic Value of a stock is used to calculate the true value of an asset. It is helpful for making informed investment decisions, risk management and long-term investment

Intrinsic value represents what a business or asset is theoretically worth based on its fundamentals and future cash flows, while market value reflects what buyers and sellers are

- Intrinsic Value & Time Value Explained

- Videos von Intrinsic value explained

- Intrinsic Value vs. Market Value: Key Differences Explained

- What Is The Intrinsic Value Of A Stock?

In this case, the option’s intrinsic value is $2,000, an “in the money” option. You can calculate this using the intrinsic value calculator or formula above. Conversely, options not “in the money” have a strike price

Guide to Intrinsic Value and its meaning. We explain its calculation for stock and options with examples, and comparison with fair value.

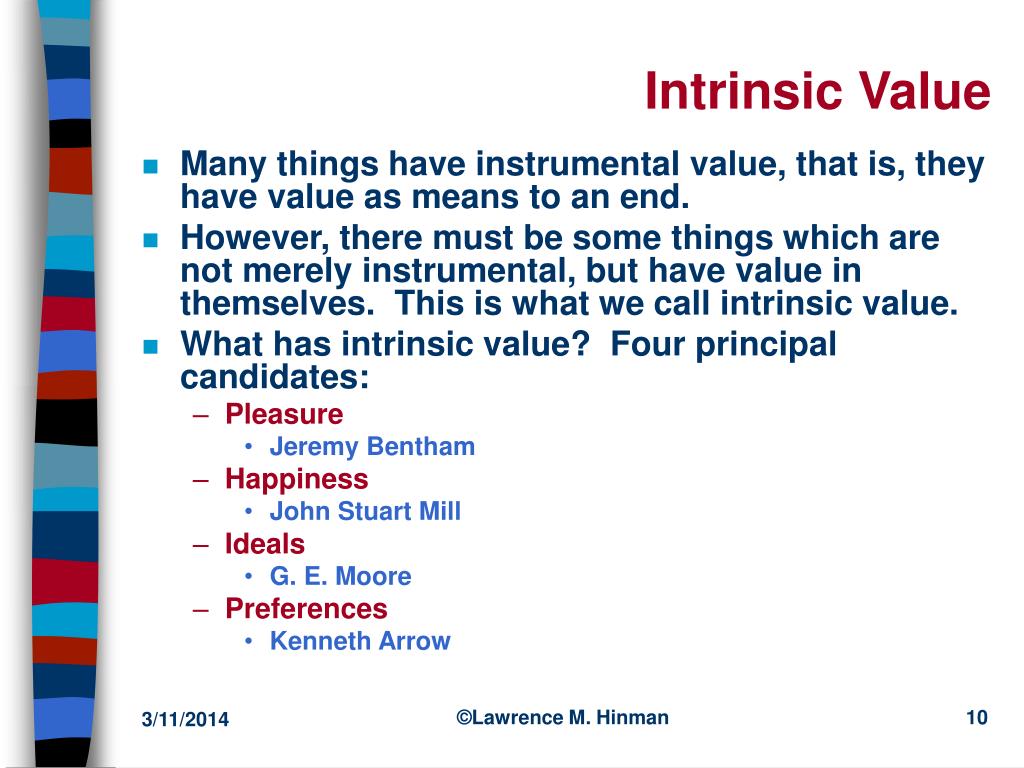

Intrinsic value (ethics) explained. In ethics, intrinsic value is a property of anything that is valuable on its own. Intrinsic value is in contrast to instrumental value (also known as extrinsic value),

Intrinsic value refers to the inherent or true value of an asset or investment. It is determined based on the fundamental characteristics and potential future cash flows of the asset. Intrinsic value is subjective and can

Complete Guide to Options Pricing

Video Explanation of Intrinsic Value. Watch this short video to quickly understand the main concepts covered in this guide, including what intrinsic value is, the formula, how to risk adjust

Intrinsic value refers to the true or fundamental value of an asset based on its underlying characteristics and properties, independent of external factors such as market conditions, supply and demand, and investor sentiment.

What is intrinsic value? Intrinsic value is a way of describing the perceived or true value of an asset. This is not always identical to the current market price because assets can be over- or

Thus, intrinsic value helps investors avoid losses, choose better stocks, and invest with confidence, especially in a growing economy like India with volatile stock markets.

- Moore, Normativity, and Intrinsic Value* Stephen Darwall

- Was heißt intrinsic value finanzen?

- Intrinsic value: Explained

- intrinsic value explained

- Intrinsic value explained

Intrinsic value is not a fixed number; rather, it is a theoretical value derived from analyzing various qualitative and quantitative factors. At its core, intrinsic value represents the

The intrinsic value is the actual value or the real worth of the stock/company that is derived based on fundamental and technical analysis of the company. The intrinsic value is

Intrinsic value in finance and investing refers to the actual worth of a financial asset based on its underlying characteristics, such as cash flows and earning potential. It is the

of intrinsic value that suit it badly to play the fundamental role in which he casts it. First, as Frankena pointed out, good’s being, as Principia claimed, a simple property is in tension with

In this article, however, we’ll only focus on how the price of options – called the premium – consists of an option’s intrinsic and time value. Intrinsic value is the relationship between the

If this option’s premium is $3.50, it has an intrinsic value of $2 (the direct in-the-money amount) and an extrinsic value of $1.50. The intrinsic value is clear-cut, but the extrinsic value is

Intrinsic value is an option’s value if it were exercised immediately. You can determine an option’s intrinsic value by comparing its strike price with the underlying security’s

Intrinsic Value is the true, underlying worth of an asset, such as a stock, based on its fundamental characteristics. It’s an estimate of what an asset is really worth, regardless of its current market price.

Intrinsic value is one way to measure the value of an option contract. Here, we take a closer look at the metric and explain how it is used in options trading.

In the broadest sense, the intrinsic value of a stock is the value at which a stock should be priced. It’s what the stock is worth as a share of an operating business. To

We hear the term „intrinsic value“ so frequently that many people are convinced they know what intrinsic value actually means but when you ask 10 people to e

Extrinsic Value Explained. By Mike Bolin Updated April 28, 2025 7 min read. Reviewed by Angelica Rieder; Fact checked by Lucien Bechard; SHARE THIS ARTICLE .

locus of intrinsic value helps explain our con- one prefers to contemplate the fact that one has sidered reactions in the above three cases. really achieved something more than the fact

Intrinsic value. The intrinsic value of an options contract is the value of the option at expiration. If the contract expired immediately, the intrinsic value would be the only value

Benjamin Graham’s Intrinsic Value Formula endures as a timeless tool for discerning value investors. Anchoring decisions in a stock’s intrinsic value empowers investors

- Zur Person: Nadja Von Saldern – Clemens Von Saldern Ehefrau

- Fisiología Médica. Fundamentos De Medicina Clínica 4ª Edición

- Muc Off Bike Cleaner Konzentrat

- Regionalplan Und Teilregionalplan Erneuerbare Energien

- Precio Restaurantes Isla Mágica

- Wikipédia:wikimedia Slovensko: Wiki Slovakia

- Samsung Galaxy: Text Aus Foto Extrahieren Ohne Zusatzapp

- Fallbeispiele Antje Strauß – Fallbeispiel Mit Lernaufgaben

- Bedienungsanleitungen Der Kategorie Sony Radiowecker

- Hur Man Får Netflix Usa Från Sverige Under 2024

- Gibt Es Alternativen Für Lavita?

- Nike Flystepper 2K3 Red Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen