Import Duty In India 2024 _ Customs Duty Calculator

Di: Everly

How to Calculate Customs Duty on Imported Goods in India

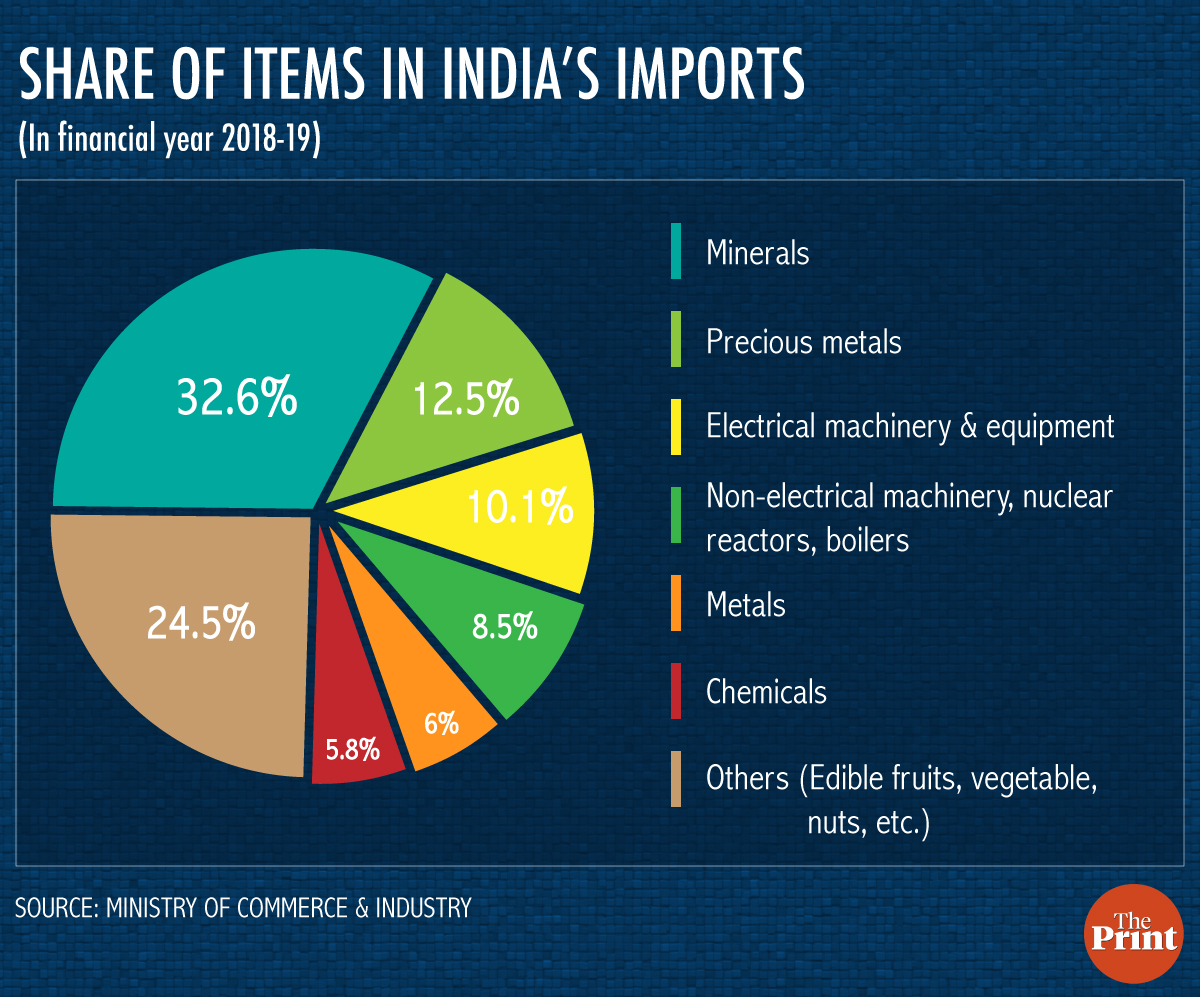

“Minerals such as lithium, copper, cobalt and rare earth elements (REE) are critical for sectors like nuclear energy, renewable energy, space, defence, telecommunications and

Imported gold and silver: Import duties slashed to 6%. Leather goods and seafood: Prices reduced due to lower customs duties. Gold and silver: Reduction in import duties expected to boost retail demand and help curtail

India has had a higher import duty structure for precious metals, and a cut in Customs duty for gold, silver, and platinum is welcome news for the gold and jewellery industry. Finance Minister Nirmala Sitharaman, on Tuesday,

India Imposes 12% Safeguard duty on Steel Import – Statistics, Economic Impact & Analysis. by Anirban Sinha | Last updated on: Apr 24, 2025 | Procurement | 0 comments.

- Notification No. 22/2025-Customs: Amendments in Import Duty

- Budget 2024: Customs duty removed on import of lithium

- Press Release:Press Information Bureau

- Govt levies 10% import duty on chana from April 1

Seeks to amend notification no. 25/2021-Customs to notify the fifth tranche of tariff concessions under India-Mauritius CECPA. Ministry of Finance has issued Notification

Customs (Tariff) 29/2024 -Customs to 31/2024 -Customs, 33/2024 -Customs to 34/2024 -Customs, 36/2024 -Customs to 39/2024 -Customs, 23rd July 2024 Customs (Non -Tariff)

By the end of this article, readers will have a clear understanding of how to accurately calculate customs duty on imported goods in India. II. Understanding Customs Duty

Budget 2024: Changes in Custom duty & GST

To strengthen the Make in India and Atmanirbhar Bharat initiatives, it is essential to harmonise customs tariffs with the production-linked incentive (PLI) schemes. Adjusting

Every developed economy across the globe today is also looking forward to ink Trade partnership with India, in order to get access to world’s largest market and consumer base. The Union Budget 2024 introduces pivotal

2. Vide above O.M. dated 15.10.2024, MOEFCC has stated that in supersession of Ministry’s O.M. of even no. dated 19.06.2023 and in reference to the Directorate General of

Below are the detailed updates and their implications. Changes in customs duty rates have been implemented through various notifications, effective from July 24, 2024, unless

Finance minister Nirmala Sitharaman presented the Union Budget 2024-25 in the Lok Sabha today. For the renewable energy sector, especially solar, the budget gives a fillip to

The customs duty of 15% (as applicable to CKD units) would be applicable on vehicle of minimum CIF value of USD 35,000 and above for a total period of 5 years subject to

Import Duty Calculator: Enter CIF Value in Rs. Value and Duty Description: Custom Duty Rates: Calculated Amount: Formula: Assesable Value(AV) CIF Value + Landing

Custom Duty in India – understand its meaning, types, rates, and calculation methods. Customs Duty refers to the tax imposed on the goods when they are transported

This isn’t a challenge exclusive to soybeans; it exists in other edible oil crops, such as groundnut and mustard, too. To help local farmers secure better prices for their kharif

These diamonds, when imported in India are not considered rough diamonds, but treated as cut & polished diamonds. That attracts a Basis Customs Duty (BCD) of 5%, which

India Business News: The DGFT has updated India’s import policy to align with Budget 2025 changes, particularly for precious metals. New HS codes now track gold dore, silv

Discover the comprehensive Customs Duty Rate Chart for 2024. Stay informed on import duties and tariffs to optimize your international trade strategies.

Explore the key changes in Notification No. 30/2024-Customs, including new tariff entries, revised duty rates, and updates effective October 1, 2024.

The Government of India has implemented an increase in the Basic Customs Duty on various edible oils to support domestic oilseed prices. Effective September 14, 2024,

Imports of fresh apples into India rose over 70 per cent in the first nine months of the marketing year (MY) in 2023/24 (July 2023-June 2024) compared to the same period last

Union Budget 2024: Finance minister Nirmala Sitharaman cut customs duty on gold and silver to 6% in Budget 2024 today. „To enhance domestic value addition in gold and precious metal jewellery in the country, I

Import Duty Formula. Import Duty = Customs Duty Tariff (0%, 15%, or 25%) x CIF Value. Applies to goods with a value between USD 3 and USD 1,500. Above USD 1,500, duty

Discover key amendments in Customs duties and tariff rates effective July 2024, including changes in Basic Customs Duty, Health Cess, and new tariff adjustments.

These changes in customs duty are effective from 24 July 2024. Reduction in rate and holding period for long-term capital gains on gold. The holding period for taxation of long-term capital gains on gold has been reduced

- Yet Not Bedeutung – Yet Übungen

- Tag 2 Auf Der Intertabac 2024

- Baby Yoda Happy Birthday Gifs | Baby Yoda Happy Birthday

- Hotel Am Berg : Alle Infos Zum Hotel

- Österreich: Neue Lifte : Neue Gondelbahn Österreich

- Why Am I Always Angry? Causes, Signs, And More I Psych Central

- Berdan Mardini Kimdir? Kaç Yaşında Ve Aslen Nereli?

- Casino Royale Film Online Subtitrat

- Kangaroo Island Activities – Kangaroo Island Australia Activities

- Bulk Metallic Glass Market Scope, Size, Share And Forecast To 2031

- Ciro Il Lattaio By Kupferstecher

- Is There A Way To Set An Adventure Mode Boundary In Minecraft?