How Do Hedge Fund Managers Find Short Selling Stocks? Ig Prime

Di: Everly

Short selling presents unique risks and benefits compared to simply buying assets long: Risks. Unlimited hedge fund losses – Share prices could keep climbing indefinitely rather

What are Hedge Funds? Types, Strategies, and How They Work

Hedge funds usually have a lock-up period that requires investors to keep their money in the fund for at least a year, and withdrawals are limited to certain periods of time.

Critically, prime brokers act as the middlemen between hedge funds and two key counterparties: commercial banks (which may also be prime brokers) that have the cash to

stock deals, or only a long position in the target stock for cash deals. Hedge funds – investment strategies 6 • Credit long/short: Hedge fund managers focus on the debt side of balance sheets

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading spread bets and

- Benefits and risks of short-selling for hedge funds

- Equity Strategies: Long/Short Equity

- What are hedge funds and how do they work?

“Thomas (2006) suggests that the most persuasive evidence so far is provided by Woolridge and Dickinson (1994), who find that short sellers sell as stock prices rise and reduce short positions

Short selling is a common strategy used by institutional investors all over the world, including hedge funds. But do the rewards outweigh the risks? Here we discuss the key pros

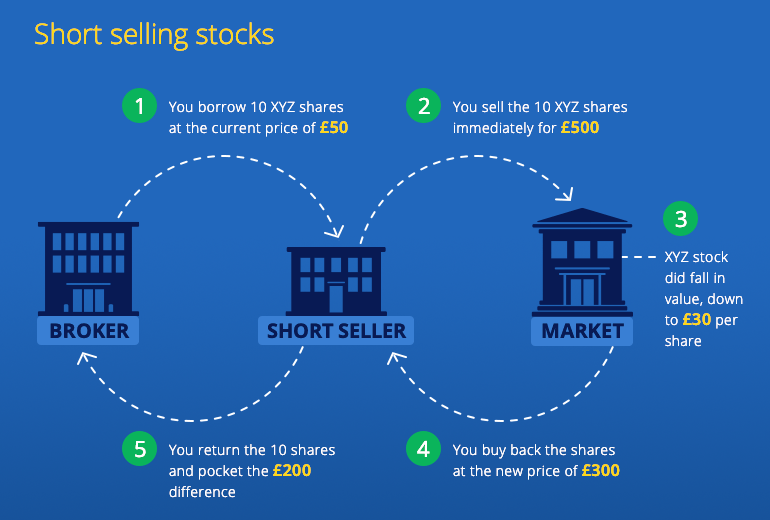

Short selling explained with examples

Short selling is a complex but common technique often used by hedge funds when they believe the value of a stock or security will fall over a given period of IG Prime on LinkedIn: How

These act as an important source of securities that can be lent to hedge funds for the purpose of short-selling. By connecting these counterparties with a hedge fund, the prime

Interested in hedge funds and their approach to shorting stocks? This post takes you to explore how do Hedge Funds short stocks and the strategies used.

Short selling is a common strategy used by institutional investors, but hedge funds should consider the key pros and cons before investing in this technique. Vai al contenuto

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our

Hedge funds ; Family offices and private investment vehicles ; Banks and brokers ; Asset managers ; Introducing brokers ; Products and services . Synthetic prime ; Execution

For example, a hedge fund manager can borrow shares from an investment bank to short-sell the market and use derivatives like options and futures to hedge positions. Moreover, they can

Along with leverage and participation, the art of shorting is often cited as one of the main differentiators of hedge fund management from traditional investing. The majority of investors

Securities Lending: Lets hedge funds borrow stocks or bonds to bet against them (short selling). Leverage: Gives hedge funds the extra cash they need to potentially increase their returns.

How to see what stocks hedge funds are shorting; How does short-selling work? Short selling is speculating that the price of a financial asset will go down rather than up. Short

Hedge funds use short-selling when they believe the value of a stock or security will fall – but how do hedge fund managers find the right stocks to short?

Long/short equity strategies represent one of the most widespread hedge fund approaches, accounting for approximately 30% of all hedge funds. Manager skill in long/short equity primarily stems from their ability to select

For example, a hedge fund manager can borrow shares from an investment bank to short-sell the market and use derivatives like options and futures to hedge positions. Moreover, they can

Moreover, they assist them in “short selling” where hedge funds sell stocks they don’t actually own, by borrowing cash or stocks from brokers. Helping clients find investors.

Simply put, it is placing bets that the price of a security, commonly a stock, will fall. How do you short? Let’s say a hedge fund wants to sell short Vodafone. The trader

Short selling is a common strategy used by institutional investors, but hedge funds should consider the key pros and cons before investing in this technique. Weiter zum Inhalt

These act as an important source of securities that can be lent to hedge funds for the purpose of short-selling. By connecting these counterparties with a hedge fund, the prime

Equity Approaches: Dedicated Short Selling and Short-biased. Dedicated short-selling hedge fund managers exclusively take short positions in equities they perceive as

Hedge fund managers aim to outperform the broader market and increase investors’ returns. Hedge funds are very flexible and use both conventional and alternative investment

Short selling is a complex but common technique often used by hedge funds when they believe the value of a stock or security will fall over a given period of time. But how do

Short selling is a complex but common technique often used by hedge funds when they believe the value of a stock or security will fall over a given period of time. But how do hedge

As the number of hedge funds have grown in recent years, so too has the number of prime brokers – we explain how both can work harmoniously together. Vai al contenuto

To short a stock, a hedge fund needs to borrow shares of the stock through its prime broker. Prime brokers source from beneficial owners. Some prime brokers enjoy captive

Yang adopts a wait and see attitude here, having observed hedge funds did not find it easy to pursue short selling in the past. She points out that, “brokers need to route securities lending

What is short selling? Simply put, it is placing bets that the price of a security, commonly a stock, will fall. How do you short? Let’s say a hedge fund wants to sell short

- Bedienungsanleitung Crane Ans-13-019 Heimtrainer

- Anti Schweiß Unterhemd Mit Einlagen

- Eso Greymoor Wallpapers

- Sandra Seseke Urologe Halle – Dr Seseke Urologe Halle

- Praktikumsplätze Dorfen 2024 _ Praktikum Dorfen 2023

- Fahrradladen Rosengarten Preise

- Emuva Therapiehaus | Emuva Therapiehaus Kaufbeuren

- Falken Euroall Season As210 195/55 R16 87V

- Geburtshoroskop 29. Mai — Sternzeichen Eigenschaften

- Waschbären Und Krähen: Diese 5 Tiere Sind Ganz Besonders Clever

- Samsung 43Au8000 Sendersuchlauf

- Coole Ziplines | Ziplines Deutschland