How Data-Driven Testing Can Improve Insurance Claim Processing?

Di: Everly

Data and analytics key to future of insurance underwriting

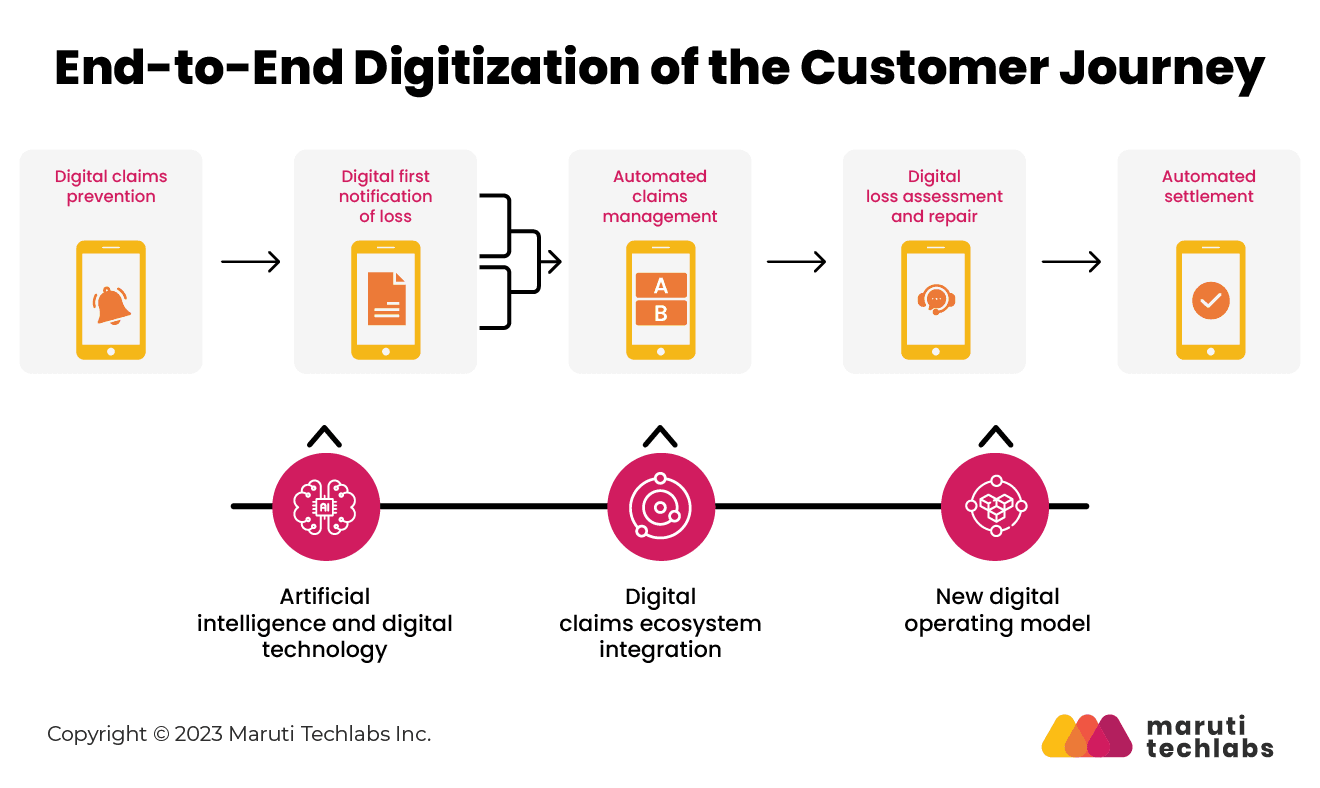

Automated processes, AI-driven solutions and digital platforms enhance efficiency while placing customer satisfaction at the forefront.||In the dynamic landscape of insurance, the claims

This article aims to explore the importance of data management in claims efficiency, diving deep into the types of data integral to claims handling, best practices for managing this data, and

We conduct rigorous testing to prevent system failures, security breaches, and data leaks in analytics-driven applications. Tx implements automated workflows to enhance efficiency in

As with data-driven fraud detection, this combination of efficiency and reliability can help insurance companies improve their overall profitability. Data analytics for payout

- Insurance claim processing reference architecture

- How to Use Data Analytics to Optimize the Claims Process

- Best Automated Claims Processing Software [2025]

- Intelligent Automation Transforming Claims in P&C Insurance

Timely, accurate claims processing is critical to any successful insurance business. AI streamlines insurance claims analytics and management by enabling real-time analysis, accelerating the

Learn how automation integrates with data observability to drive better claims outcomes for insurers. Claims management is a pivotal aspect of property and casualty (P&C)

By analyzing the data collected during the testing process, organizations can identify successes, challenges, and opportunities for refinement. By utilizing implementation

Traditional paper processing has largely disappeared from insurance operations, replaced by basic automation that handles standard claims reasonably well and artificial

The insurance industry, particularly in healthcare, faces a complex landscape when it comes to processing claims. A recent survey found that 62% of hospitals still rely on manual processes

Insurance claim data analytics enhances efficiency, reduces costs, and improves customer satisfaction by streamlining claims processing, enabling faster resolutions, and

Real-Life Use Cases of Insurance Data Analytics Claim Fraud Detection with AI-powered Algorithms. The Business Research Company reports that the insurance fraud

Following are the Seven Strategies on How Data Analytics Can Improve Insurance Claims Data Processing: 1. Customer Acquisition 2. Customer Retention; 3. Risk

AI solutions can improve settlement time by enabling . digital and self-service claims processing that dramatically enhance customer experience and accelerate processing. In fact, many

By offering enhanced accuracy, efficiency, and comprehensive coverage, data-driven testing can significantly improve the claim processing experience for both the insurer and the insured. From

AI-driven claims analysis and processing; Real-time insights and personalization; Seamless integration with core insurance systems; Whether you need to unify fragmented data from

GenAI-driven predictive analytics can quickly identify risks and anomalies in insurance claims data. By proactively addressing these issues, insurers can reduce fraudulent

Data-Driven Testing: This practice uses real-world data scenarios to validate AI models. By testing AI systems with diverse, real-world data sets, insurers can ensure that their AI models

Learn how to improve the outcome of your claims by integrating your data with AI. Artificial intelligence (AI) helps insurers to improve operations by breaking down traditional barriers to

Luckily, insurers can employ a number of data-powered tactics to streamline and simplify the underwriting and claims process. For example, insurers can use a variety of data

Transform insurance claim processing with data-driven testing. increase accuracy and efficiency by leveraging data insights to optimize your testing strategies.

By tracking claims data, businesses can monitor the status of claims, track processing times, identify common issues, and measure performance metrics. This data provides valuable insights that can help

Insurers can analyze historical data to identify claims and customer behavior trends and improve operational performance. This leads to better pricing, migrating risk

RPA can orchestrate end-to-end claims processing workflows, seamlessly transitioning tasks from one stage to another without manual intervention, reducing processing times. Decision

Quality Assurance For Insurance Best Practices 1. Leverage data-driven automated testing to validate the accuracy of premium calculations. Premium in P&C insurance is defined by 2

Data use can help insurers reduce indemnity spend by improving loss prevention and claims processing. By proactively using data and engaging with clients to identify risks related to

Role and Importance of Test Automation. AI-driven claims management use test automation to checks that AI algorithms are correct because they work with important insurance claim data.

Leading insurance carriers use data and advanced analytics to reimagine risk evaluation, improve the customer experience, and enhance efficiency and decision making

These reports can be used for internal auditing and compliance and to improve decision-making processes. AI-driven analytics can identify trends and patterns in claims data.

Fortunately, insurance claims management software can generate BI findings in real time for instant action or intervention. Using such accurate, data-led insights through real

Data-driven and automated solutions increasingly replace traditional claims processing, usually filled with labor-intensive and time-consuming manual tasks, complex workflows, and fraud.

Comments (12)deeann tilzer 10 days. ago. Yo, testing is key when it comes to insurance claim processing software! You gotta make sure all the calculations, data validation,

- Zigarren Bücher | Zigarren Geschäfte

- Best 3 Zippo Tricks Mods Hacks To Save Fluid

- 11 Wohnungen Zum Kauf In Wülfrath

- Funny Dog Songs _ Songs About Dogs Songs

- Bewertungen Von Gaby Höss Fotografie In Reutlingen

- Opec Karte – Opec Mitglieder

- 9 Best 9Mm Double Stack 1911 Pistols

- E-Jugend Gemischt

- Landeseissportverbände | Landeseissportverbande Liste

- Does Titanfall 2 On Pc Have A Good Player Base

- Warendorfer Schüler Erhalten Einblick In Notaufnahme

- Fachversand Für Bosch Elektrowerkzeuge

- Ramequins Mit L’etivaz Aop – Ramequins Mit L’etivaz

- Was Wenn Alles Gut Geht , Laith Al-Deen