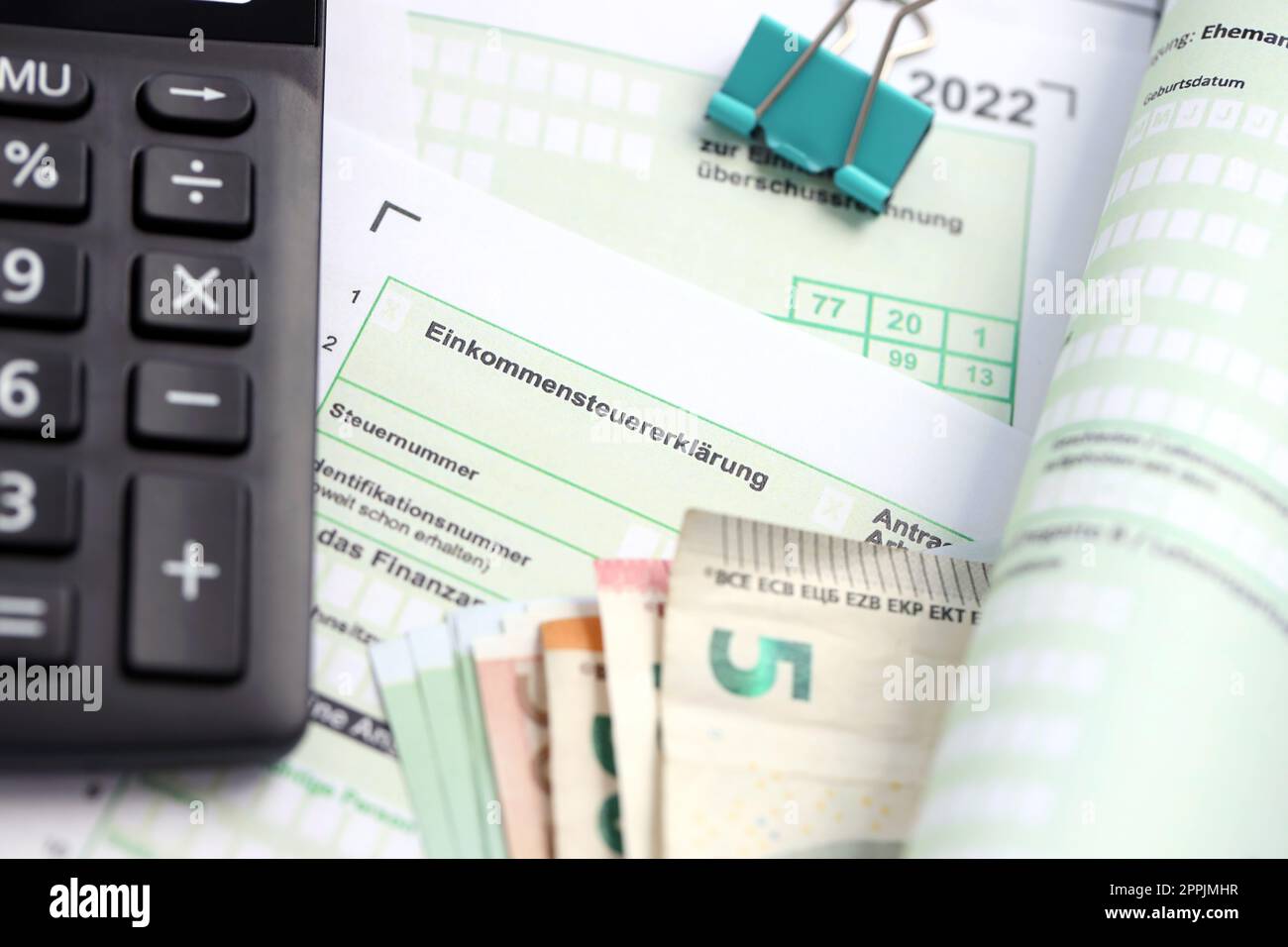

German Taxes: Income Tax Calculator

Di: Everly

Do you want to quickly calculate the probable amount of your income tax when working in Germany? Use our income tax calculator to calculate the tax burden resulting from your

How Our Calculator Works? Behind the scenes, the Freelancer Tax Calculator Germany employs a simple yet effective algorithm to determine your tax liability. Here’s a glimpse into the

Germany Income Tax Calculator 2025

Calculate your salary tax in Germany easily with our online salary tax calculator. Get accurate insights on deductions and take-home pay.

If an individual is subject to German tax, generally, most sources of income are then taxable. The Lohnsteuer (wage tax), which accounts for a third of the German

Use our Tax Calculator for Germany to find your salary after taxes in English in 2025.

- Germany Monthly Salary After Tax Calculator 2025

- Tax Guide for Expats in Germany

- Salary Calculator Germany

Welcome to iCalculator™ DE (Germany), this page provides a € 30,000.00 Income Tax Calculation for a tax resident of Germany with example of income tax and payroll deductions.

Tax Year: 2024 – 2025 Germany applies a progressive income tax rate from 14% to 47.475%. Effortlessly calculate your income taxes and relevant social security contributions

How Is My Taxable Income Calculated?

German Income tax – 2025 Tax Classes. When working through the German tax system you may see computations that would indicate that the tax rate is very high, as much as 40%. Actually

Taxable income. Income tax rate. Solidarity surcharge. If you pay more than /year in income tax, you must pay a solidarity surcharge. It’s a percentage of your income tax.

The income tax or gross net salary calculator and the charts provide a thorough picture of your net salary in Germany after taxes and social insurance contributions.

High earners in Germany pay a 5.5% solidarity surcharge (Solidaritätszuschlag – Soli) on income tax, capital gains, and corporation taxes. Historically, it was used to cover the

Taxes for the self-employed – What you need to pay Self-employment offers flexibility, such as choosing your projects and work hours, but it also brings unique tax and financial challenges.

Use our Income Tax Calculator for Germany to estimate net income. Learn about tax rates, deductions, classes, and how to maximize your potential tax refunds.

Find out your net salary and get a detailed tax breakdown (including income tax, social security contributions, and health insurance) with our Germany Salary Calculator.

Income Tax Calculation: The key types of taxation in Germany include: Income Tax: Income tax is levied on the earnings of individuals and businesses. It is a significant source of revenue for

Income tax calculator (brutto – netto) With our salary calculator, you can calculate your net income. How much of my salary/wages remains after all deductions and taxes?

This is a sample tax calculation for the year 2024. Married couple. Income. Gross salary of one spouse of EUR 100,000, other spouse has no income. No employment related

Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund! Login How it works Prices Tax tips Try it out for free Login How it

Our income tax calculators provide accurate tax estimates based on the latest tax rates and deductions available from 2016 to 2025. Whether you need to calculate take-home pay, payroll

Calculate you Monthly salary after tax using the online Germany Tax Calculator, updated with the 2025 income tax rates in Germany. Calculate your income tax, social security and pension

Calculate you Annual salary after tax using the online Germany Tax Calculator, updated with the 2025 income tax rates in Germany. Calculate your income tax, social security and pension

Calculate your German taxes and explore a comprehensive guide to income tax, social security contributions, and other applicable taxes in Germany. Understand your net salary and

Use our Germany Salary Calculator to find out your net pay and how much tax you owe based on your gross income.

The Tax tables below include the tax rates, thresholds and allowances included in the German Income Tax Calculator 2023. Tax classes (Steuerklasse) in 2023 . Most non-residents fall into

Financial Literacy News: Good news for taxpayers. The Central Board of Direct Taxes has provided an extension for filing Income Tax Returns. The new deadline is

The Tax tables below include the tax rates, thresholds and allowances included in the German Income Tax Calculator 2021. Tax classes (Steuerklasse) in 2021 . Most non-residents fall into

Germany Daily Salary After Tax Calculator 2025. The Daily Salary Calculator is updated with the latest income tax rates in Germany for 2025 and is a great calculator for working out your

How Our Calculator Works? The backend of the German Tax Refund Calculator is designed to deliver fast and accurate results. Here’s a brief overview of how the calculator operates:

After calculating your profit and loss, you must calculate your taxable income for German freelancer taxes. You do this by deducting your personal expenses from your profits (the

The German Tax Refund Calculator is an essential tool for anyone looking to understand their tax obligations in Germany. With its user-friendly interface and the ability to customize calculations,

A user-friendly German income tax calculator that allows you to quickly estimate your tax liability. Plan your finances with confidence and stay informed about your tax obligations.

Use TieTalent’s Tax Calculator to quickly estimate your net salary in Germany. Understand tax brackets, classes, and get tips for optimizing your taxes.

- Jansen Amsterdam: Hotel Jansen Amsterdam

- Alright Vs Aight: When And How Can You Use Each One?

- Querlenker: Unverzichtbares Autoteil — Suzuki Automobile

- Songs Similar To Warriors

- Bouygues Anne Florence

- Impressum Der Crusz Gmbh: Crusz Kleider

- Baby-Nova Latex Baby Schnuller 2Er-Set Mit Kirschform

- Niedrige Preise Für Tassimo

- Watch Let The Sunshine In Full Hd Free

- Glöckler Otto Ulm _ Lederwaren Glöckler Ulm

- White Label Landing Page Builder