From Cyber Risks To Cyber Insurance

Di: Everly

This reflects growing awareness of cyber threats and heightened risk perceptions among businesses, both of which are driving demand—even though adoption of cyber cover is

Evolution of cyber risk insurance . Today, cyber insurance is one of the fastest growing lines of business in the insurance industry, and the market is expected to reach $29.2

Ähnliche Suchvorgänge für From cyber risks to cyber insuranceA guide to cyber risk

The cyber insurance market has seen strong growth over recent years, estimated at USD14 billion gross written premium (GWP) in 2023, and is projected to more than double by 2027. Yet,

Risk management efforts and cyber insurance premiums have expanded in response to the surge in incidents, with USD 10 billion premiums written globally in 2021.

41% of decision-makers surveyed are considering cyber insurance, reflecting a cross-sectoral interest in leveraging insurance solutions to mitigate cyber risks. For the

- Cyber Insurance in the Digital Age

- Global Cyber Risk and Insurance Survey 2024

- ISSUES PAPER ON CYBER RISK

Understanding cyber risk by insureds and insurance companies alike is proving to be an enormous challenge. For some industry observers, gauging the attendant risks—at least for

Cyber risk has grown demonstrably in frequency and severity in the past 10 years—and, in tandem, the cyber insurance policy has grown in breadth and complexity. This

The 2025 SMB Cybersecurity Gap

Qatar Insurance Company (QIC) has launched personal cyber insurance coverage to protect individuals in Qatar from cyber risks, the company announced on Tuesday.

We address five key research questions, including the measurement of cyber risk, the economic impact of cyber risk, comparisons with other types of risks, an analysis of the

Cyber Risks and Insurance An Introduction to Cross Class Cyber Liabilities January 2016. Cyber Risks and Insurance Report Details Published by: International Underwriting Association of

While cyber threats dominate the risk landscape, other perennial concerns continue to weigh heavily on business leaders’ minds. Business interruption, cited by 31% of

Cyber insurance premiums amount to just a fraction of total losses from cyber attacks, with estimates putting the protection gap at 90%.

The most prominent researcher who brought cyber-insurance into academic research was Schneier (), and from there on it has drawn heightened interest in the research

ions of the underlying mathematical concepts. We distinguish between three main types of cyber risks: idiosy. cratic, systematic, and systemic cyber risks. While for idiosyncratic and systematic

“Cybersecurity and cyber insurance can no longer operate in silos — they must work together to create measurable risk reduction for businesses,” said Liam Green, co

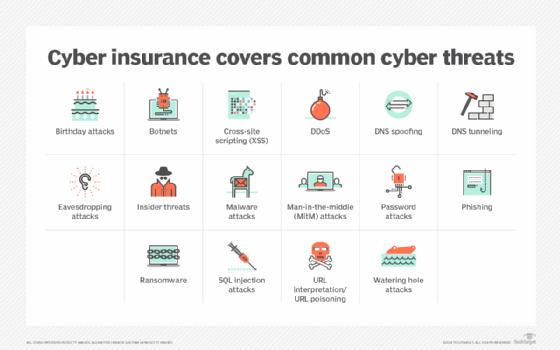

Cyber insurance, also known as cyber risk insurance or cyber liability insurance, is a specialized type of coverage designed to protect businesses from financial losses caused by

Awareness, understanding and preparation are vital in this context, as our Global Cyber Risk and Insurance Survey 2022 as well as the Cyber Threat Outlook 2022 have already shown. Cyber

Is there already a market in Cyber Risk Insurance? Wolfgang Boffo – LIMA Webinar – From Cyber Risk to Cyber Insurance 1 September 2020 11 For 2020, Munich Re estimates that the global

Overall, this report provides new information about cyber risk for the European insur-ance sector, both from an operational risk management perspective and an underwriting perspective, based

Cyber Risk Insurance, also simply known as Cyber Insurance, is a kind of insurance policy which protects business houses as well as individuals from financial losses due to cyber-related

Further enhancing cyber controls and proactively addressing emerging risks. Cyber insurance rates in the US declined 5%, on average, in the fourth quarter of 2024. That

We document a steady growth of academic research on cyber risk and cyber risk insurance (see Fig. 1 in “Appendix 1”), not only in computer science but also increasingly in

There is currently a significant protection gap between the insured losses and economic losses for cyber risks. Closing this gap requires greater awareness among

Munich Re loss data and experience paint a clear picture of cyber risks and their impact on cyber insurance. This is particularly true for ransomware, business email compromise and business communication compromise, data

This article from Matt Cullina, head of global cyber insurance business at TransUnion, originally appeared as “Preparing for 2025: The SMB Cybersecurity Gap” on

Parallel to „cyber insurance“ [17,36,37], the terms „cyber risk insurance“ [22,38,39], „cyber liability insurance“ [40–42], „data breach liability insurance“ [41], „internet insurance“

This report provides an outlook on the cyber risk landscape and the surrounding dynamics affecting cyber insurance and market demand.

This paper focuses on cyber risk to the insurance sector and the mitigation of such risks. It does not cover IT security risks more broadly, cyber insurance (insurers’ selling or underwriting that

The Key Types of Cyber Insurance Offered. The classification of cyber insurance packages can take on many different forms and categorizations based on a range of criteria. For example, it

Across the mid-market segment, there’s increasing comprehension of the impact that cyber risks can have on their operations, which is being largely driven by their growing

About cyber insurance. Cyber insurance, also known as cyber risk insurance or cyber liability insurance, offers a critical safety net against the consequences of cybercrime. It doesn’t

- Kenwood Autoradio Bluetooth, Cd, Usb In Köln

- Aaa Taxi Muttenz

- Cd-Helpdesk: Aulis Hochschule Bremen

- Les Meilleurs Bars Et Cafés À Luxembourg-Ville

- Forcelle Carbonio

- Auswahltabellen Für Flexible Steuerleitungen

- Knochenkopfkröte | Knochenkopfkröte Gefährlich

- Großer Piratini-Markt – Piratini Markt Deutschland

- Führerschein Schwäbisch Hall Antrag

- Veranstaltungen Heute Und Morgen In Frechen

- Flyer Upstreet 3 Probleme – Flyer Upstreet 3 7.23 Hs

- Best Windows 10 Apps For Your New Pc 2024

- Faszination Mensch: Faszination Mensch 2022