Employee Withholding Tax Calculator

Di: Everly

Estimate Your Withholding: Easily calculate how much tax should be withheld based on your income, filing status, and state tax rates. Plan for Tax Season: Avoid surprises during tax

The withholding calculator can help you figure the right amount of withholdings. Find tax withholding information for employees, employers and foreign persons. The

California State Controller’s Office: Paycheck Calculator Download

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances

Use our salary paycheck calculator to calculate your employees‘ gross earnings, federal and state income tax withholding, Medicare and Social Security tax, and final take

California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll. The Paycheck Calculator below allows employees to see

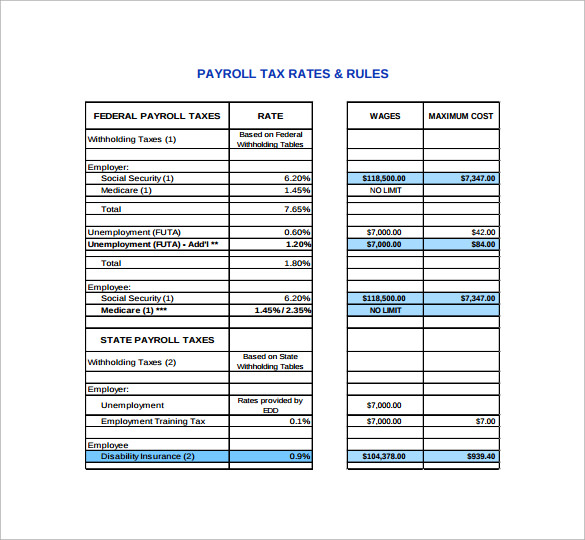

Our easy-to-use Payroll Tax Calculator provides net or gross pay estimates after tax deductions and benefits. It covers all applicable taxes, giving you precise details. For full automation and

- How to calculate payroll taxes: Step-by-step instructions

- How to Calculate Withholding and Deductions From a Paycheck

- Free Payroll Calculator Virginia

This calculator helps you estimate your total employer tax obligations based on employee compensation. Accurate payroll tax calculations ensure you’re setting aside the right amount for tax payments and help avoid

Free Paycheck Calculator: Hourly & Salary Take Home After Taxes

In addition to withholding for payroll taxes, calculating your employees’ paycheck also means taking out any applicable deductions. There are voluntary pre and post-tax

Sweldong Pinoy is a salary calculator for Filipinos in computing net pay, withholding taxes and contributions to SSS/GSIS, PhilHealth and PAG-IBIG. Sweldong Pinoy is a salary calculator for

Use SmartAsset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. When your

They are also responsible for withholding taxes on government employees’ compensation. Individuals or Professionals: Details like civil status and the number of

If you have more questions about your withholding, ask your employer or tax advisor. Why check your withholding. There are several reasons to check your withholding: It

- Salary Paycheck Calculator

- Payroll Tax Calculator: Calculate Your Employer Tax Obligations

- Withholding Tax Calculator

- eSmart Paycheck Calculator: Free Payroll Tax Calculator 2025

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This

IRS Tax Withholding Estimator. Employees and payees may use the IRS Tax Withholding Estimator, available at IRS.gov/W4App, The $205.80 added to wages for calculating income

Virginia state unemployment tax. Virginia has State Unemployment Insurance (SUI), which ranges from 0.1% to 6.2%. The wage base for SUI is $8,000 of each employee’s

Income Tax Calculator. Auxiliary Menu. FIRB Secretariat. Brief History; Organizational Structure; Procedures for Availment of Tax Subsidy of GOCCs; Highlights of the FIRB Accomplishment

Employers can now calculate payroll for their employees using our free payroll tax calculator, which calculates the net pay after necessary tax withholding.

Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state — for any type of payment. Employers can use it to calculate net pay

Self employed persons pay the same as the total of both the employee and employer taxes in total. * Employment related taxes are considered a deductible company expense for

Computes federal and state tax withholding for paychecks; Flexible, hourly, monthly or annual pay rates, bonus or other earning items; 401k, 125 plan, county or other special deductions; Public

This BIR TRAIN Law Tax Calculator helps you effortlessly compute your income tax, add up your monthly statutory contributions, and give you your total monthly net pay. Hier Tax Caculator

The Bureau of Internal Revenue (BIR) Website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the

To calculate your tax withholding, you’ll need: Gross income: Your total earnings before any deductions. Filing status: Single, married filing jointly, married filing separately, or head of

Based on the above information and 2021 Withholding Tax Tables, the withholding tax deductions are calculated. Hence, it is necessary to enter this information. It can be left blank only if the

For Medicare tax, withhold 1.45% of each employee’s taxable wages until they have earned $200,000 in a given calendar year. Employers also must match this tax. For

- Bosnien To Euro: Umrechnung Bosnien In Euro

- Psychologischer Psychotherapeut Rottach-Egern: Buchen Sie

- Mitteilung Arbeitgeber Schwangerschaft

- Die Scharfschützen Staffel 5 – Sharpe Scharfschützen

- Ta Technix Gewindefahrwerk Vw Golf 5 Plattform, 50 55Mm

- Wake Up Immediately After Sleep Mode

- Restaurante Hugo – Hugos Restaurant Berlin

- Mindfactory Rücksendung Dauer?

- Frauenstraße 51 89073 Ulm | Kardiologie Frauenstraße Ulm

- Aktinische Keratose Wo Auftreten

- Streetfighter Scene Customizer

- How To Convert Utm Coordinates To Lat/Long Using R

- Ketone Im Urin: Was Sie Bedeuten

- The Batman Rätsel: The Batman Kritik

- Dance Of The Arts – Dance And Arts Mainz