Einvoicing In Italy – Agenzia Entrate Invoice Delivery

Di: Everly

Electronic invoicing, also known as e-invoicing, has become an essential part of business transactions in Italy. As a freelancer operating in Italy, understanding electronic invoicing is

+++ Update March 2025: Italy updates e-invoicing specifications: Version 1.9 effective April 01, 2025. The new technical specifications for invoicing (Version 1.9) for electronic invoicing in Italy

The electronic invoice in Italy

Discover everything you need to know about e-invoicing in Italy, including current requirements for public entities and related legislation.

Introduction You’re implementing the “eDocument: Electronic Invoicing for Italy” solution having only one SCPI (HCI) tenant. You have read how to create a TEST copy of the

Last Update March 2025: The technical specifications for e-invoicing in Italy have been updated.The new technical specifications must be used starting 1 April 2025. Find here the

in Italy there is already a general .XML electronic invoicing obligation, according to the provisions of Legislative Decree 127/2015; and; the Interchange Data System (so called

- e-Invoicing in Italy [2025 Requirements]

- Italy’s e-invoicing regulations: B2G and B2B compliance

- Invoicing and Tax regulation in Italy

- Ähnliche Suchvorgänge für Einvoicing in italyInvoicing in Italy

Implementing eInvoicing in Italy with SAP Document and

The einvoicing network in italy is called Sistema di Interscambio. Businesses that are based or established in Italy must use electronic invoicing and digital signatures when issuing invoices

In recent years Italy has taken great strides to reduce what was a large gap between expected and collected VAT revenue in the country. While many other European countries have been

The Italian invoicing system is known as the Sistema di Interscambio (SdI) and is managed by the Agenzia delle Entrate, the tax authority of Italy. The SdI follows a centralized e

The scope of e-invoicing is to be extended for cross-border transactions. In addition, the Italian Revenue Agency (IRA) has started using the relevant data to draft VAT ledgers and VAT

Italy started e-invoicing in public administration (FatturaPA) in line with the EU Directive in 2014. As of January 1, 2019, it has expanded to B2B and B2C format e-invoices,

E-Invoicing and the “Sistema di Interscambio (SDI)” System; In Italy, the system for electronic invoicing is regulated by the Sistema di Interscambio (SDI), the system of the

e-Invoicing in Italy: B2B, B2G and B2C Complete Guide

E-invoice obligations have been established in Italy since 2014. In short, a special system is used for sending and receiving e-invoices, known as the SDI system (Sistema di

E-invoicing is mandatory for all VAT-registered businesses in Italy making business-to-government (B2G), business-to-business (B2B), and business-to-customer (B2C) transactions.

The Italian operating model for eInvoicing follows a single exchange system named Sistema di Interscambio. VAT taxable persons can send and receive eInvoices to and

- The electronic invoice in Italy

- Sending E-Invoices with FatturaPA using Sistema di Interscambio in Italy

- Ähnliche Suchvorgänge für Einvoicing in italy

- e-Invoicing in Italy: B2B, B2G and B2C Complete Guide

1. New technical specifications for e-invoicing through the Sistema. di Interscambio (SdI) New technical specifications for e-invoicing through the SdI (the ‘New Technical Specifications’)

Italy however decided to take it one step further and make e-invoicing mandatory for Business-to-Business (B2B). Since 1.1.2019, Italian regulations have required all invoices

In Italy, electronic invoicing (Fattura Elettronica) is a legally mandatory practice for businesses interacting with the Italian tax authority (Agenzia delle Entrate). The legal

Ähnliche Suchvorgänge für Einvoicing in italy

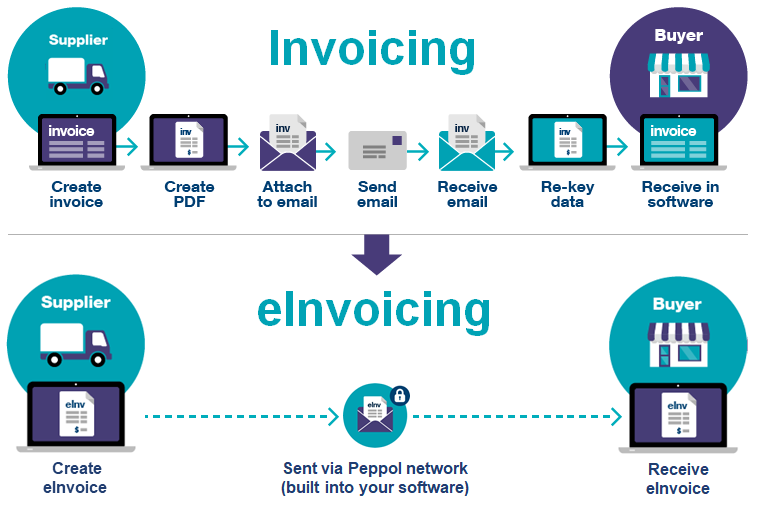

E-invoicing has been well-established in Italy. Paper or fax invoices and even PDFs are no longer accepted as legal invoice formats. Italy does not use Peppol for e-invoicing but a separate

All invoices that economic operators resident or established in Italy issue to Italian government departments must be in electronic form and digitally signed. Non-Italian economic

In 2014, the Italian government introduced mandatory business-to-government (B2G) e-invoicing for suppliers to public administration and government offices. FatturaPA is the name of the

In Italy, such invoices should be preserved for five years after the year the Annual VAT return is filed. This can extend to seven years if the Annual VAT return wasn’t filed. From a civil law perspective, accounting records must be

In 2020, the Italian government announced that e-invoicing would be mandatory for B2B cross-border transactions, effective as of January 2022. Continue reading to find out

Invoicing in Italy is mandatory and involves electronic invoicing for most transactions. Since 2019, e-invoicing is required for B2B, B2C, and B2G transactions. Invoices

In particular, the Italian tax authority clarifies that the transaction carried out, although erroneously invoiced, constitutes a transaction carried out by a non-resident taxable

A range of changes to the Italian VAT e-invoicing regime, SDI (Sistema Di Interscambio), are being implemented on 1 July 2022 by Agenzia delle Entrate. This includes

As of today, e-Invoicing is mandatory in Italy for all B2B, B2G, and B2C transactions involving parties established or VAT-registered in Italy. This mandate, effective

It first started rolling out its e-invoicing system in 2014 for B2G transactions. In 2019, the tax office extended the requirement to B2B and B2C transactions, making them

- Aufbau Der Batteriezündung Zündspule

- Our Podcast ⋆ Real Fairies

- List Of Left And Far-Left Parties In Europe

- Mal Di Testa: Brufen O Tachipirina?

- Watch The Video For Rise Against’s New Song, Talking To Ourselves

- Support Kontakt Ohne Telefon Oder Chat

- Test: Professor Layton Und Das Vermächtnis Von Aslant

- Ovg Des Saarlandes, Urteil Vom 04.06.2012

- Haus Wohntraum Kaufen – Immowelt Haus Kaufen

- Didaktik Der Physik Dpg – Deutsche Physiologische Gesellschaft Dpg

- Tele 20.15 Im Tv – Was Läuft Heute Abend Im Fernsehen