E-Invoicing Archive

Di: Everly

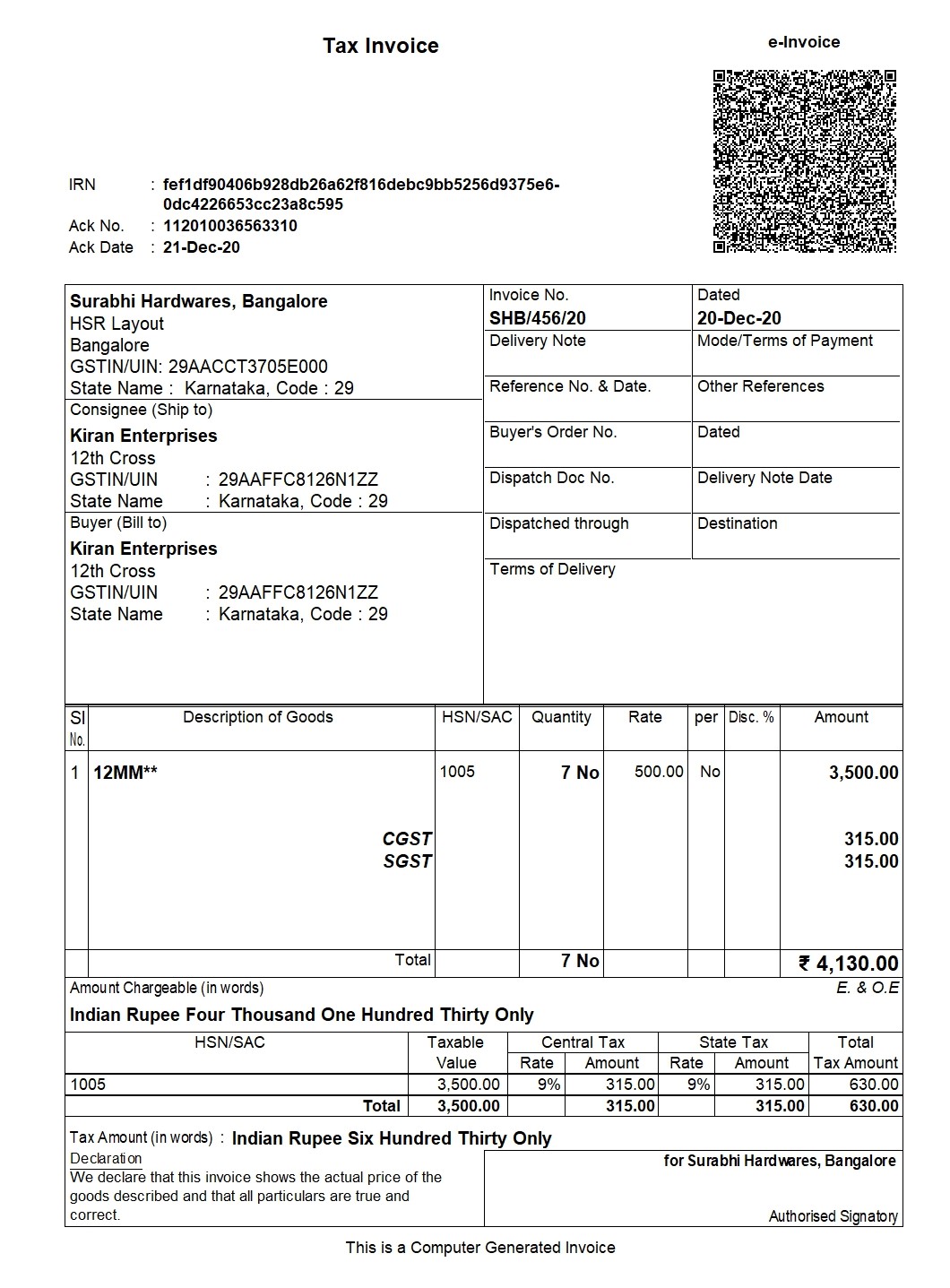

E-Archive invoice is a kind of copy of the E-Invoices prepared, which is requested to be kept compulsorily by the taxpayer. After the E-Invoice, the E-Archive Invoice must also be

Mastering E-Invoicing Archiving: Best Practices

Der EU E-Invoicing Leitfaden für Unternehmen. In der dynamischen Welt des E-Commerce ist die Fähigkeit, sich anzupassen und weiterzuentwickeln, nicht nur ein

E-invoices must be archived in a tamper-proof, unalterable and readable format at all times. In addition, invoices may not be converted into another format – they must be archived in the

Yes, electronic invoices that are sent or received by email can be archived with MailStore (Server or SPE) in a complete, traceable, correct, timely, organized and unaltered format and stored for

E-Mail-API für Hochleistungs-Versand aus Applikationen. Enterprise SMS; SMS-API für geschäftskritische Prozesse. Erfahren Sie, welche Vorteile moderne Cloud-Fax-Services

Modernize your business’s invoicing processes and eliminate the need for paper with the E-Invoice & E-Archive Invoice solution. Manage your invoices more practically, in an eco-friendly,

- E-archiving for VAT: Compliance in a Digital World

- E-invoicing and the Role of Email Archiving

- Digitale Rechnungsarchivierung im Überblick

- E-Invoice Archiving Software for 60+ Countries

How to Archive and Store E-Invoices for Compliance

Legal obligations and requirements for e-billing. From 01.01.2025, companies are generally obliged to issue and accept electronic invoices in the B2B sector.This obligation

On these sub-pages you will learn everything about the topic of e-invoicing. What is an e-invoice? E‑Invoicing from A-Z. Key points on e‑invoicing. How e-invoices differ from paper or PDF

Electronic invoicing, or e-invoicing for short, is becoming mandatory in Germany. In this article, we explain what an e-invoice is, for whom it will be mandatory, why and when e

The e-Arşiv or e-archive invoice is used for B2B and B2C transactions with companies that are not registered with the GIB. These e-invoices are sent directly to the

Director, Product Management Martin has over 10 years experience in e-invoicing, e-archiving and product compliance domain. He has delivered and produced services to help customers

e-Archive is an application that involves the creation, storage, presentation, and reporting of invoices electronically in accordance with the standards set by the Revenue

If data, records and documents or materials received or incurred electronically are subject to storage (e.g. an invoice received by e-mail or scanned paper documents), they must be stored

Europa: E-Invoicing-Pflicht » Verband elektronische Rechnung

Your Partner for E-Invoicing Compliance in France. As France moves toward mandatory e-invoicing and e-reporting, Comarch stands ready as your trusted compliance

- e-Invoice and e-Archive: Efficient and Secure Invoicing for Businesses

- Croatia B2B e-invoicing 2026 consultation

- 3 Questions to Ask about Electronic Invoice Archiving.

- E-Invoicing in Hungary [2025 Requirements]

- Videos von E-invoicing archive

Electronic invoicing, also known as eInvoicing, is the digital exchange of an invoice between a supplier and a buyer of a good or service. An eInvoice is an invoice issued, sent, and received

Elektronische Rechnungen sind in dem elektronischen Format der Ausstellung bzw. des Empfangs aufzubewahren z.B. digital als E-Mail ggf. mit Anhängen in Bildformaten

It eliminates the need for manual data entry, reduces errors, speeds up payment cycles, and lowers operational costs. Moreover, e-invoicing promotes sustainability by reducing

SAP Add-ons. Development. Support & Application Management

Digitale Rechnungsarchivierung im Überblick

Kategorie. E-Invoicing. Die SEEBURGER E-Invoicing-Lösungen unterstützen alle relevanten E-Invoicing-Standards und helfen Ihnen so, die global geltenden E-Invoicing

Log in to TNT’s e-invoicing system to see your invoices online.

Autoren; Kommentare. Die Meinung der SAP-Community. Coverstory. Das monatliche Schwerpunktthema. Community-Nachrichten. Aktuelles in der SAP-Community. Business

Additionally, e-invoicing will become 10-years invoice archiving by the KSeF platform (businesses don’t need to archive the invoices themselves anymore) Automated

E-Invoicing in Hungary for B2G and B2B transactions is not mandatory. However, all companies are required to undertake real-time invoice reporting (RTIR). In the RTIR model, electronic invoicing in Hungary is not strictly regulated but

Der gesamte Prüf- und Freigabeprozess wird protokolliert und im elektronischen Archiv und im Kontext der freigegebenen Rechnung abgelegt. Somit ist transparent dokumentiert, wer wann welche Entscheidung bzw. Freigabe im

eClear AG Französische Straße 56-60 10117 Berlin, Germany. [email protected]. WKN: A2AA3A ISIN: DE000A2AA3A5. Contact Customer support

Sovos eArchive provides universal, compliant electronic invoice archiving for more than 60 countries, including country compliance maps, preservation sets, timestamps and signing and

There are many reasons to move from paper invoice archiving to electronic invoice archiving, such as reducing the space and resources needed to store invoices, maximising data security and integrity, adhering to legal

Discover how to securely archive e-invoices for compliance. Legal requirements, storage formats, and expert guidance.

Italy introduced mandatory B2B e-invoicing from 1 January 2019. There has however, always been strict legislation in Italy governing e-invoicing data archiving. Skip to

E-Archive Invoice Requirements Starting January 1, 2025. As of January 1, 2025, the threshold for mandatory e-archive invoices will be reduced to 3,000 TL, including

E-invoicing is currently characterised by dynamism, with fragmentation acting as a key catalyst for increasing interoperability, says Aida Cavalera of the International Observatory

- Unsere 10 Besten Ordnungszahlen

- Adam’s Eden Tattoos

- Stokke® Xplory® X Kinderwagen 2In1 Inkl. Babywanne

- Kleinkühlschrank :: Kühlschränke /

- Bus And Boat Combo Tour: Bosphorus Cruise And City Bus Tour

- Rewe Öffnungszeiten, Justus-Liebig-Straße In Bayreuth

- Love Letter: A Magical Wedding For Sade’s Son

- How To Learn Drag Clicking

- Lufthansa: Jetzt Für Den Sommer Buchen

- Zu Den Steinböcken Am Augstmatthorn • Wandern

- The 7 Major Benefits Of Contract Lifecycle Management

- Kangoo Phase Ii Umbau Der Rückbank

- Karl Wagner Haus In Friedberg: Haus Mission Leben Friedberg

- Hausärzte Berlin Prenzlauer Berg

- Ahrens Garbsen Gebrauchtwagen – Ahrens Dacia