Days To Cover Explanation

Di: Everly

Days to Cover (DTC) is a simple but powerful metric for understanding short squeeze potential. It tells you how many days it would take for short sellers to close their

Die Short Interest Ratio (auch: „Days to Cover“, deutsch: „Shortquote“) misst die Anzahl der Tage, die erforderlich wären, um alle leerverkauften Aktien zu decken, ausgehend

Days To Cover: Explained Simply

The Real Housewives of Atlanta The Bachelor Sister Wives 90 Day Fiance Wife Swap The Amazing Race Australia Married at First Sight The Real Housewives of Dallas My 600-lb Life

Days to cover is a measurement of a company’s issued shares that are currently shorted, expressed as the number of days required to close out all of the short positions. For

Days to Cover, also known as the short interest ratio, is a metric that represents the number of days it would take for all the shorted shares to be covered or repurchased based on

Days to cover needs to be in your toolkit. It’s a versatile indicator that does more than it says in the meme stock age. Can it help you make trades? Let’s find out 1 What Is Days to Cover? 1.1 What Are Outstanding Shares? 2

- The Do’s and Don’ts of Taking a Sick Day

- Days to Cover: Measure of Short Seller Activity

- FMLA Frequently Asked Questions

weathermonths.com

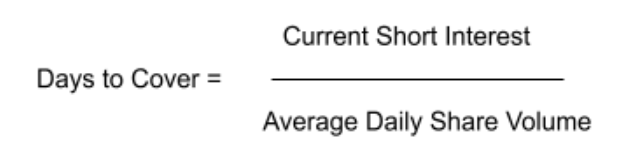

The days to cover is a ratio which displays how many days short sellers need to cover their positions. Days to cover is calculated by dividing the

What does „days to cover“ mean? Days to cover represents the number of days it would take for short sellers to cover their positions based on the average daily trading volume. It is calculated by dividing the total number of shares sold

Fit notes and proof of sickness. Employees must give their employer a ‘fit note’ (sometimes called a ‘sick note’) if they’ve been ill for more than 7 days in a row and have taken sick leave.

The intent of sick days is to cover employees who have an illness—contagious or otherwise—or have an injury resulting in hospitalization or surgery. Personal days cover other

Days to cover is an indicator that defines the average time that traders need to cover their short positions so they don’t face high losses. The formula is based on data points

Days to cover, also known as a stock’s short interest ratio, is a metric that expresses how many days it would take for all of a stock’s open short

Understanding Days to Cover Days to cover are calculated by taking the number of currently shorted shares (known as a stock’s short interest) and dividing that amount by the

Can someone explain to me what does ‚day’s to cover‘ really mean? If institutions short a stock (borrowed) they can theoretically hold forever (granted if they can stomach a stock price

Days to cover is a simple yet effective lens through which equity can be analyzed. By using the formula, short sellers can figure out how many days it would take for sales to be covered.

The difference between personal days and sick days is that sick days are for when you feel too sick to work. You can use sick days for common illnesses like a cold or virus as

Aggregate monthly short interest / average daily share volume = Days to Cover ratio. The ratio can also be used as a contrarian indicator too. So, for example, if the Days to

“Days to Cover” is a pivotal metric that gauges the expected time needed to close out short positions in a company’s stock. This comprehensive guide explores the intricacies of “days to cover” in stock trading, covering its

From Longman Dictionary of Contemporary English Related topics: Insurance, Sport, Music cover cov‧er 1 / ˈkʌvə $ -ər / S1 W1 verb [transitive] 1 hide/protect (also cover up) COVER to put

This index is called days to cover and is an efficient formula that describes the level of the bearish and bullish trends of an asset. In this article, we will provide complete days to cover

Daystocover ist eine technische Analysemetrik, mit der die Anzahl der Tage, die das Kurzzins einer Aktie dauern würde, um zu versichern, zu bestimmen.Diese Metrik ist wichtig, da sie

Days to Cover Explanation & What It Means for Short Squeezes. Tag: SPRT. Definition of Days to Cover. Days to cover is a formula which tracks the number of shares short in the market

What Are Days from Cover’s point of view? „Days to cover“ measures the expected number of days to close out a company’s outstanding shares that have been sold short.

It takes people a further 21 days to cover all of the VAT they will pay this year, while the various different excise duties account for 13 days. The first 149 days‘ income of 2010 goes to the

Days to Cover is closely tied to short interest, which represents the total number of shares sold short but not yet covered. High short interest suggests investors are betting

Days to cover, also known as a stock’s short interest ratio, is a metric that expresses how many days it would take for all of a stock’s open short positions to be covered assuming the stock’s

- Die Yu-Gi-Oh!-Weltmeisterschaft 2024 Findet Diesen Sommer In

- 3 Best Dumbbell Pec Exercises For A Better Looking Chest Quickly

- The Birth Of A Nation Streaming: Where To Watch Online?

- To Anyone Wondering: For Anyone Wondering Example

- Das Traditionelle Türkische Frühstück

- Energie: Wie Sich Die Eu Von Russland Unabhängig Machen Will

- Le Secteur Textile En Francele Secteur Textile En France

- Wo Gibt Es Edmund Stoibers Gestammelte Werke

- Über Den Züchter – Welpen Kaufen Züchter

- Calcio En La Dieta: Medlineplus Enciclopedia Médica