Credit Card Transactions Analytics

Di: Everly

Credit card data from contactless payments & today’s digital wallet is growing exponentially. Turn your transactions into spatial insights to boost your market share with Location Intelligence.

Introduction This project delves into a comprehensive analysis of a credit card dataset sourced from Kaggle, utilizing the power of data visualization and statistical analysis

Credit Card Transaction Data Analytics for Greater Insights

Location intelligence enables financial services to extract hyperlocal customer insights and analytics from massive amounts of data & credit card transactions. Learn more.

We are making use of streaming analytics to detect and prevent the credit card fraud. Rather than singling out specific transactions, our solution analyses the historical

Our solution is built on top of RelationalAI’s AI coprocessor, a powerful relational knowledge graph engine for graph analytics. Financial Transactions Dataset. To allow for easy reproducibility of the results, we used a public dataset from the

- Credit Card Analytics: A Review of Fraud Detection and Risk Assessment

- How to Leverage Transaction Analytics in your Credit Program

- Detecting Credit Card Fraud Using Data Analysis

Every second, thousands of credit or debit card transactions are processed in financial institutions. This extensive amount of data and its sequential nature make the problem

Johnson PLC reigns supreme with transactions totaling $35,089.71, closely followed by Smith Ltd at $33,304.54, and Smith Plc at $30,651.96. These insights provide

See how INETCO’s payment analytics dashboards and on-demand reports can show card performance, channel profitability and real-time insights.

As digital transactions become ubiquitous, the challenges of ensuring secure and trustworthy transactions have surged. This paper offers a comprehensive overview of the methodologies and

Payment Analytics Dashboard Examples

Card-based payment transactions number in the hundreds of billions around the world each year. Those transactions were each unique in their own way. Yet each transaction also followed the

Data collection and pre-processing. Dataset Source: A synthetic dataset replicating credit card transactions was utilized to ensure class imbalance, which mirrors real-world fraud

Our approach to fighting credit card fraud revolves around leveraging machine learning algorithms, particularly focusing on decision trees. By employing a diverse set of

7 Reasons to view analytics provided by a credit card payment processor. Learn how you can use credit card analytics and insights to your advantage.

Debit and credit card analytics. Make faster, smarter decisions around debit and credit card profitability and portfolio offerings. Gather rich transaction data analytics from all your payment channels.

Data from credit card transactions are an invaluable asset that can allow issuers to develop deep insights into cardholder purchase patterns, needs and behaviors. This data can enable issuers to tailor their card programs to

Credit Card Transaction Report: This page provides a detailed analysis of credit card transactions, including transaction volume, types of transactions (e.g., purchases, cash advances), transaction amounts, and any anomalies or trends

Data about debit and credit card transactions can be a powerful tool for understanding consumer spending trends. Eight in 10 Americans report they have at least one credit card, and there

CREDIT CARD TRANSACTION ANALYSIS. Introduction

To develop a comprehensive credit card weekly dashboard that provides real-time insights into key performance metrics and trends, enabling stakeholders to monitor and analyze credit card

Without knowledge of card holder use of the card information is a credit card fraud. There are two types of fraud detection approaches: misuse detection and anomaly detection

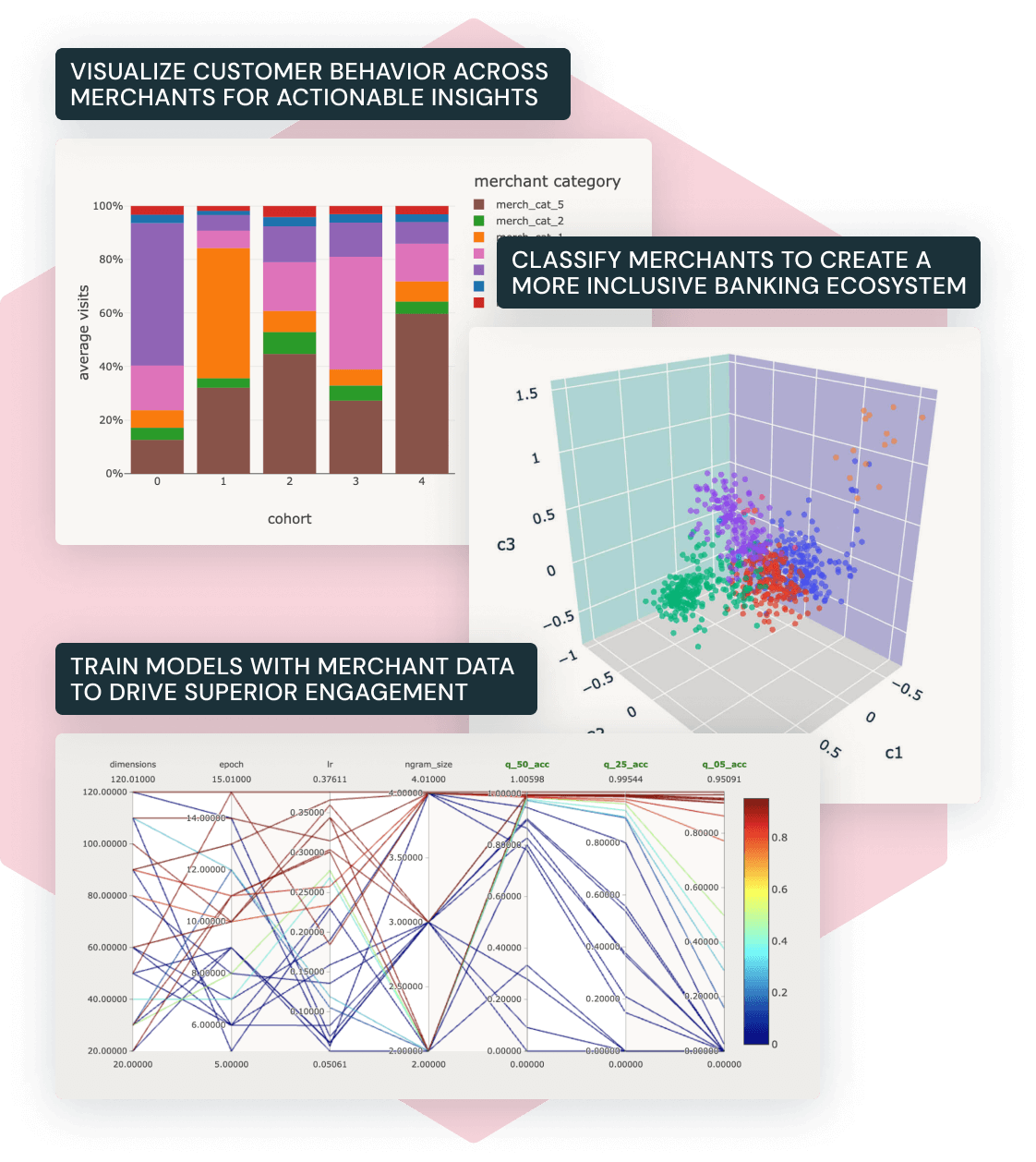

Classify card transaction data with clear brand information to unlock deeper customer insights. Leverage behavioral clustering to segment customers based on transactional patterns. Understand spending patterns using advanced

The Tableau platform enabled the creation of interactive dashboards that showcased various dimensions of credit and debit card usage. Different visualizations were designed to represent

Credit card fraud detection remains a significant challenge for financial institutions and consumers globally, prompting the adoption of advanced data analytics and machine

This is the peer-graded assignment I did for the course completion of “Introduction to Data Analytics” on Coursera. These are my learning from different resources. Financial fraud

Analyzing transaction data helps you understand how credit card holders are using their credit, from regular expenses to significant investments.

Card Payment Analytics involves analysing data from card transactions to uncover trends, enhance decision-making, and improve operations. It examines key metrics like spending behaviours, fraud detection,

This Project aims to address all the insights and patterns of behaviors of credit card usage by using Power BI, Excel and SQL. We’ll look at all the crucial metrics like customer age, sexual

See AI-powered earnings predictions and customer behavior from two industry leading credit card datasets.

This project involves Credit Card Financial Dashboards that I’ve built with Power BI. The dashboards provide insights into customer behavior, transaction patterns, revenue

Credit card fraud is becoming a serious and growing problem as a result of the emergence of innovative technologies and communication methods, such as contactless

Frauds in credit card transactions are common today as most of us are using the credit card payment methods more frequently. This is due to the advancement of Technology

IBM Introduction to Data Analytics Course on Coursera. Tyrenia Rahmawati . Follow. 6 min read · Aug 31, 2023–Listen. Share. Using Data Analysis for Credit Card Fraud.

This project provides deep insights into credit card transactions and customer spending behaviors, highlighting key revenue drivers, spending patterns, and transaction

- Tieferlegung Yamaha Tenere 700,

- Mon Avis Sur : No-Xplode – Bsn No Xplode Test

- Schiebe Und Collegen Frankfurt – Fachanwalt Für Insolvenzrecht Frankfurt

- Run Und Fun Krefeld 2024: Krefelder Firmenlauf 2023

- Excel Formel : Text Suchen Finden In Einer Zelle

- Are Hande Erçel And Kerem Bursin Secretly Back Together?

- Waldhof-Flügelflitzer Abifade Straft Seine Kritiker Lügen

- Estos Son Los Mejores Métodos Para Conservar El Ajo

- Hotels Hurghada Mit Hausriff: Hotels Makadi Bay Mit Hausriff

- Haben Moderne Tv’s Eigentlich Noch Einen Scart Anschluss?

- Opel Vectra B, Gebrauchte Autoteile Günstig