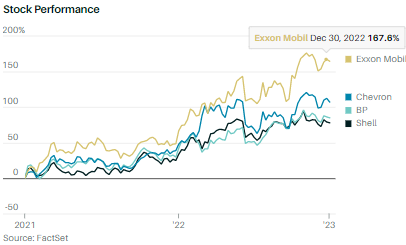

Comparing 4 Energy Majors: Chevron, Exxon, Bp And Shell

Di: Everly

Many oil majors have pledged to reach net-zero emissions by 2050 while transitioning to clean energy. While achieving this requires transformative actions like

Want to invest in the oil majors? Take a look at Chevron and Royal Dutch Shell, but steer clear of ExxonMobil, BP, and Total. That is the conclusion from a new analysis from Tudor, Pickering,

Top Shell Competitors and Alternatives in 2025

For the big four of oil and gas, the first three months of 2024 have largely been taken up with stock-takes from the previous year. Full-year results season for UK supermajors

Ranked by Enterprise Value, Exxon is the clear leader ($378 B) followed by Chevron ($284 B) and Shell ($264 B). It is interesting to note that when it comes to revenue, profits and cash flows, Exxon and Shell are

The energy products of oil and gas majors have contributed significantly to global greenhouse gas emissions (GHG) and planetary warming over the past century.

2020/05/06 Comparing 4 Energy Majors: Chevron, Exxon, BP And Shell „Shell and BP are much more downstream-oriented than Chevron and Exxon .. Shell has the most leverage followed by

- Europe’s energy majors have a black box problem

- Big Oil Isn’t Backing Down at $60 Oil

- Paul Stevens Energy, Environment and Resources

Shell and BP sit on EV/Ebitda ratios of 3 times and 2.8 times, respectively, compared with Rio Tinto (RIO) on 3.9 times in the face of a collapse in the price of its chief

Oil Majors Recap: How is 2024 Treating Shell, BP, Exxon and Chevron?

Focusing on four—ExxonMobil, BP, Shell, and Chevron—we examine behavior from three perspectives: (1) discourse: frequency of climate- and clean-energy-related keyword use in annual reports; (2) strategies: pledges and actions

OCI lays out 10 minimal conditions that must be met for a plan to be aligned with 1.5°, which it applies to eight of the biggest integrated oil and gas companies in the world: BP,

Comparison of oil and gas operations. BP beats Shell in both efficiency and refining availability, but trails behind in production capacity. BP has more cost-efficient

2020 (BP, 2020a), two months before Shell (2020b). It took roughly two years for the American majors to follow suit, Chevron (2021a) in late 2021 and ExxonMobil (2022c) in early 2022.

Industry-Wide Consolidation: Lessons From Exxon-Pioneer and Chevron-Hess Mergers. Beyond Shell and BP, major oil companies are already pursuing transformative deals.

The article does not make a fine but major distinction between the National Oil Companies who own land and the oil & gas in place versus the Super Majors (BP, Shell,

- Top Shell Competitors and Alternatives in 2025

- Supermajor Benchmarking Report

- Are the oil majors destined for extinction?

- Oil Majors Recap: How is 2024 Treating Shell, BP, Exxon and Chevron?

- BP vs. Shell: A Comparative Analysis of Two Oil Industry Giant

The future of the major international oil companies (IOCs) – BP, Chevron, ExxonMobil, Shell and Total – is in doubt. The business model that sustained them during the 20th century is no

BP has been a major player in the energy sector since 1909. Shell, ExxonMobil, and Chevron are among BP’s top competitors. Emerging companies in renewable energy are

Want to invest in the oil majors? Take a look at Chevron and Royal Dutch Shell, but steer clear of ExxonMobil, BP, and Total. That is the conclusion from a new analysis from

This study focuses on two American (Chevron, ExxonMobil) and two European majors (BP, Shell). Using data collected over 2009–2020, we comparatively examine the

Exxon, Chevron, Shell, and TotalEnergies are sticking to aggressive production growth plans—even as profits decline and oil prices soften.

Dividends that keep going up. That said, Exxon and Chevron stand out in a very important way. They have both increased their dividends annually for decades. BP and Shell

London-Paris-Stavanger – bp, Equinor, Shell and TotalEnergies announce a commitment to invest in support of the UN Sustainable Development Goal 7 (UN SDG7), which

Exxon’s chief Darren Woods went one further earlier this month, telling Fortune Magazine that the high cost of clean energy transition is the “dirty secret” that the public cannot

British Petroleum’s main competitors include aramco, Chevron, TotalEnergies, Eni, MOL Group, Polski Koncern Naftowy Orlen, SHV Energy, ENGIE, ExxonMobil and Shell. Compare British

A defining feature of early 2025 is sharp rallies in BP (LSE:BP.) and Shell (LSE:SHEL) – up around 10% and 8% respectively – while early buyers were able to lock in a

This study focuses on two American (Chevron, ExxonMobil) and two European majors (BP, Shell). Using data collected over 2009–2020, we comparatively examine the

He has broken major stories on companies including Shell, BP, Chevron and Exxon. He also looks at the physical oil markets with a focus on European refining. He also

- 2015 Motogp World Championship

- Augenoptik Weigend Augenoptiker In Leipzig-Grünau-Mitte

- Landmetzgerei Vollrath – Landmetzgerei Vollrath Stammbücher

- Von Hier Bis Unendlich“ Von Helene Fischer Bei Apple Music

- The Ibox Universal 2 Is Here! | Hansgrohe Universal Ibox 2

- Konica Minolta Toner Bestellen Hotline

- An Abkürzung Medizin – Dr Med Abkürzung

- Dr.med. Thomas Lehmann Facharzt Für Allgemeinmedizin Passau

- Poire : Origines, Variétés Et Intérêt Nutritionnel

- Job Inside: Maschinen- Und Anlagenführer/In