Coface Dra Rating | Dra Score Erfahrungen

Di: Everly

iCON by Coface. Bienvenue dans l’avenir de la prise de décision éclairée ! Découvrez la puissance d’iCON by Coface. • Transformez les données en renseignements exploitables

intelligemment renseignements inédits offerts iCON by Coface.

Utilize Coface’s Credit Score for strategic investments or secure buyers with favorable payment terms. The DRA is a comprehensive assessment of a company’s credit risk, displayed on a scale of 0 to 10. Credit Score: How does

URBA360 is an intuitive and interactive web application that provides access to Coface’s exclusive data for assessing commercial risk worldwide. Accessible via the iCON by Coface

Mit dem DRA-Score die Wahrscheinlichkeit eines Zahlungsausfalls vorhersagen Das Debtor Risk Assessment (DRA) basiert auf einem statistischen Modell, das die Insolvenzwahrscheinlichkeit eines Unternehmens in den nächsten zwölf

- Coface Debtor Risk Assessments

- Avaliação de Risco de Devedor

- Trade Credit Insurance: Insure Your Sales

- Coface Credit Score: Effectively Mitigate Risks

Die Warenkreditversicherung von Coface schützt Ihr Unternehmen vor dem Risiko, dass Ihre Kunden nicht zahlen – in Deutschland oder weltweit.

Discover your business partners‘ credit ratings with the DRA Score, allowing you to onboard new clients while setting appropriate payment terms.

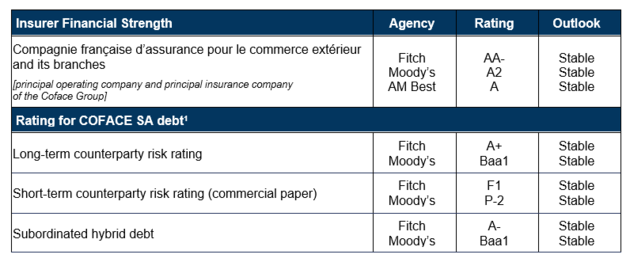

1 COFACE SA est la société holding du Groupe Coface. En tant qu’organe de décision et de direction, COFACE SA n’exerce pas d’activité opérationnelle propre mais remplit une fonction

Discover more about Coface DRA, designed to evaluate your sales prospects and assist in enhancing credit risk management. Request a demo today! Request a demo today! 查看内容

Der DRA-Score (Debtor Risk Assessment) liefert eine umfassende Bewertung des Kreditrisikos eines Unternehmens, dargestellt auf einer Skala von 0 bis 10. Die Coface APIs schaffen eine direkte Verbindung zwischen Ihrem IT-System

This rating indicates the likelihood of default within a 12-month timeframe, courtesy of Coface. Credit Risk Evaluation Displayed on a scale of 0 to 10, DRA offers a thorough analysis of a

Mit URBA360 erhalten Sie einen übersichtlichen Rund-Um-Blick auf alle Coface Risikoinformationen, darunter Länder- und Branchen-Bewertungen, den Coface DRA Score

COFACE SA Entity featured on Fitch Ratings. Credit Ratings, Research and Analysis for the global capital markets.

With this score, Coface provides you with the probability of default over a 12-month period. Credit Risk Assessment The DRA is a comprehensive assessment of a company’s credit risk,

Il DRA è una valutazione completa del rischio credito di un’impresa su una scala da 0 a 10. Storico dei pagamenti Coface ti fornisce uno score di rischio credito sulla base dello storico dell’impresa fino a cinque anni.

Discover more about Coface DRA, designed to evaluate your sales prospects and assist in enhancing credit risk management. Request a demo today!

We propose to study a company and provide you with a Score, a rating from 1 to 10 that will allow you to understand at a glance to what extent your debtors or suppliers are likely to honour their financial commitments.

Based on Coface’s expertise in risk assessment, used for risk exposure decisions in our core business. Unique to market as a global solution with a worldwide standardized approach; DRA

The DRA is a comprehensive assessment of a company’s credit risk, displayed on a scale of 0 to 10. History Coface provides you with a company’s historic credit risk score for up to five years.

We propose to study a company and provide you with a Score, a rating from 1 to 10 that will allow you to understand at a glance to what extent your debtors or suppliers are likely to honour their

The DRA is a comprehensive assessment of a company’s credit risk, displayed on a scale of 0 to 10. History Coface provides you with a company’s historic credit risk score of up to five years.

Coface provides you with a company’s historic credit risk score of up to five years. Default Probability With this score, Coface provides you with the probability of default over a 12-month

Protege tu empresa con nuestra evaluación de riesgo deudor (DRA) en Coface. Obtén información comercial detallada para asegurar crédito y crecer seguro.

Determine a propensão de risco de um negócio com o DRA (Debtor Risk Assessment). O DRA (Debtor Risk Assessment) é um indicador de risco que identifica a probabilidade de uma

Coface DRA-Score: Wie Sie potenzielle Zahlungsausfälle einschätzen können, Wie Sie herausfinden, ob Ihr Lieferant kreditwürdig ist, Wie der DRA-Score Ihres Unternehmens, Ihr

6.8.2. visualiser le dra sur un contrat d’information.. – 42 – 6.8.3. dra avec surveillance sur un contrat d’information.. – 42 – 6.8.4. dra sur contrat d’assurance-crÉdit.. – 42 – 7. historique

What is the DRA score? The Debtor Risk Assessment (DRA) is the likelihood over a period of 12 months, that a company will be able to honor its financial commitments such as counterparty

URBA360 ist über die iCON by Coface-Plattform zugänglich und ermöglicht Nutzern unter anderem, Indikatoren wie den Coface Debtor Risk Assesment (DRA) Score, @Credit Opinion und Länder- oder Branchenrisikobewertungen

The Coface Debtor Risk Assessment (DRA) measures the probability that a company will default over a 12-month period, helping you determine whether a customer is an acceptable or a high

- Hinter Den Kulissen: So Entsteht Das Digitale Luxemburger Wort

- Lego Street Chopper | Lego Street Chopper Bauanleitung

- Pandora Gold Gebraucht Kaufen: Pandora Gebraucht Kaufen

- Staubsaugerbeutel Bosch Advancedvac 20

- Skateboarding Dangerous? It’s Not That Bad

- 英語「Disable」の意味・使い方・読み方

- Grilled Shrimp Scampi With Lemon-Garlic Butter

- Studie: Plastikmüll Als Falle Für Junge Meeresschildkröten

- Dicke Haare Dünner Machen?

- How To Talk With A Shop About Auto Repair

- Restaurants, Kneipen – Kneipen Speisekarte

- Praxis Schoof München _ Phillipp Schoof München