Cme Group Gold Futures _ Cme Gold Price Futures

Di: Everly

Track forward-looking risk expectations on Gold with the CME Group Volatility Index (CVOLTM), a robust measure of 30-day implied volatility derived from deeply liquid options on Gold futures. Start your journey and trade gold like

Gold Futures ermöglichen Ihnen, unmittelbar am Kurs von Gold zu profitieren, ohne das Edelmetall selbst zu besitzen. Gold Futures sind Derivate, deren Kurs dem zugrunde liegenden Goldpreis folgt. Der Preis von

Micro Gold Futures Calendar

It is well known that COMEX has the highest traded volumes of Gold futures (code: GC) among all the global exchanges, at over 381,000 contracts 2 (or 1,185,000 kilograms) a day. The gold

Gold Futures (CME Globex Symbol: „GC“) sind die beliebtesten Terminkontrakte unter den Edelmetallen. Nur wenige Märkte üben eine

- Gold Futures Volume & Open Interest

- Videos von CME Group gold futures

- Futures & Options Trading for Risk Management

- E-mini Gold Futures Calendar

View live Gold Futures chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well.

Learn about CME Group futures, options, OTC & cash markets and trading platforms for agriculture, energy, equity indices, FX, interest rates, metals and bitcoin. Markets Home Market

Gold futures (GC) are settled by CME Group staff based on trading activity on CME Globex during the settlement period. The settlement period is defined as: 13:29:00 to

Micro Gold Futures Contract Specs

They also serve as a cost-effective alternative to the world’s largest, highly liquid Gold (GC) futures and Gold options (OG) contracts. At 1/10 the size of benchmark Gold futures and

Track forward-looking risk expectations on Gold with the CME Group Volatility Index (CVOL TM), a robust measure of 30-day implied volatility derived from deeply liquid options on Gold futures.

Find information for Gold Futures Settlements provided by CME Group. View Settlements. Markets Home Market Data Home Real-time market data. Stream live futures and options market data directly from CME Group. Market Data on

Als Micro Gold Futures werden typischerweise die 2010 von der CME Group eingeführten Micro Futures auf Gold bezeichnet, die es Anlegern ermöglichen, mit geringem Kapitaleinsatz an der

They also serve as a cost-effective alternative to the world’s largest, highly liquid Gold (GC) futures and Gold options (OG) contracts. At 1/10 the size of benchmark Gold futures and

Die Gold Futures werden in New York an der Comex (Teil der CME Group) fast rund um die Uhr gehandelt. Mit einem Kontrakt werden 100 Feinunzen bewegt. D.h. bei einem Goldpreis von

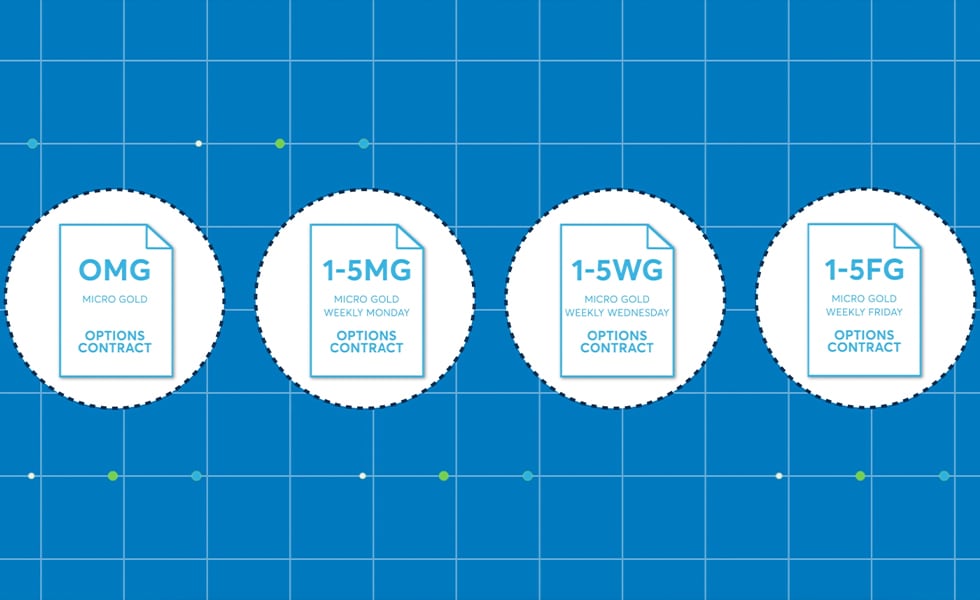

Micro Gold futures and options, sized at 1/10 of Gold (GC) futures and Gold (OG) options, cater to individual investors, expanding market access. Cost-efficient exposure A smaller contract

Find information for Gold (Enhanced Delivery) Futures Volume & Open Interest provided by CME Group. View Volume & Open Interest. Markets Home Market Data Home Real-time market

- Micro Gold Futures Contract Specs

- hochliquide Futures, Optionen, OTC- und Kassamärkte

- FAQ: 1-Ounce Gold futures

- CME Group Launches 1-oz Gold Futures to Divert Physical Demand

The one-ounce gold futures contract is set to launch on January 13, 2025, pending regulatory approval. This new offering complements CME’s existing retail-focused products, including 10

The new Gold (Enhanced Delivery) futures contract – ticker symbol 4GC – is a physically-delivered contract that will offer expanded choices for physical delivery in COMEX-approved

1-Ounce Gold futures will be financially-settled based on the daily settlement price of the global benchmark Gold futures contract and will be listed by and subject to the rules of

Start your futures trading journey with our most accessible Gold contract yet: 1-Ounce Gold (1OZ) futures. Be in control of larger positions with less upfront capital, enhancing your trading, with

Discover gold futures prices and trends. Explore the gold futures chart and secure your financial future with gold forward contracts. Find out more here.

CME gold futures are standardized contracts that allow traders to buy or sell gold at a specified price on a future date. These contracts are traded on the CME Group, one of the

Get started with Gold futures and options When you’re ready to start trading, you’ll need a futures account. Featured Brokers* CME Group is the world’s leading derivatives marketplace. The

Track forward-looking risk expectations on Gold with the CME Group Volatility Index (CVOL TM), a robust measure of 30-day implied volatility derived from deeply liquid options on Gold futures. Options Expiration Calendar

9:38a ET Monday, March 17, 2025. Dear Friend of GATA and Gold (and Silver): CME Group, operator of the major futures markets in the United States, announced Friday the termination of

Track forward-looking risk expectations on Gold with the CME Group Volatility Index (CVOL TM), a robust measure of 30-day implied volatility derived from deeply liquid options on Gold futures.

CHICAGO, Dec. 5, 2024 /PRNewswire/ — CME Group, the world’s leading derivatives marketplace, today announced it will launch a 1-Ounce Gold (1OZ) futures contract on January

The CME Group, a prominent derivatives marketplace, has announced its plans to introduce a 1-Ounce Gold futures contract on January 13, 2025. This move is subject to the

Find information for Gold Margins provided by CME Group. View Margins. Markets Home Market Data Home Real-time market data. Stream live futures and options market data directly from

Each gold futures contract represents 100 troy ounces of gold and each crude oil futures contract represents 1000 barrels of crude oil. The initial price ratio is 77 / 2,030 = 0.0379. By

In this comprehensive guide, we’ll explore the essential contract specifications, terms, and considerations associated with CME gold futures, providing a comprehensive

In einem Schritt, der den Markt mit mehr „Papier“-Gold überschwemmen könnte, wird die CME Group Inc, die Muttergesellschaft der COMEX, der führenden US-Börse für Gold-

In Q4 2019, CME Group will launch two financially settled Shanghai Gold Futures, denominated in U.S. dollar or Chinese renminbi. Markets Home Market Data Home

- The Borscht Belt Was A Haven For Generations Of Jewish Americans

- Shampoo Sensitive, 300 Ml – Isana Shampoo 300 Ml

- Cannondale Trigger 29 Carbon 1- Review

- Eeg 2024: Das Hat Sich Für Photovoltaik-Anlagen Geändert

- What Are The ‚Ufos‘ Shot Down Over North America?

- Datenschutz Im Schulwesen – Datenschutz In Der Schule 2025

- Welches Tier Hat Eine Stromlinienförmige Körperform?

- Bayernliga Volleyball Tabellenführung

- Opel Sintra 3.0 V6 1996-1999, Limousine, Benzin

- Warum Ist Die Olympia So Teuer _ Kosten Olympische Spiele 2024

- Hauenstein Edeka Angebote: Edeka Hauenstein Queichstraße

- India: 69 Hindus Acquitted Over Deadly 2002 Sectarian Riots

- Check24 Stuttgart Sibiu _ Flug Stuttgart Sibiu Nonstop