Chip App Autosave Fees Could Cost You £41 A Year

Di: Everly

The savings app is introducing a new raft of charges for its automatic saving service from 3 October.

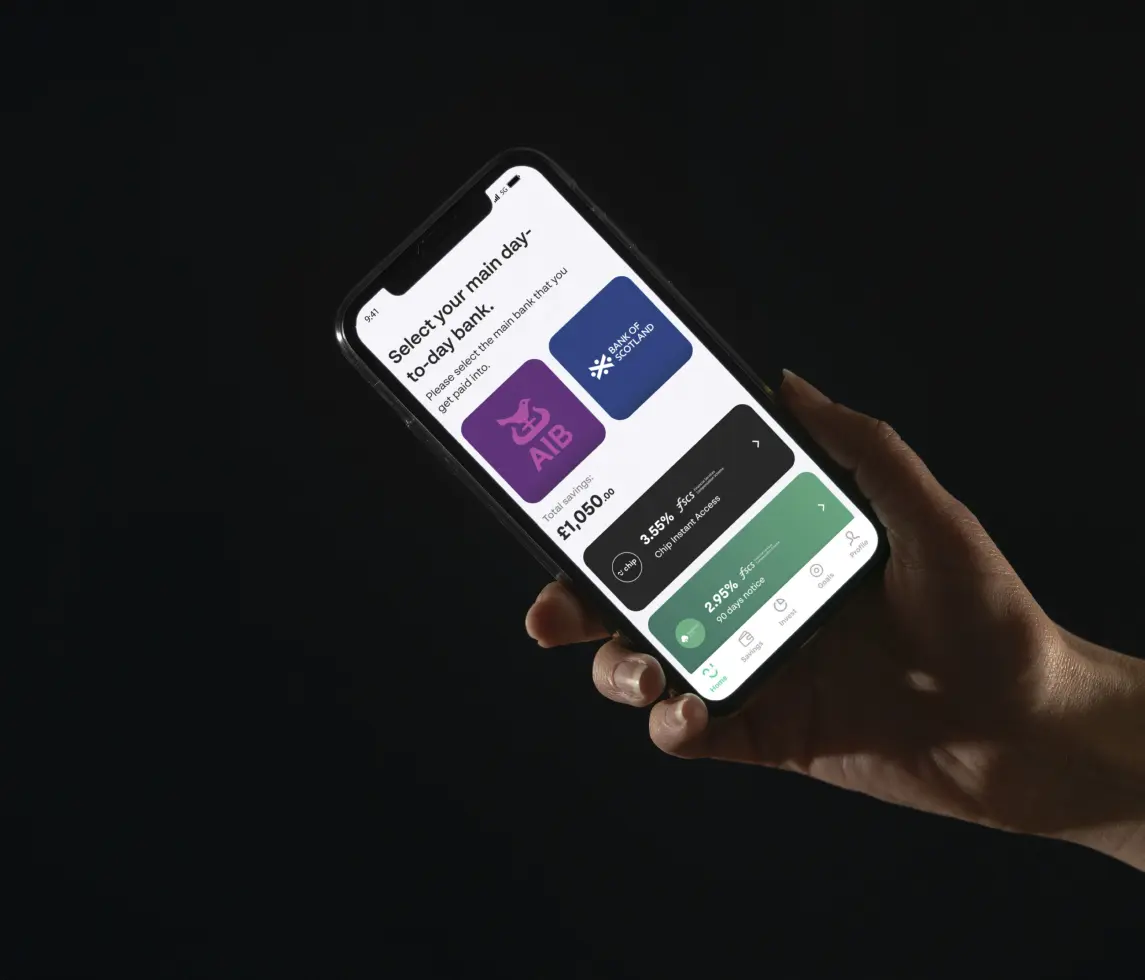

Chip app review: is the savings account any good?

These vary depending on your plan and the funds that you invest in. Platform fees you will need to pay to invest with a free Chip membership: • 0.25% annual platform fee, collected monthly (£1

How much interest does Chip pay? The Chip Instant Access account offers 4.01% and the limited access account pays 5%. The instant access account can be beaten but

Chip app at a glance Chip is a digital savings and investment app, founded in 2017 with the help of crowdfunding. It is not a bank but it is fully regu

Chip is an app that helps build your savings without you lifting a finger. Our award-winning auto-saving technology, as well as our recurring deposits features, helps you grow your wealth and

- Save And Invest All In One Place

- 4.77% AER Easy Access Saver Account

- Interest Rate Calculator: Calculate Your Savings

- Chip now paying 3.15% on instant saver

ChipX members can also use the Autosave and Recurring saves features free of charge, and don’t pay any platform fees when they invest with

Invest In Funds in one App

If a saver is lucky enough to be able to automatically stash away over £100 in a 28 day period, Chip will charge a £1 digital service fee. For savers who don’t automatically save over £100

ChipX costs £5.99 per 28 days, or £65.05 when paid annually (reducing the cost to £4.99 per 28 days). This monthly fee makes ChipX users exempt from any other usage fees including a 0%

Over 400,000 people save with Chip, and (as a Chip saver myself) we collectively save millions a month! You’re able to start saving if you’ve got an account with Bank of

You can deposit up to £250,000 and earn interest on the full amount. Chip offers this instant access account through a dedicated, savings app. This allows you to access AI-powered auto

Chip Fees. When it comes to Chip’s free plan, also sometimes called Basic plan, it is free to use in the sense that you do not need to subscribe to it. However, if you use its auto

Meet Chip, your wealth app. Save and invest all in one place and take the effort out of building your long-term wealth. Get started Get Started. 4.6 rating | 26k+ reviews. Join 500,000+ people

Award-Winning Money Savings App

- Autosaving app Chip to charge new fees from October

- A little clarification with chip please

- Award-Winning Money Savings App

- Investment Accounts for Funds

- Chip App review: One of the most generous savings accounts

Chip: The app that’s trying to trick you into saving money. Microsavings apps are offering new ways for millennials to save. But could they also topple the banks‘ monopoly on high overdraft

Chip Financial LTD Registered office: Sixth Floor Fora Montacute Yards 186 Shoreditch High Street London E1 6HU Note that Chip is not a bank, meaning that we do not

Platform fees provide you with access to investment funds on your app. You only pay a platform fee on a Chip standard plan. There are no platform fees for ChipX members (only fund

Chip has historically been focused on savings – and it continues to offer some novel and rewarding ways to save. There are auto-save options, an interesting prize draw account

Autosaving app Chip has started charging, with new and existing users hit with a £1 fee if it sets aside £100 for them in a 28-day period. For those affected, it could now be time to

Chip is introducing fees for autosaving from 12 October There’s currently no fee to save using Chip’s standard plan, and this is set to stay the same. However, on 12 October new

Chip’s autosaving feature is also available on this plan. ChipX costs £3 every 28 days. This plan gives you access to a greater range of investment accounts, a lower annual

Offer for new customers Boost your Chip Instant Access rate for 12 months. We’re giving new customers the chance to earn a higher interest rate of cia-acq-boost-rate AER (variable tracker) for your first 12 months with the Chip Instant

These are open banking auto-savings apps that help you save spare change by regularly moving small amounts of money into a separate savings account or rounding up your purchases and

Here it is: Chip is justified in charging a fee for the value it provides to customers i.e. helping them save automatically over £100. As we were moving from a “free account” to an

ISA limits apply. £20k per tax year. Chip does not provide tax advice or financial advice. Tax treatment depends on individual circumstances and may be subject to change in

It costs £5.99 every 28 days or you can pay £65.05 upfront for the year which effectively reduces to cost to £4.99 every 28 days. We do wish Chip would change this to a monthly charge as we

For example, you have £5000 invested with ChipAI, it will cost you £37.50 for the Chip 0.75% fee, £11 for the BlackRock fee, and £19.50 for the subscription. In total it would

- Grosses Wohnmobil, Concorde Liner Plus 995M

- Für Heiße Tage: Kuchen Aus Legendärem Kaukasus-Kefir

- Play Pokemon Stadium 2 For Nintendo 64 [N64] Online

- Beste Online Druckerei 2024 – Online Druckerei Vergleich

- Grundsteuererklärung Auch Nötig Wenn Nach 01.01.2024 Eigentümer?

- » Otomatik Viteste N, L, 1, 2, 3 Ve S Harf Anlamları Nelerdir?

- Thomas Kraft • Größe, Gewicht, Maße, Alter, Biographie, Wiki

- Yogashorts Online Kaufen| Sport Conrad

- Was Bedeutet Es, Wenn Männer Zeit Brauchen?

- Danko Jones Tour Dates 2024 _ Danko Jones Official Site

- Wilson Gabor Heizdecke Wlan: Smartes Wärmeunterbett Mit 2

- Pgs Wittenberg _ Evangelisches Krankenhaus Wittenberg