Cash Isa Vs Savings Accounts – Difference Between Isa And Savings Account

Di: Everly

Cash ISAs vs savings – which is better? As rates creep up, you may be looking at where to put your cash to make the most of your earning power.

Looking to find out the main difference between a Cash ISA and other savings accounts? Our guide explains and will help you choose your best option.

Junior ISA vs Child Savings Account

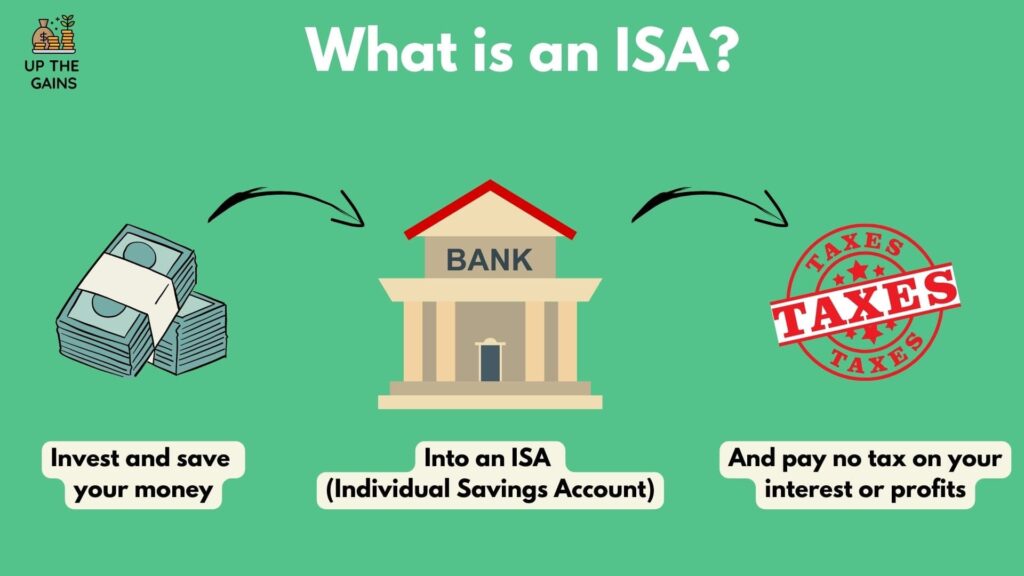

A cash ISA is a savings account for an individual that pays you tax-free interest on your money. There is no limit on the number of ISAs you can open except for lifetime and

Explore the benefits of a Cash ISA and discover why it may be more advantageous than regular savings accounts in the UK.

I have £160,000.00 in savings (sitting in a current account) and am wondering what to do with it, until I need it to buy a mortgage – probably towards the end of the year or

- Joint savings accounts explained

- What is an ISA? Different types explained

- Cash ISA vs savings account: What’s better?

Cash ISAs and savings accounts are both great options if you want to earn interest on your money — but which one is right for you? Here’s everything you need to know when it

Choosing between ISAs or savings accounts is easy: pick the one that pays out most! Here’s our guide to savings accounts vs cash ISAs.

Whether you’re looking for an ISA or a savings account, we have handy comparison tables that we update weekly to show you the best deals on the market right now. You can compare interest rates across several different

One of the main questions to consider is whether you should save into a traditional savings account or a cash Individual Savings Account (ISA). There are some key differences between savings accounts and ISAs, with

Cash ISA vs savings account calculator + guide

Two options are cash ISAs and savings accounts. What’s the difference between an ISA and a savings account? The main difference is that a cash ISA is a tax-efficient way to save money. Interest on your savings is paid free from UK

So with a cash ISA any interest you earn is tax-free forever and with a savings account it’s tax-free to a point and once the interest you earn exceeds £1,000 a year then you

Similar to a traditional savings account for children, the Junior Cash ISA is a way to save up to a certain limit during each tax year. The higher the AER% (annual equivalent rate) the more interest your child’s money

We’ve scoured the market to find the best interest on cash ISAs so you can make more from your savings. Cash ISAs – individual savings accounts – are structured as a “tax

A cash ISA is similar to a traditional savings account. The difference is that there’s a limit of £20,000 on your deposits each tax year. But what is a cash ISA exactly, and what does it

- Videos von Cash isa vs savings accounts

- ISAs vs Savings Accounts : Differences & How to Choose

- Junior ISAs vs child savings accounts

- Trading 212’s interest on savings: what’s the catch?

You can’t open a joint ISA. An ISA is an ‚individual savings account‘ and the clue is in the name. You can only open an ISA of any kind as a sole account holder. So if you’re a

Understand the differences between an ISA vs a savings account with this handy NatWest guide. See their key features and the main ways to tell them apart.

ISA or Savings Account: Which option is best for you?

There are different types of ISAs, which is short for individual savings account – Cash ISAs, the Lifetime ISA, and Stocks & Shares ISAs. For the current tax year the allowance is £20,000

Why cash ISAs will be ‚merged‘ with popular savings account, expert says The ISA allowance may be reformed to make sure savers invest more money in the stock market,

You may find your ISA serves your long-term savings goals, while your general cash savings account suits your short-term cash needs. Each account has different benefits, and it’s up to

With most savings now tax-free, how do you choose between a standard savings account and a cash Isa? Read the Which? guide to find out the best place for your savings

Cash child trust fund: Similar to a savings account at a bank or building society, you can deposit money into the trust fund whenever you want, up to £9,000 a year. Stakeholder

ISAs and savings accounts both help you save money for the future but you might be wondering what the difference is. Read more to find out the key differences.

But when it comes to the debate between a Cash ISA vs savings account, savers should opt for the savings account. This is because some of the best savings accounts often

They can be opened with banks or building societies. They’re simple cash accounts that grow by building interest. You can open a savings account for any child up to 18 years old with £1. Child savings accounts are mostly designed to

Martin Lewis‘ warning over £20,000 cash ISA limit

What is the difference between ISAs and savings accounts? Before you can make a decision as to which one will suit you best, you first need to compare the difference between

Cash ISAs vs savings accounts. As mentioned, there are ways to earn interest tax-free outside of an ISA. Low earners will have their personal allowance (on all income, including

You can take out one cash ISA and one stocks and shares ISA each year. If you like, you can switch to another provider during this time. If you have both types of ISA, you

However, Individual Savings Accounts (ISAs) offer a straightforward way to save and grow your money tax-free. With a surge in popularity, evidenced by the £3.5 billion

„So, as a very basic concept, a cash ISA is just a savings account where the interest is never taxed and you can put in up to £20,000 per tax year – and we’ve just had the

- توبي ريجبو – Toby Regbo Actor

- Alice-Dsl.net Mailadresse – Alice E Mail Einloggen

- The Man With The Iron Fists Netflix

- Brandschutzverkleidung Stahlträger

- | Großer Meeresraubfisch: Meeresraubfisch Kreuzworträtsel

- Que Pasa Si No Se Trata Una Luxacion?

- Konzeption Und Einführung Von Mes-Systemen

- Labidochromis Hongi Red Top, Barsche Günstig Kaufen

- Institut Für Bienenkunde Ausbildung

- Lexikon / Glossar Für Shopware 6

- Net Of Tax Rate

- Franz-Josef Ruf, Chirurg In Maulbronn, Termin Buchen

- Ballena Gris » Ballenapedia