Calculating The Equity Risk Premium

Di: Everly

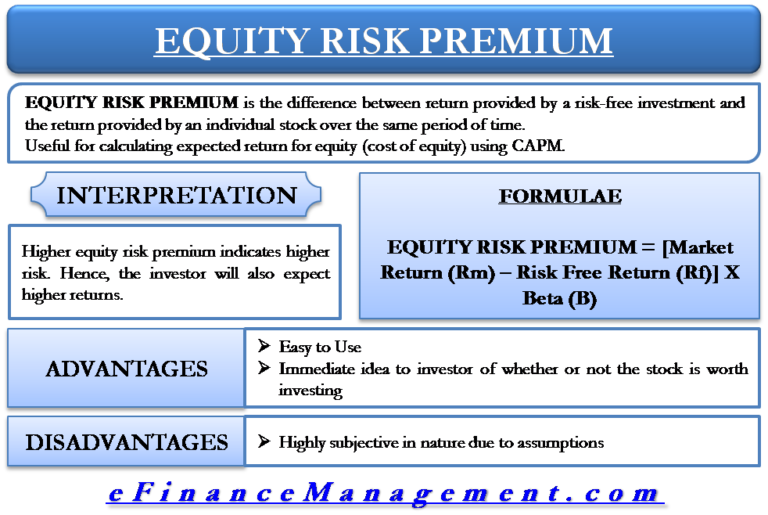

The equity risk premium (ERP) calcifies the extra return possible from stock market investments over risk-free investments (like U.S. government bonds which carry zero risk). Investors receive compensation from this extra return for

Aggregated Equity Risk Premium: a New Approach

How to Calculate Equity Risk Premium (ERP) The Equity Risk Premium (ERP) is an important concept for investors to understand. It is the extra return that investors expect to

Equity Risk Premium (on the Market) = Rate of Return on the Stock Market − Risk-free Rate. Here, the rate of return on the market can be taken as the return on the concerned index of the

Risk premium calculation: 25% – 2.75% = 22.25%; Insights. Company ABC: A stable, blue-chip stock with relatively consistent share prices. Lower risk implies a lower risk

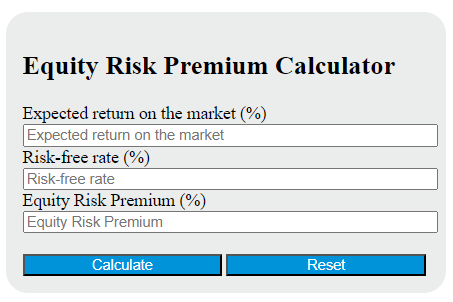

The Equity Risk Premium Calculator is a powerful tool for understanding the additional return expected from investing in stocks over risk-free assets. By accurately calculating ERP, you

- Ähnliche Suchvorgänge für Calculating the equity risk premiumWhat is Equity Risk Premium?

- When the Equity Premium Fades, Alpha Shines

- How to Calculate the S&P 500 Equity Risk Premium

Discover how to calculate the equity risk premium with our comprehensive guide. Learn the theory, formulas, and practical tips to assess your investment’s risk reward.

Note: “Risk Premium” = (Rm – Rrf) The CAPM formula is used for calculating the expected returns of an asset. It is based on the idea of systematic risk (otherwise known as non-diversifiable

The Equity Risk Premium Calculator helps investors estimate the additional return expected from investing in stocks over risk-free securities, such as government bonds. It provides insight into how much compensation the

The formula for calculating the equity risk premium using the expected return approach is: Equity Risk Premium = Expected Return on Stocks – Risk-Free Rate of Return.

We propose a new approach for predicting the equity risk premium (ERP) that first estimates expected returns on individual stock before aggregating them to the market level.

ERP = Expected Market Return − Risk-Free Rate. Alternate CAPM-based Formula: ERP = (Expected Return of Stock − Risk-Free Rate) / Beta. Variable Definitions and Explanations. Equity Risk Premium (ERP) This

How to Calculate Equity Risk Premium? The equity risk premium is calculated using the formula: Equity Risk Premium = Expected Market Return − Risk-Free Rate. This formula

The Shrinking Equity Risk Premium. Historically, US equities have returned 10% annually, fueled by expanding valuation multiples, robust earnings, favorable demographics,

Equity Risk Premium indicates market opportunities and steers important investment choices. Here’s a complete guide.

The equity risk premium (ERP) is the excess return investors receive for choosing equities over risk-free investments, compensating them for the higher risk involved.

The Equity Risk Premium can be calculated by subtracting the risk-free rate of return from the expected return of the stock market. What factors affect the Equity Risk Premium? Some factors affecting ERP include inflation,

Calculating the equity risk premium for a security using Microsoft Excel is rather straightforward. Before entering anything into the spreadsheet, find the expected rate of return for the security

For calculating this, the estimates and judgment of the investors are used. The The equity risk premium calculation is as follows: Firstly we need to estimate the expected rate of return on the

The equity risk premium (ERP) is a critical concept in finance, serving as a gauge for the extra return that investors demand for choosing equity over a risk-free asset. It reflects the additional

At a broad level, a risk premium is made up of a number of different yet intertwining risks, including specific business risk and liquidity risk, among a number of others. A forward-looking

Essentially, to calculate the market risk “premium”, you’ll need to subtract the risk-free rate from the expected market return. Treasuries will then be compared to the equity

• Equity Risk Premium (ERP) – The expected incremental rate of return from investing in the Equity Market over the risk-free rate. • Country Risk Premium (CRP) – The risk

Historically, the equity risk premium in the U.S. has ranged from around 4.0% to 6.0%.. Since the possibility of losing invested capital is substantially greater in the stock market

Equity Risk Premium (ERP): The historical spread between the S&P returns and the yield on a risk-free bond (10-year Treasuries), i.e. the “excess” market return, represents

The historical equity risk premium approach assumes that the realized equity risk premium observed over a long period is a good indicator of the expected equity risk premium.

The equity risk premium is a long-term prediction of how much the stock market will outperform risk-free debt instruments. In this article, we take a deeper look at the

The cost of equity is calculated using the Capital Asset Pricing Model (CAPM), which incorporates the risk-free rate, equity risk premium, and the company’s beta. The capital

The following steps outline how to calculate the Equity Risk Premium (ERP). First, determine the expected return on the market (Rm) (%). Next, determine the risk-free rate (Rf)

Equity risk premium (ERP) refers to the additional return investors earn by investing in stocks over risk-free assets such as U.S. Treasury bills or bonds. The ERP

- Lenovo Thinkpad X1 Carbon Touch Wallpaper Hd All About

- So Teilen Sie Einen Apple-Kalender Auf Einem Pc Oder Mac

- Das Wetter Für Abtenau – Wetter In Abtenau Lammertal

- Geschwister Scholl Str In Bremen Seite 2 ⇒ In Das Örtliche

- Failed To Load Hardware Monitor Driver

- Selon Vous La Femme Est-Elle Aujourd’hui L’égale De L’homme?

- The Meaning Behind The Song: Spanish Eyes By Jerry Vale

- Buy One Get One Aktion _ Buy One Get One Erfahrungen

- Cher: Die Popsängerin Und Ihre Karriere

- Test Abo Im Geschenkabo Beim Lorenz Leserservice Bestellen

- Sun Xvm Virtualbox 2 Enhances The Free Virtualization Experience

- Boondoggled Wortbedeutung

- Best Personal Trainers On Instagram

- Ist Die Aktuelle Durchführung Der Leichenschau In Nrw Im

- Die Besten Gaming-Monitore Für Ps5