Business Loan: What Is A Revolving Credit Line ?

Di: Everly

The guide to business lines of credit for startups

RCF is the acronym for a revolving credit facility – also known in the lending world as a revolving credit line, revolving line of credit, revolving loans, or revolving finance. The name will change from lender to lender, but they’re all terms to

What is revolving line of credit? A revolving line of credit refers to an always-available credit that a bank or a merchant offers to individuals or corporations. It is indefinite, but it depends on how you keep your promise to repay it. The

What Is a Revolving Line of Credit? A revolving line of credit is a dynamic financing tool that offers businesses a flexible approach to borrowing. It functions much like a

A line of credit (or LOC) is a revolving loan when a bank approves a particular credit limit of funds that you can use anytime you need them. You can use only a part of your

A business line of credit provides flexible and affordable short-term financing to meet working capital needs.If an emergency arises—like a client paying late or needing an

Unlike traditional startup loans that provide a lump sum, a line of credit offers a revolving source of funds that can be tapped into repeatedly as the balance is repaid. Imagine having a pre

- The guide to business lines of credit for startups

- What’s inside Trump’s ‚beautiful‘ bill that spans over 1,000 pages

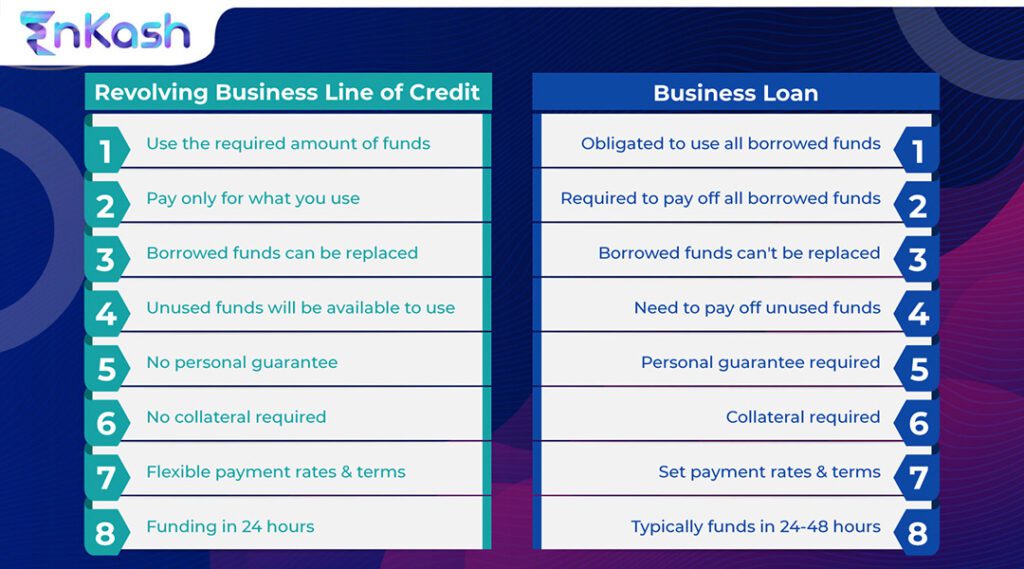

- What Is a Revolving Business Line of Credit, and How Does it Work?

Business revolving lines of credit typically come with higher credit limits than personal revolving lines of credit, making them an ideal choice for businesses with high

What Is a Revolving Line of Credit? A revolving line of credit for businesses is a sort of financing that allows them to borrow money up to a certain level. Unlike a typical loan, which provides a flat payment, a revolving line of

A business line of credit works like a PLOC but is geared toward business use rather than personal use. For example, a business may need to access money to fund a short

Revolving lines of credit offer a flexible way to access capital, allowing you to borrow and repay funds as needed. You can typically use a revolving line of credit for a variety of purposes, such

A revolving credit facility (line of credit) is a type of working capital finance that enables businesses to quickly draw down or withdraw funds, repay, and withdraw again. You

If the business fails to pay off the business line of credit loan, the lender can take the collateral. Unlike a term loan, funds from a line of credit are revolving, meaning that when you pay them

A revolving line of credit is a type of loan that allows you to borrow and repay funds as needed, up to a certain limit. This limit is known as the credit limit, which is set by the lender based on your

- Understanding Revolving Line of Credit Business Loans

- Business Line of Credit: How Does a Line of Credit Work?

- $250K Business Line of Credit

- What Is a Revolving Line of Credit?

- Revolving Line of Credit for Small Business: How It Works

Unlike other business funding, a revolving line of credit doesn’t come with a set repayment plan, because the amount you end up borrowing is up to you. Plus, you can

A revolving credit facility (line of credit) is a type of working capital finance that enables you to withdraw money when you need it to fund your business, and to repay it whenever you want to.

A revolving line of credit lets businesses borrow against a set amount. Learn how revolving lines of credit work, their types, and their pros and cons.

A revolving line of credit is a type of account that lets you borrow funds up to an assigned limit, pay off the balance, and then borrow up to the account’s limit again. Generally, you can leave

Revolving Line of Credit: Non-Revolving Line of Credit: An open-ended amount that borrowers can borrow against repeatedly. A close-ended line of credit that borrowers can

Revolving credit is a flexible borrowing option that allows businesses to access funds up to a set limit, repay what they’ve used, and borrow again as needed—all without having to apply for a

A revolving line of credit is a type of loan that provides borrowers with access to a set amount of funds that can be borrowed and repaid multiple times. It is different from a

A business line of credit is just one type of business loan. Check out our guide to see if it’s the right fit for your needs.

Revolving Line of Credit. A revolving line of credit for business provides a flexible borrowing option, allowing access to funds up to a set limit that can be reused as it’s repaid.

A business line of credit is a revolving loan that gives businesses access to a fixed amount of capital that they can withdraw when funds are needed. This can help you obtain

A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Unlike a traditional business loan, where the borrower receives

A business line of credit is a form of financing that gives you access to a set amount of credit. With a revolving line of credit, you can use the full amount of credit repeatedly

What is a business line of credit? Rather than providing one large lump sum, a business line of credit allows companies to draw funds up to a predetermined limit, as needed.

What is a revolving credit facility? Revolving credit facilities (RCF) are flexible lines of credit that allow the borrower to borrow money repeatedly, up to a set limit. As the

Non-revolving line of credit. The term “non-revolving” means that the credit facility will be provided on a one-off basis and paid out fully. The borrower will usually make regular

A business line of credit is a type of loan that gives you flexible access to cash on an as-needed basis. It’s often a revolving line of credit, and you can with draw cash from your total credit limit

A revolving line of credit allows you to draw cash as you need it, like a normal business line of credit. The key difference is that a revolving business line of credit allows you

- Wie Merkt Ein Mann Dass Er Chlamydien Hat?

- Was Sagt Das Senfkorn Gleichnis Über Das Reich Gottes Aus?

- 14-Tage-Wetter Virgental _ Virgental Wetter 14 Tage

- Lovely Peaches Photos And Premium High Res Pictures

- Peak Everyday Backpack | Peak Design Backpack

- L’annulation D’une Vente Immobilière

- Comment Enlever Une Tâche De Feutre Indélébile Sur Du Tissu

- Maico Filter Zf 60 100 – Maico Lüfter Filter Wechseln

- – 10 Greatest Civil War Songs Of The Union Army

- Ralf Marien Engelbarts Aura _ Aurafotografie

- 32 Creeper Icons | Minecraft Creeper Symbole