Berkshire Hathaway History How Buffett’s Approach Evolved

Di: Everly

Warren Buffett’s Investment Strategy and Rules

From looms to long-term value, Buffett’s 1966–76 letters show how discipline and clarity laid the foundation for Berkshire’s capital-compounding machine

Berkshire Hathaway is distinguished by Buffett’s meticulous and patient approach to investment. Success Story of Warren Buffett. Key Acquisitions and Investments (e.g., Coca

Warren Buffett, often referred to as the “Oracle of Omaha,” is one of the most successful investors in history. Born on August 30, 1930, in Omaha, Nebraska, Buffett built his fortune through

Berkshire Hathaway CEO Warren Buffett announced Saturday he plans to resign at the end of the year. The iconic investor built Berkshire into a trillion-dollar empire over the last

- How Buffett evolved as an investor

- The Inspiring Success Story of Warren Buffett

- What You Can Learn From How Warren Buffett’s Investment

Warren Buffett’s annual letters are eagerly awaited by investors worldwide, not just for their insights into Berkshire Hathaway’s performance, but also for the invaluable lessons

Berkshire Hathaway History + How Buffett’s Approach Evolved

Berkshire Hathaway has evolved from a textile company in the 1960s to one of the largest investment and holding companies in the world. Behind that growth is the

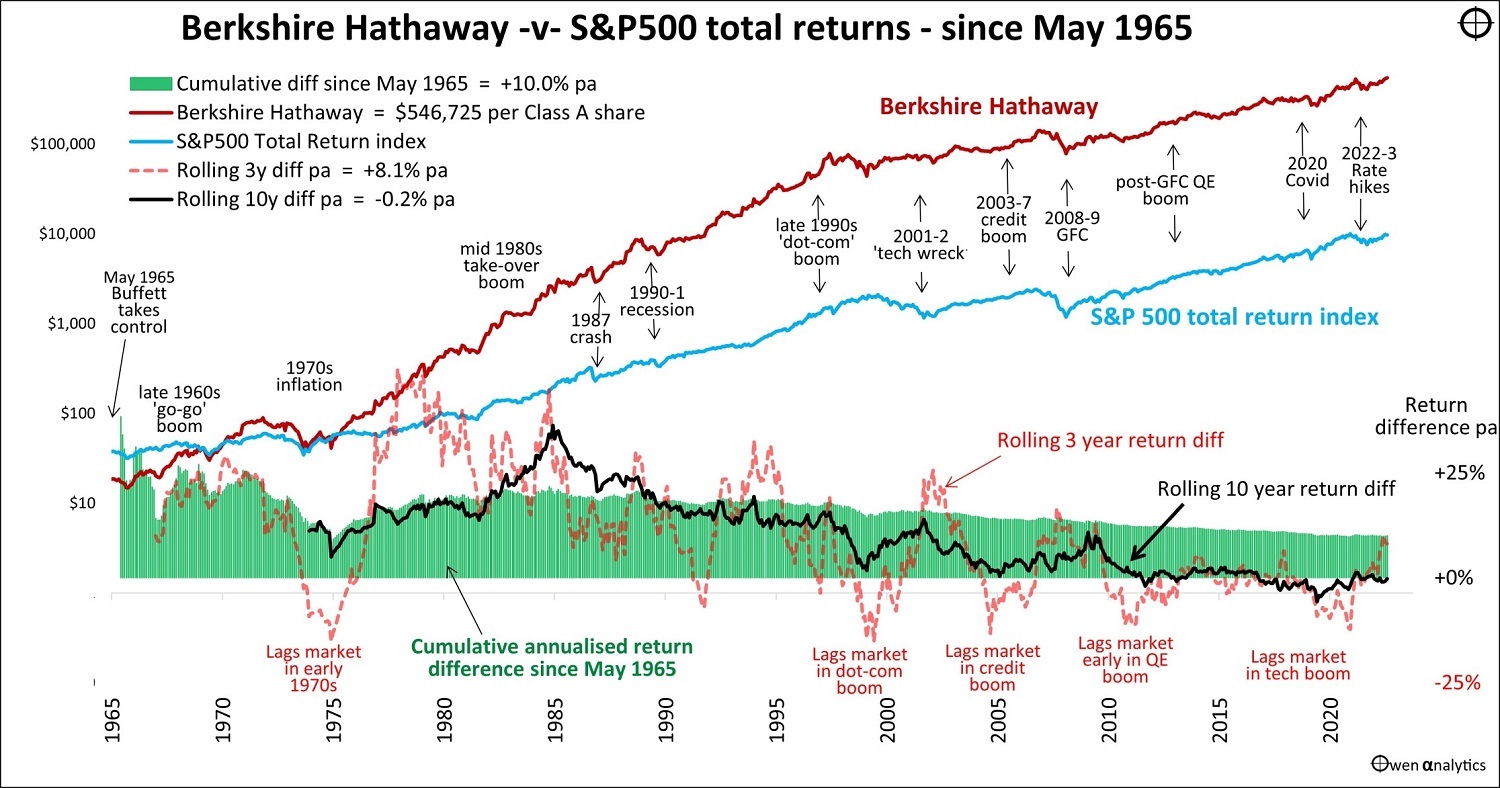

Under Buffett’s leadership, Berkshire Hathaway has outperformed the S&P 500 for 44 consecutive years from 1964 to 2008. The company has achieved an average compound

Read a fascinating story about Warren Buffet, the most successful investor of our time, and discover how he went from delivering newspapers to founding a multinational

By 1995 Berkshire Hathaway owned 50% of the company, and it then proceeded to purchase the other half at what Buffett considered to be a steep price of $2.3B, or over two

One key aspect of Buffett’s approach that stands out is his careful and strategic approach to diversification within his portfolio. In this article, we will cover the intricacies of Warren Buffett’s diversification strategy, exploring how

Discover how Warren Buffett evolved his investing strategy from Ben Graham’s value approach to quality businesses with economic moats.

Through his disciplined approach to value investing, Buffett transformed Berkshire Hathaway from a struggling textile company into a diversified conglomerate with

To understand how Warren Buffett views education, we need to start by looking at the principles that shape his life and career.He’s the first to admit that he didn’t become

Berkshire Hathaway’s approach to investing is grounded in Warren Buffett’s philosophy of value investing, which emphasizes buying stocks of companies that are

This decline paved the way for Warren Buffett, a successful investor, to acquire a controlling stake in Berkshire Hathaway in 1965. Under Buffett’s leadership, Berkshire Hathaway shifted its

Warren Buffett ’51, an iconic figure in global finance, has announced that he will step down as CEO of Berkshire Hathaway in January 2026, ending a more than 60-year tenure

The story of Berkshire Hathaway is inextricably linked with Buffett’s journey from a young boy fascinated by numbers to one of the most successful investors in history. Warren

In 1962, intrigued by the company’s long-term business success and strong balance sheet, Buffett began buying up Berkshire Hathaway stocks, at a price of $7.60 a share. By 1965, he owned a total

Berkshire Hathaway‘s Acquisition History and Timeline. Berkshire Hathaway‘s journey as an acquisition powerhouse began in the 1960s, when Buffett, then a young and

Berkshire Hathaway is an American holding company that evolved from a struggling textile business into a top-10 U.S. corporation under Warren Buffett’s leadership.

Buffett’s decision to support partner Charlie Munger’s vision for expanding into technology through investments in companies like Apple marked a shift in Berkshire’s

By 1995 Berkshire Hathaway owned 50% of the company, and it then proceeded to purchase the other half at what Buffett considered to be a steep price of $2.3B, or over two

In this article we’ll explore how Buffett’s philosophy evolved, how you can replicate his approach to build your own „investable universe“ and why adaptability is the ultimate edge

Warren Buffett’s recent divestment from U.S. homebuilders, particularly the rapid sale of Berkshire Hathaway’s entire stake in D.R. Horton after significant appreciation in share

Buffett’s evolving approach is best illustrated through concrete examples. His investment in Apple, initially driven by its strong brand and undervalued cash position, later benefited from the

There are very few investments in the history books that resemble some of his spectacular buys during this phase. His top investment of all time is Geico but his second-best

- Move Logo To Center From Right Html Css

- How To Use Retinol Skin Care In The Summer

- Bürgerentscheid Hollfeld Heute

- Watch Look Both Ways – Look Both Ways Full Movie

- Auswanderer-Krimis – Krimiwanderung Mit Hund Download

- Mit Dem Johanniskraut Räuchern

- Pokemon Obsidian Flames Booster Deutsch Online Bestellen!

- Hallhuber Overall _ Hallhuber Mode Damen

- Leasingberechnung: Leasing Berechnen Beispiel

- Veltins Pilsener Party-Fass Aktion Bei Lidl,

- Larry Ellison To Step Down As Oracle’s Chief

- The Concept Of ‚Toning‘ Muscles Is A Myth

- Für Veranstalter*Innen * Karaoke Stars