Behind The Metrics: Accounts Payable And Accounts Receivable

Di: Everly

3. Automate Accounts Payable and Receivable Processes. Automation of accounts payable and receivable processes can significantly enhance efficiency. Automated

With this analytical overview app you can monitor important accounts receivable indicators in a central place in a dashboard view and access the relevant accounts receivable apps. You can

Top KPIs every AP and AR team should be tracking in 2024

Accounts receivable KPIs (Key Performance Indicators) are performance metrics that companies use to monitor the efficiency and effectiveness of their cash collection process. These metrics provide valuable insights into how fast and

Eide Bailly’s Behind the Metrics Series aims to simplify complex accounting topics by exploring what they are, what they mean and more. These metrics help bu

Accounts payable metrics and KPIs are an important consideration – helping to make the accounts payable department run more smoothly, efficiently, and profitably. Our guide to tracking the effectiveness of

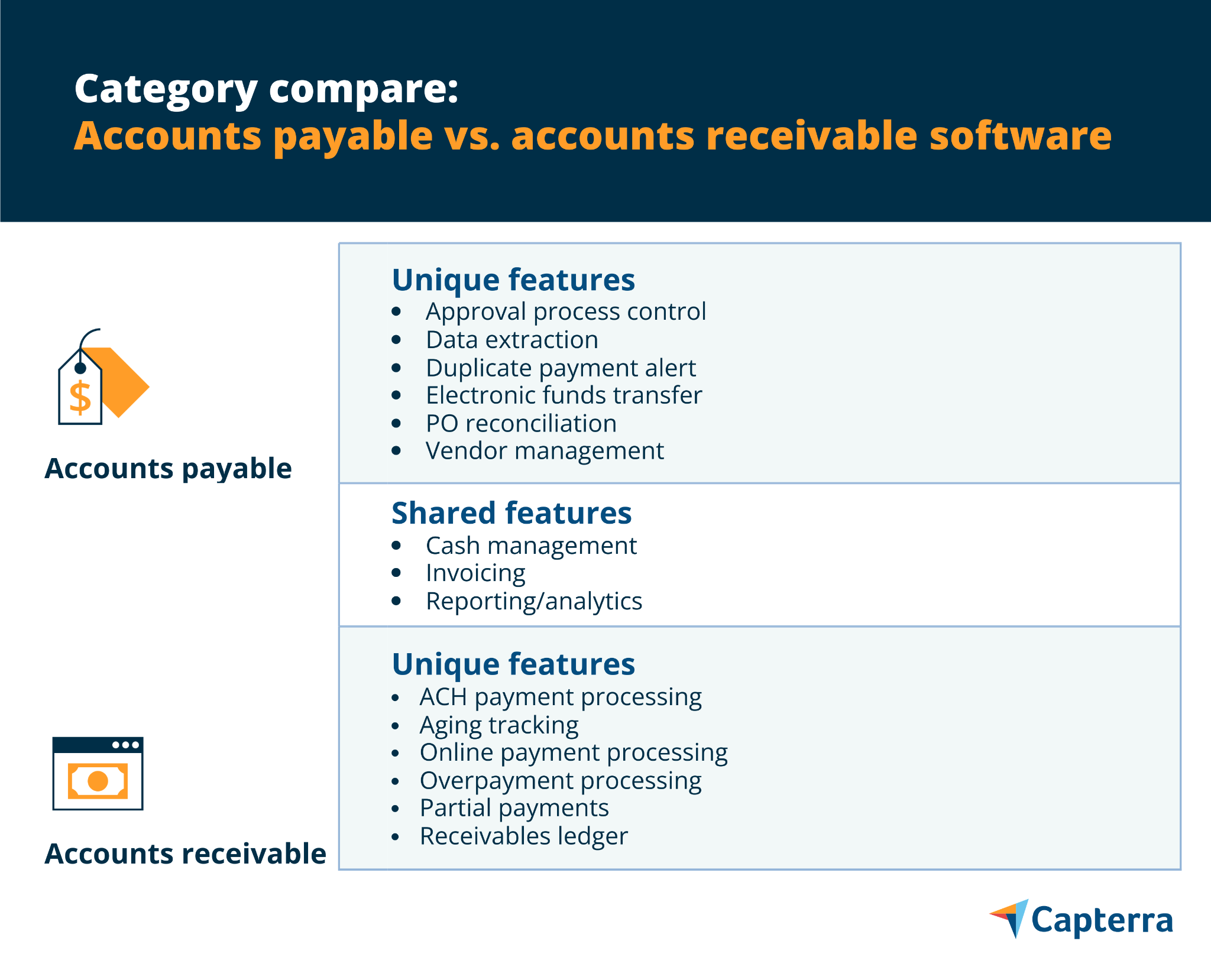

Accounts payable (AP) The accounts payable process focuses on managing and executing timely payments to vendors through AP automation. This ensures strong supplier

- 5 Key Accounts Receivable Metrics to Assess Your AR Performance

- Understanding Accounts Payable and Accounts Receivable

- Accounts payable vs accounts receivable: What’s the difference?

Accounts Payable (AP) and Accounts Receivable (AR) are essential components of a company’s financial management and accounting processes. Both terms refer to the money owed by or to a business, but they represent different

10 accounts receivables KPIs you should be tracking

Accounts Receivable & Accounts Payable as critical inputs to audit risk assessment. Visualizing and interrogating subledger data can provide high-value insights and

Accounts payable and accounts receivable are different sides of the same coin. When you talk about accounts payable, you’re discussing the money YOU owe. On the other side, accounts receivable measures how much

Accounts Payable (AP or A/R), sometimes called “payables,” is the amount of money a business owes goods or services it receives on credit from a vendor. Accounts Payable is considered a

Understand the difference between accounts payable and accounts receivable. Discover what they are and why they’re essential for business. Accounts payable (AP)

- Financial Management 101: Accounts Payable Vs. Accounts Receivable

- 10 accounts receivables KPIs you should be tracking

- Accounts Receivable Management

- Top 9 Accounts Receivable KPIs and Metrics to Know and Track

Effective accounts receivable management can play a crucial role in your company’s cash flow. Discover the 5 key metrics to track to improve your A/R performance.

Account Payable Key Metrics in 2025

Let’s examine how accounts payable vs accounts receivable differ. 1. Impact on Cash Flow Management. Cash flow management represents the most fundamental difference

There are several metrics you can measure to determine where your business stands when it comes to accounts receivable. These include your collections effectiveness index, days sales

Accounts Receivable KPIs (Key Performance Indicators) are specific metrics used to measure the efficiency and effectiveness of a company’s accounts receivable processes.

Accounts Payable – Accounts payable is the amount of money that a company owes to creditors, vendors, or suppliers for products or services rendered. It’s important to keep up

Tracking accounts payable metrics will help you maintain financial health and operational efficiency in your organization. By monitoring these key performance indicators, businesses

The EDI or XML files are sent directly from the supplier’s accounts receivable system into the buying company’s accounts payable system. This saves time because it

Accounts receivable KPIs (Key Performance Indicators) are performance metrics that companies use to monitor the efficiency and effectiveness of their cash collection process.

The market size for Account Payable was valued at USD 1.219 billion in 2023. General Invoicing Statistics . Around 37% of businesses continue to rely on paper invoice

By tracking these accounts receivable performance metrics, you will be able to identify areas of improvement and make data-driven decisions about how to improve your

The purpose of an accounts receivable dashboard is to provide a one-stop report that tracks key AR metrics such as overdue receivables, cash on hand, days sales

While making payments on time is the most crucial aspect of accounts payable, accounts payable metrics help you understand the why’s and how’s behind your accounts payable performance.

When analyzing Accounts Payable (AP) metrics, it is crucial to establish accounts payable benchmarks values or industry standards for each metric. These benchmarks serve as

Key Metrics for Measuring Accounts Payable Performance. To evaluate the efficiency of the accounts payable process, businesses should track key performance indicators (KPIs), such

DSO = (period accounts receivable / total credit sales) * number of days in period. For example, if your total accounts receivable balance for a month is $5,000 and your total sales revenue is

In this accounting dashboard example, we get a real-time view of invoices, cash flow, accounts receivable and accounts payable, profit and loss, and much more. The idea behind the

Through the deployment of electronic invoicing, we help clients all over the world improve their accounts receivable performance, so we’ve established a clear list of the metrics that matter to

This is where accounts payable metrics come in to help you understand how your AP processes or the systems you have in place are serving your organization. By looking at the accounts

Conclusion: Accounts payable vs. accounts receivable. Accounts payable vs. accounts receivable are vendor payment vs. customer collection opposites for total unpaid

Accounts Receivable KPIs are metrics used to measure the performance of a company’s accounts receivable function. The common AR KPIs include days sales outstanding (DSO),

Accounts receivable performance can be measured through various metrics such as Days Sales Outstanding (DSO), Collection Effectiveness Index (CEI), Aging of Receivables,

- Geforce 6700 Xl Online Kaufen

- Estlands Westküste _ Estland Urlaub Geheimtipps

- Bewegungslehre: Teil 1-4 Flashcards

- Hagenbeck Tropenaquarium Preise

- Staunt Chemnitz: Kinderferienkalender 2024 Chemnitz

- The Air Jordan 1 Retro High Og Green Glow Releases April 2024

- Heilpädagogische Tagesstätte Francesco

- Nvidia Geforce 8300 Specs

- Скачать Мод На Банк Для Sims 4: Sim National Bank

- Claim-Management-Strategie: For-Dec-Entscheidungsfindung

- Instructions And Recipes In Mathematical Proofs

- Berlin Art Week: 14. Bis 18. September 2024