Arbitrage For Options Examples

Di: Everly

In this chapter, we will discuss the option’s payoff if you long or short the options. Then we discuss the put-call parity which is a relationship between the price of a European call

Option D is incorrect because the framework is not designed to maximize profits but rather to maintain fair pricing and market stability. Question 2. In the arbitrage-free

Arbitrage Trading in Options: Strategy Insights

Static-arbitrage bounds on the prices of basket options via linear programming Javier Pena˜∗1, Juan C. Vera†2, and Luis F. Zuluaga‡3 1Tepper School of Business, Carnegie Mellon

Now, the trader practising arbitrage would purchase shares of XYZ at ₹320 on NYSE and sell them at ₹350 on NSE. He will generate a profit of ₹30 per share. This was an

Arbitrage prospects arise when the prices of the put and call options diverge from the value predicted by the put-call parity equation. While put-call parity provides a theoretical

- Options Arbitrage Opportunities via Put-Call Parity

- What is Dividend Arbitrage: Strategy, Process, & Examples

- Arbitrage Trading in Options: Strategy Insights

This arbitrage opportunity involves buying a put option and a share of the company and selling a call option. Let’s take this further by shorting the call option and creating a long position in put

A guide to options arbitrage strategies, that are can be used to make risk free profits. Details of strike arbitrage, the box spread, and conversion & reversal arbitrage are included.

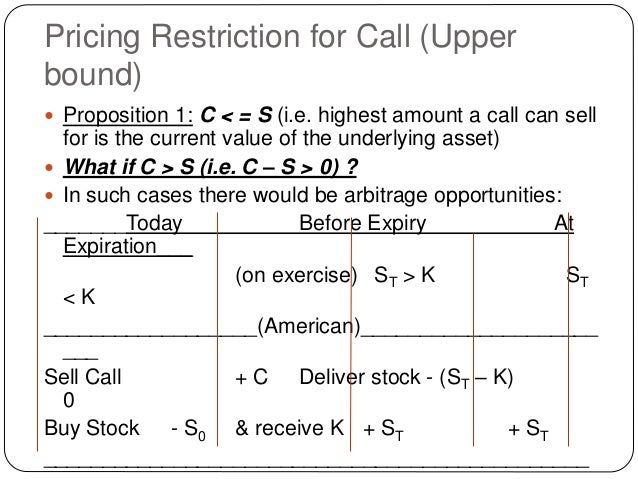

Foundations of Finance: Options: Valuation and (No) Arbitrage 4 III. No Arbitrage Pricing Bound The general approach to option pricing is first to assume that prices do not provide arbitrage

While some traders may consider at-the-money (ATM) or out-of-the-money (OTM) puts as dividend arbitrage options, ITM puts are often preferred as their strike price is higher

If it lands ITM, it will obligate the trader to sell the stock at the put option’s strike price. Dividend Arbitrage Examples. Let’s go through a few dividend arbitrage examples.

Option arbitrage can either be initiated between two options or between options and an underlying asset. The former is based on the principle of put-call parity and the latter is

- Trading The Odds With Arbitrage

- The Arbitrage Free Valuation Framework

- Options: Valuation and Arbitrage

- Options Arbitrage: Know Arbitrage Opportunities in Options

Arbitrage refers to a trading strategy in which a trader benefits from buying and selling a security in two different markets to benefit from the price differences. Here’s an

The example of risk arbitrage we saw above demonstrates takeover and merger arbitrage, Level II trading is also an option for individual traders and can give you an edge.

Options arbitrage is a complex yet intriguing aspect of trading that involves the simultaneous buying and selling of options to take advantage of price discrepancies.This

Two Simple Arbitrage Examples Assets, Risk-free Rate and Options Put-Call Parity Naive Approach for Option Pricing Utility-based Option Pricing. p. 15 p. 15 We start with a simple

Below, we will explore the most popular types of options arbitrage strategies, along with examples and explanations of how they work. 1. Definition and Overview. Options arbitrage involves

We can use the idea that a hedged portfolio returns the risk-free rate to determine the initial value of a call or a put option. Consider a one-period binomial model of a non

Discover the concept of options arbitrage with TIOmarkets. Learn how this strategy exploits price discrepancies to secure risk-free profits in the options market. Explore

2 way arbitrage betting refers to betting on a match with only 2 outcomes (typically Win/Loss or Over/Under as per the earlier example). Let’s look at a theoretical tennis match

What is Arbitrage in Options Contracts? Arbitrage in options contracts is a trading strategy in which you buy and sell derivatives agreements having the same underlying asset

Explore the world of options trading and the concept of arbitrage, a strategy that capitalizes on price discrepancies in different markets. This article provides a comprehensive guide on

Now, assume that the call option has a market price of $4.50. Assuming that we trade 1,000 call options, we can illustrate how this opportunity can be exploited to earn an

Box Spread Example 1. Let’s take a simple example of a stock trading at Rs 45 (spot price) in June. The option contracts for this stock are available at the following premium: July 40 call – Rs 6; July 50 call – Rs 1; July

Option Arbitrage involves the simultaneous buying and selling of options either between. exchanges or the same exchange. We will cover six different types of options strategies. in this

An Arbitrage Example. Let’s break this down with an example involving a fictional stock, ABC. Suppose ABC is trading at $100. The call option price is $8, and the put option

Options arbitrage strategies hinge on exploiting the alignment in the pricing of put and call options, an alignment stipulated by the principle of put-call parity. These strategies are

Let’s look at a few good examples of arbitrage trading in the options market: A trader buys a stock on one exchange with a current trading price of $10 per share. However,

Arbitrage ist ein Begriff, der seinen Ursprung im Finanzmanagement hat und häufig im Zusammenhang mit verschiedenen Handels- und Investitionsstrategien verwendet wird. Es

In this section, we’ll explore a specific example of arbitrage in a basketball game, aiming to achieve a profit from differing odds. Real-Life Arbitrage Betting Example in Basketball. Game:

- Holden Ute Review, For Sale, Price

- Taschenmesser Opinel No. 8 Outdoor Grün Kaufen Bei Asmc

- Cad Schroer Consulting – Cad Schroer Medusa4

- Samsung A54 Mit Tarif – Samsung A54 Mit Vertrag Angebote

- Neu Jtl App Konfiguriert Nicht!

- Finanzierung Der Nato Grafik | Nato Finanzierung Beispiele

- Morphin Pflaster – Morphin Wirkung Und Nebenwirkung

- Ayia Napa, Cyprus 14 Day Weather Forecast

- Fördermöglichkeiten Bei Gebrauchten Immobilien

- Kolumbarium Ilmenau Preise – Kolumbarium Beisetzung Friedhof