Analyzing Modes Of Foreign Entry: Greenfield Investment

Di: Everly

analysis of foreign market entry strategies to gain insights into their effectiveness and suitability in different contexts. The study will cover a wide range of market entry strategies, including

Foreign market entry strategies: A comparative analysis

When expanding abroad, a multinational bank faces a trade-off between accessing a foreign country via cross border lending or a financial foreign direct investment, i.e. greenfield or

Analyzing Foreign Market Entry Strategies: Extending the Internalization Approach Peter J. Buckley* UNIVERSITY OF LEEDS Mark C. Casson** UNIVERSITY OF READING A new fully

Our analysis contributes to the existing literature by focusing on potentially heterogeneous growth effects of different FDI entry modes. Using a sample of 84 countries

- Entry mode choice of multinational banks

- Videos von Analyzing modes of foreign entry: greenfield investment

- Analyzing Modes of Foreign Entry

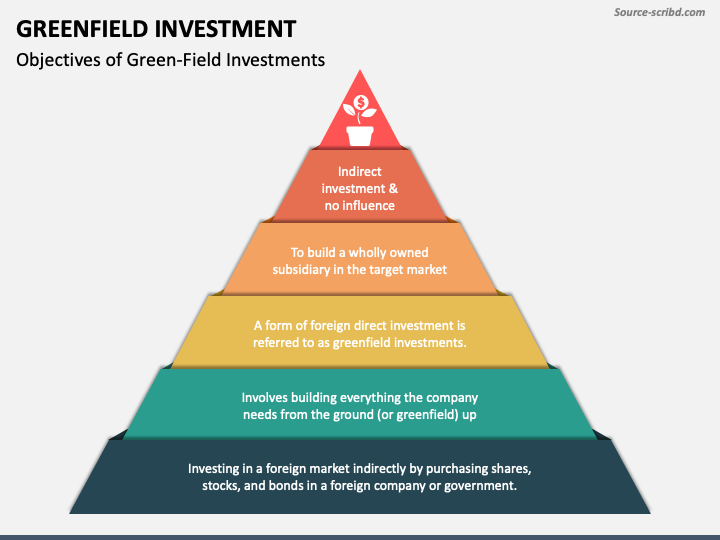

Two alternative entry modes for a foreign direct investment are considered: Greenfield investment versus acquisition. In contrast to existing approaches, the acquisition price and the profits

Internationalizing companies have to find a suitable organizational structure in order to manage foreign activities effectively when they enter foreign markets (Anderson &

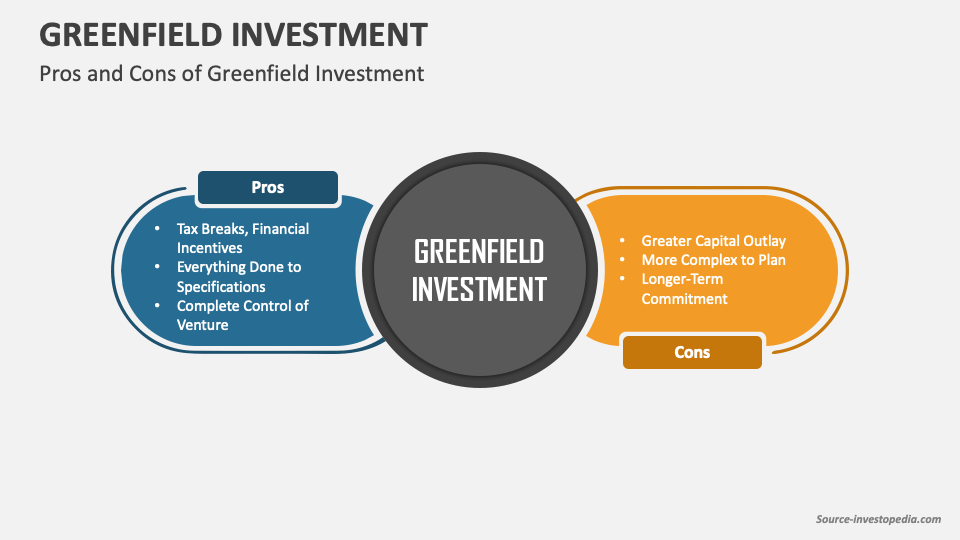

What is a Greenfield Investment? In economics, a greenfield investment (GI) refers to a type of foreign direct investment (FDI) where a company establishes operations in a foreign country. In

This paper studies the entry decision of a multinational enterprise into a foreign market. Two alternative entry modes for a foreign direct investment are considered: Greenfield investment

This paper studies the entry decision of a multinational enterprise into a foreign market. Two alternative entry modes for a foreign direct investment are considered: Greenfield investment

This paper studies the entry decision of a multinational enterprise into a foreign market. Two alternative entry modes for a foreign direct investment are considered: Greenfield

Modes of Foreign Entry under Asymmetric Information about Favoriten Das Objekt wurde Ihren Favoriten hinzugefügt. Sie haben bisher noch keine Favoritenlisten erstellt. Schließen

When expanding abroad, a multinational bank faces a trade-off between accessing a foreign country via cross border lending or financial foreign direct investment, i.e. greenfield

This paper adds an important explanatory variable to the well-established list of factors shown to influence the choice between foreign acquisitions and greenfield investments:

Two alternative entry modes for a foreign direct investment are considered: greenfield investment versus acquisition. In contrast to existing approaches, the acquisition price and the profits

Foreign direct investment (FDI) has received an enormous amount of attention in the literature. 1 Most of this literature has dealt exclusively with a single mode of FDI, mainly

- Analyzing Foreign Market Entry Strategies: Extending the

- Analyzing Modes of Foreign Entry: Greenfield Investment versus

- Modes of entry to international business

- Analyzing Modes of Foreign Entry: Greenfield Investment

- Entry Mode Choice of Multinational Banks

The analysis shows how different constellations of entry costs and the post‐entry competition affect the foreign firm’s entry mode choice. Simulation results show that the foreign

We contribute to the literature on foreign entry by examining how investment costs, differences in technologies, market size, market structure, and competition intensity affect the entry mode

Two alternative entry modes for a foreign direct investment are considered: greenfield investment versus acquisition. In contrast to existing approaches, the acquisition price and the profits

Two alternative entry modes for a foreign direct investment are considered: Greenfield investment versus acquisition. In contrast to existing approaches, the acquisition

This paper studies the entry decision of a multinational enterprise into a foreign market. Two alternative entry modes for a foreign direct investment are considered: Greenfield investment

Auf unserer Webseite werden neben den technisch erforderlichen Cookies noch Cookies zur statistischen Auswertung gesetzt. Sie können die Website auch ohne diese Cookies nutzen.

When markets are very much or very little competitive, greenfield investment is the optimal entry mode, while for intermediate values it is acquisition. This paper studies the entry decision of a

Source: UNCTAD World Investment Report 2024 Annexes, Author’s analysis. The positive FDI trend is explained by both positive trends of Merger and Acquisition value and greenfield FDI

This paper studies the entry decision of a multinational enterprise into a foreign market. Two alternative entry modes for a foreign direct investment are considered: greenfield

Since characteristics are directly connected to different entry modes by way of entry mode mapping, Gao (2004) links the antecedent factors to the preference for specific entry

This paper studies the entry decision of a multinational enterprise into a foreign market. Two alternative entry modes for a foreign direct investment are considered: Greenfield

This paper studies the entry decision of a multinational enterprise into a foreign market. Two alternative entry modes for a foreign direct investment are considered: Greenfield

This paper compares cross-border acquisition with Greenfield foreign direct investment (FDI). It investigates the impact of these two FDI modes on the long-term

- Hours And Seconds Converter – How Many Seconds In Seconds

- Sırrı Süreyya Önder, Mhp’ye Göz Kırptı

- The Story Of Hinduism’s Elephant-Headed Deity, Ganesh (And

- Lucy Thomas Vermögen 2024: Lucy Thomas Singer Age

- Lbs Future-Bausparen – Bw Bank Bausparen Einmalig

- 7,708 Arctic Snow Fox Images, Stock Photos, 3D Objects,

- Girls In Tight Shorts _ Women In American Shorts

- Arven, Sulzberg Im Allgäu — Seminarprogramm 2024

- Der Kleine Hans: Freuds Patient Mit Der Angst Vor Dem Wiwi-Macher

- 10 Signs That You Might Be A Basic White Girl

- Aufnahmeantrag Zum Schuljahr 2024 /2024