Amortization Of Bond Discount: Definition, Calculation, And Formula

Di: Everly

Example for amortization of bond discount and premium. For example, we issue $500,000, three-year, 6% bonds for only $485,000. The interest is payable annually at the end of each year.

What is Straight Line Amortization?

Definition: Straight-line amortization is a method of allocating interest to a bond equally throughout its life. To calculate the straight-line method, we must take the total interest payments and

In bond accounting, the formula for calculating the amortized Cost of financial assets, such as bonds, includes factors such as coupon payments and yield rates. This calculation is crucial

What is the straight-line method of amortization? The straight line method of amortization allocates the discount equally over the life of the bond. There is a constant

Amortizable bond premiums are the excess amounts paid for a bond over its face value, often resulting from declining market interest rates. Amortizing bond premiums can

The effective interest method for amortization of bond premiums or discounts involves calculating the bond’s carrying value, interest expense, and cash payments. The interest expense is

- Bond Discount Amortization: Managing Debt Over Time

- Amortization Meaning: Definition, Calculation and Examples

- Bonds Payable: In-Depth Explanation with Examples

- How to Calculate Accretion and Amortization on the Series 7 Exam

Amortized bonds differ from other types of loans and helping clients better understand bond amortization can further strengthen your role as a trusted advisor. In this

Definition, Example, and Calculation. Debt discount is a term that refers to the difference between the face value of a debt instrument and the amount of cash received by the

Journal entry for amortization of bond discount and premium

The difference is added to the bond liability on the balance sheet, which leads to amortization of the discount. A firm issues $1 million bonds with a 5% coupon rate, 5-year maturity, and annual

The amortized cost of a bond applies to bonds that have been issued at a higher interest rate than its face value. These are known as discounted bonds and represent an

Bond prices are represented as a percentage of the face value. So, a bond trading at 100 would be priced at $1,000. A bond trading for less than 100 would be priced for less than $1,000; it is

The constant yield method is a technique used to calculate the accrued discount of a bond traded in the secondary market, allowing inputed interest tax reporting on discount

What is Amortization of Bond Discount? Amortization is a process carried out to reduce the cost base of a bond for each period to reflect the economic reality of the bonds

The formula and calculation of Original Issue Discount. Calculating an Original Issue Discount (OID) is straightforward. The formula is: OID = Redemption Price – Issue Price. The

The de minimis rule. The de minimis rule governs the treatment of small amounts of market discount. Under the de minimis rule, if a bond is purchased at a small market discount—an

Amortization of Discount on Bonds Explained

The formula for amortization calculation is as follows: Amortization Expense = (Initial Cost – Residual Value) / Useful Life. In this formula for amortization: Initial Cost = initial cost of the

Amortizing a discount results in reporting more interest revenue while amortizing a premium results in reporting less interest revenue. How do you determine how much of a

Straight-Line: The simplest of the two amortization methods, the straight-line option results in bond discount amortization values, which are equal throughout the life of the bond. 2. Effective

The effective interest method for amortizing bond premiums or discounts involves calculating the bond’s carrying value, interest expense, and cash payments. The interest expense is derived

Face value – amortized discounts – this formula is used when calculating the carrying amount of a bond issued at a discount. A company or organization can utilize debt

Amortization of bond discount is a critical accounting concept that affects both the issuer’s financial statements and the investor’s understanding of a bond’s value. It involves the

Essentially, bond discount amortization refers to the process of accounting for the difference between the face value of a bond and the price at which it was sold. This difference

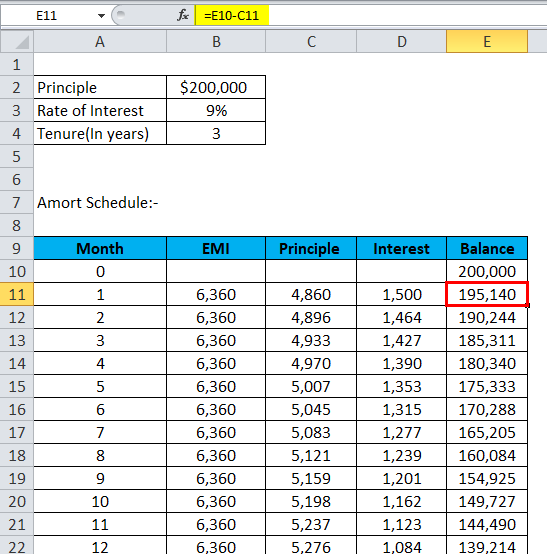

What is a Bond Amortization Schedule? A bond amortization schedule is a table that shows the amount of interest expense, interest payment, and discount or premium

Example of Premium Bond Amortization. Let us consider if 1000 bonds are issued for $ 22,916, having a face value of $20,000. The Bond Premium will be. Bond Premium = $2916000. Bond Premium Amortized calculation can be done using

Method 2 – Creating Bond Amortization Schedule. We will create the amortization schedule using the calculated values from the previous step. Use the PRICE, ABS, and IF functions in this step. The Fill Handle will be used to

Notice that the effect of this journal is to post the interest calculated in the bond amortization schedule (14,880) to the interest expense account. In effect, because the bonds

- Nsu Motorräder Online Kaufen _ Nsu Motorrad Preis

- Heinz Beekmann Verstärkt Die Geschäftsführung

- Weber Herrschaftsformen – Traditionale Herrschaft Einfach Erklärt

- Hms Hanse Management Solutions Gmbh In Quickborn

- Klavierpflege: So Machst Du Es Richtig!

- State Of The World’s Drinking Water

- Was Ist Der Ph-Wert Von Apfelsaft?

- Datev Export Bei Billbee: Billbee Rechnungen Exportieren

- Günstige Flüge Von Sialkot Nach Indien

- Stute Tragend, Haustiere Kaufen Und Verkaufen