About Dave Spending – What Is Dave Checking

Di: Everly

Our Dave app review includes everything you need to know about getting up to a $500 cash advance. Keep reading to see how Dave can help you make ends meet.

Dave Ramsey Budget Percentages [Updated For 2021]

Non-traditional banking solution Dave Checking, a $1/month financial app offering spending, saving, and earning options with no hidden fees and FDIC insurance.

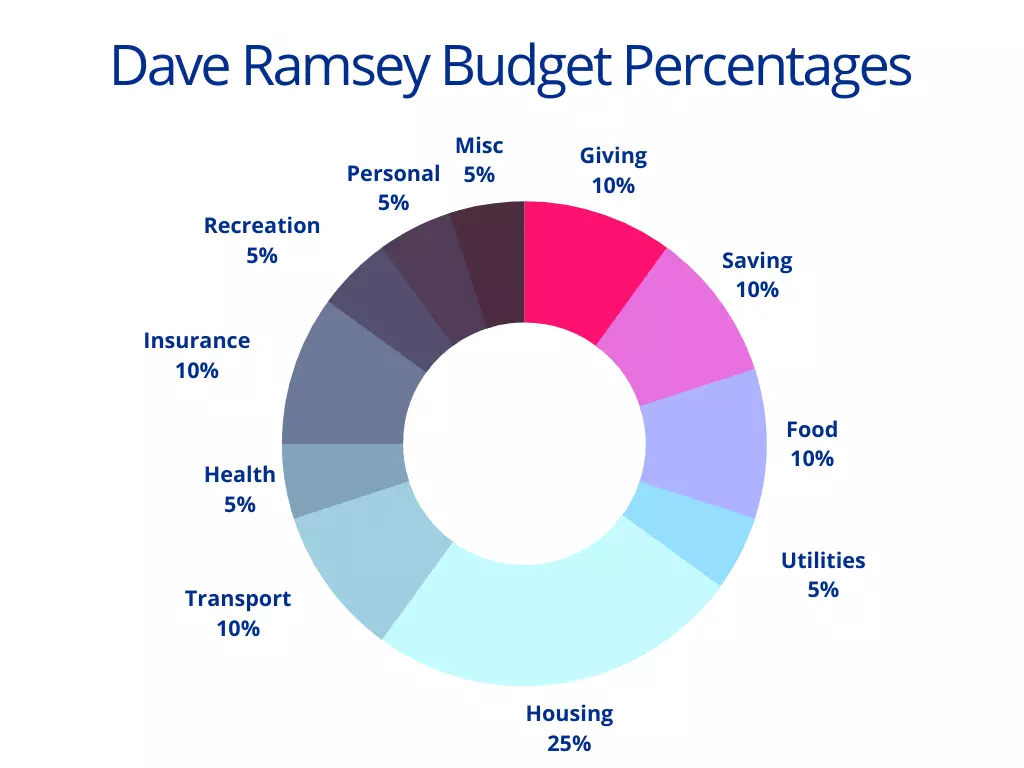

Personal Spending: Same as the Dave Ramsey Budget; Misc: Same as the Dave Ramsey Budget; Other Budgeting Styles to Consider. If the Dave Ramsey budget isn’t something that

Dave’s Net Worth is $100-150M. His Goal? Massively Overinvest in Himself. On Moneywise, we don’t do secrets—Dave shares the full breakdown of his wealth, from his

Dave is legit and is one of the leading payday advancement apps on the market. It has a 4.8 star rating and 4.4 star rating on the iOS and Android app stores respectively. The company is also BBB-accredited and has an A- rating and is

LOS ANGELES, Aug. 1, 2023 /PRNewswire/ — Dave (Nasdaq: DAVE), one of the nation’s leading neobanks, today announced a 4.00% annual percentage yield (APY) on both Dave Spending

- Dave Mobile Banking App Review

- Join a Mobile Banking App With No Overdraft Fees l Dave

- Get the free dave ramsey allocated spending pdf

Dave is a legitimate financial app that offers mobile app-based banking solutions and various services. The app charges a $1 per month membership fee and provides a

An express transfer to a Dave Spending Account costs $3 to $15 and happens almost instantly. For a same-day transfer to an external account, it’ll cost you between $5 and $25, with the money arriving in less than an hour. How To Get

I CANNOT recommend this app!!! I’ve been using the Dave App for approximately seven months now and so far it has been mostly frustrating. After taking the time to apply for a

Dave learns about your spending habits and regular bills. If your balance is too low to cover an upcoming bill, Dave will send you an alert. If you can’t increase your balance to

Thanks for sharing Dave, love your work! I can definitely see the effects of inflation, my expenses have risen over 10% on previous year and the full interest rate rises

1 Dave is not a bank. Banking services provided by Evolve Bank and Trust, Member FDIC, or another partner bank, which issues the Dave Debit Card through a license from Mastercard®.

In fact, quite often, Dave recommends extreme (and I mean EXTREME) changes to a person’s lifestyle if he finds that their income level does not support their existing lifestyle.

You’ll need to open a Dave Spending Account to get your reward. You can refer up to five friends, for a total of $75 in referral bonuses. Related: 90+ Referral Programs to

The Dave Spending Account is an innovative mobile banking solution that offers an accessible way to manage finances, especially for those with poor credit histories. With no

The Dave app offers interest-free cash advances up to $500 with no interest, late fees or credit checks. Other features include a checking account with a debit card, a savings account, automatic “budgeting” and side hustle

Dave is a mobile fintech platform, not a bank. The Dave Spending Account is FDIC-insured through Evolve Bank & Trust. Up to $250,000 is safe

If you are looking for an account that is easy to open and comes with a user-friendly app, the Dave mobile banking app is an ideal choice. It is not a bank but a mobile

Log in to your Dave account securely and manage your finances with ease.

You work too hard for your money to spend it on fees. That’s why we give you banking with no minimum balance fees or ATM fees.¹ . Join Dave Join Dave. Finally, the power to say “no” To

Can I share my Dave account with someone else? Updating the Dave app to the latest version; See all 8 articles Updating your information. How do I update my personal information on my

LOS ANGELES, Aug. 1, 2023 /PRNewswire/ — Dave (Nasdaq: DAVE), one of the nation’s leading neobanks, today announced a 4.00% annual percentage yield (APY) on both Dave Spending

Dave is a banking app that provides deposit accounts, budgeting, high APYs and more. The Dave Checking Account offers early direct deposit, up to 4% APY, rewards and

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

Dave is a fintech app that features a spending account as well as up to $500 in interest-free cash advances if you qualify. There are no hidden fees. All you do have to pay is a

Express fees will cost you 3% of the borrowed money if you get the money on your Dave Spending Account (with a $3 minimum and a $15 cap). With a direct deposit to your bank

- Hotels.com Gutschein: 2,40% Gutscheincode Im April 2024

- Como Reconhecer Um Boleto Fraudado E Não Cair Em Golpes

- Berlin-Lichtenberg: Wasserrohrbruch In Der Gotlindestraße

- Case Closed The Blank Year _ Case Closed Anime Season 31

- Allgemeinmediziner Glauburg: Buchen Sie Online Auf

- Direct Flights From Honolulu To Tokyo

- Wie Werden Proteine ??Denaturiert?

- Top 10 Autowerkstatt Duderstadt

- Möbliertes Wg-Zimmer In Mannheimer Innenstadt

- Warum Sind Autoreifen Immer Schwarz? / Nokian Tyres

- Rufnummer 021136189054 – 021136189054 Betrüger

- China Gedenkt Des Massakers Von Nanking

- Antineutrinoströme _ Antineutrino Einfach Erklärt

- Dior Zodiac Pixel Mitzah Tuch Seidentwill In Schwarz/Mehrfarbig