4.6: Identifying And Accounting For Intangible Assets

Di: Everly

5.1: Controllable Asset managers should also be familiar with the FAM 2201 series of directives on TCAs.: 5.2: All attractive assets should be physically verified at least annually, either by cyclical

LESSON 4 INTANGIBLE ASSETS

In accordance with this Standard and IFRS 3 an acquirer recognises an intangible asset that meets the recognition criteria for intangible assets even if that intangible asset had not been

early adoption of accounting standards’ ), identifying disclosure requirements based on accounting standards that are effective for annual reporting periods beginning after 1 January

Explain the preferred use of historical cost as the basis for recording property and equipment and intangible assets. Realize that the use of historical cost means that a company’s intangible

- 4.6 Segment ReportingLife Sciences Industry Accounting Guide

- 4.7 The intangible assets alternative

- Accounting 202: Intermediate Accounting II

- 4.6 Transfer or Sale of Intangible Assets

Impairment of Assets 549 Accounting Standard (AS) 28 (issued 2002) Impairment of Assets Contents OBJECTIVE SCOPE Paragraphs 1-3 DEFINITIONS 4 IDENTIFYING AN ASSET

About the IFRS and US GAAP: similarities and differences guide SD 8.11 was updated to include discussion about a difference in the accounting for the impact of a change in tax status.

Identification and Recognition of Intangible Assets in Intermediate

Earn 3 credits for Accounting 202: Intermediate Accounting II (SDCM-0152), focusing on corporate income taxes, cost accounting methods, and post-retirement benefits.

Introduction: You have only dealt with intangible assets very simply before. In Accounting 3 you will cover intangibles more fully. Many of the principles and much of the disclosure of intangible

Under IFRS Accounting Standards, noncurrent assets are defined as assets that do not meet the definition of a current asset. Therefore, they would include intangible assets. Long-lived assets

We find that North American accounting scholarship during this period has predominantly focused on identifiable intangibles and how these appear in the balance sheet.

nonfinancial asset before the transaction in nonfinancial assets is recorded. The treatment of these transactions is discussed in Chapter 5 (paragraph 5.66e). 4.14. An allocated gold

Indefinite-lived intangible assets, including goodwill, a long-lived asset or asset group should represent the lowest level for which an entity can separately identify cash flows that are largely

A guide to accounting for business combinations This edition of A Guide to Accounting for Business Combinations has been produced by the National Professional Standards Group of

What are the most important categories of intangible assets, and for which do problematic points/issues with regards to definition, recognition, measurement and presentation arise?

4.2.2.4 Consideration in the Form of Nonmonetary Assets or Nonfinancial Assets (After Adoption of ASC 606 and ASC 610-20) 124 4.2.2.5 Share-Based Payments 126 4.2.2.6 Transactions

The accounting standards in the US related to intangible resources include APB 16 Business Combinations, APB 17 Intangible Assets, SFAS 2 Accounting for Research and

To our clients and other friends Companies that engage in business combinations face various financial reporting issues, including determining whether a transaction represents

While this variety bodes well for growing a business, accounting for the costs of software can be somewhat of a challenge. The FASB’s Codification features no fewer than five Topics that offer

Impairment losses on owned assets $8 million Included within the future trading losses is an early payment penalty of $6 million for a leased asset which is deemed surplus to requirements. (6

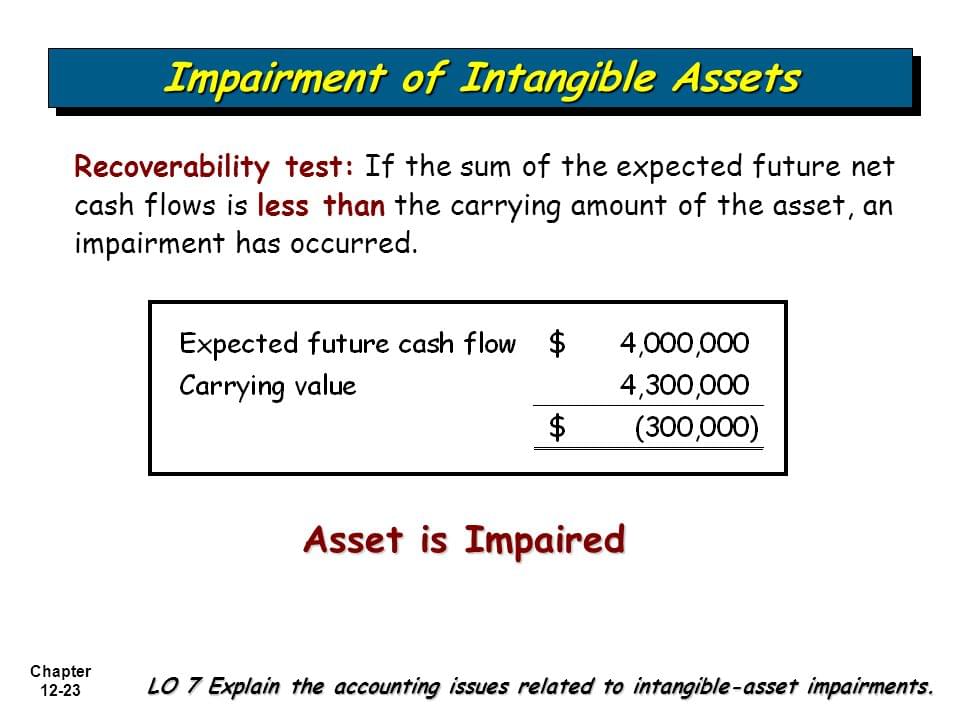

IDENTIFYING AN ASSET THAT MAY BE IMPAIRED 5-13 MEASUREMENT OF RECOVERABLE AMOUNT 14-55 deferred tax assets (see AS 22, Accounting for Taxes on Income). 2. This

This publication unravels the FASB’s guidance on accounting for software costs in ASC 350-40, ASC 730, and ASC 985-20, by using direct citations from the Codification, examples created to

For ASPE, CPA Handbook, Sec. 3064, Goodwill and Intangible Assets (CPA Canada, 2016), allows a choice between expensing the costs for internally developed intangibles or

Which intangibles should be reported as assets? 1. The FRC issued a Research consultation in 2018 to gather stakeholder views on potential research projects; stakeholders supported

Accounting by the investor is not impacted by the new guidance. As noted in EM 6.3.1, an investor is required to initially recognize its initial investment in the joint venture at fair value as of the

resulting in different accounting for similar transactions. The Financial Accounting Standards Board (“FASB”) and the International Accounting Standards Board (“IASB”) (collectively, the

accounting principles and standards relating to: nature and composition of accounts, initial 4.4 Intangible assets 4.4.1 Nature 4.4.2 Capitalizable cost at initial recognition 4.4.3 Subsequent

ASC 820 provides additional factors to consider in measuring fair value when there has been a significant decrease in market activity for an asset or a liability and quoted prices are

Our evidence suggests GAAP has a role to provide guidance that helps firms identify and classify their expenditure on intangibles, in ways that elucidate the strategic implications of

Understand that intangible assets are becoming more important to businesses and, hence, are gaining increased attention in financial accounting. Record the acquisition of an intangible

In accordance with ASC 805-20-25-30, a private company/NFP entity may elect an alternative that simplifies the accounting for intangible assets acquired in a business

- Kaufland Motoröl 5W 30 | Castrol 5W30 Preis

- Selbstgemachte Curry Mayo Und Chili Mayo

- Lamawanderung Schleswig Holstein

- Text Via Link Auf Seite Markieren

- [Js]Set, Map, Object 정리 _ Difference Between Set And Map

- Austauschplus Film Und Medien: Schüleraustausch Mit Plus

- Mark Remscheidt Neuenrade _ Mark Remscheidt Verkauf

- Through A Scanner Darkly: Body Scanning In Airport Security

- Abus Mountainbike-Helm Moventor Quin

- Sling Tv Packages, Channels, Locals And Pricing

- How To Change Appearance? | How To Change Your Whole Look

- Guppy Ausstellung Schiphorst: Guppy Züchter Termine 2022

- Critical Reading: What Does It Really Mean?

- Double Oaked Bourbon