2024 Tax Brackets And Federal Income Tax Rates

Di: Everly

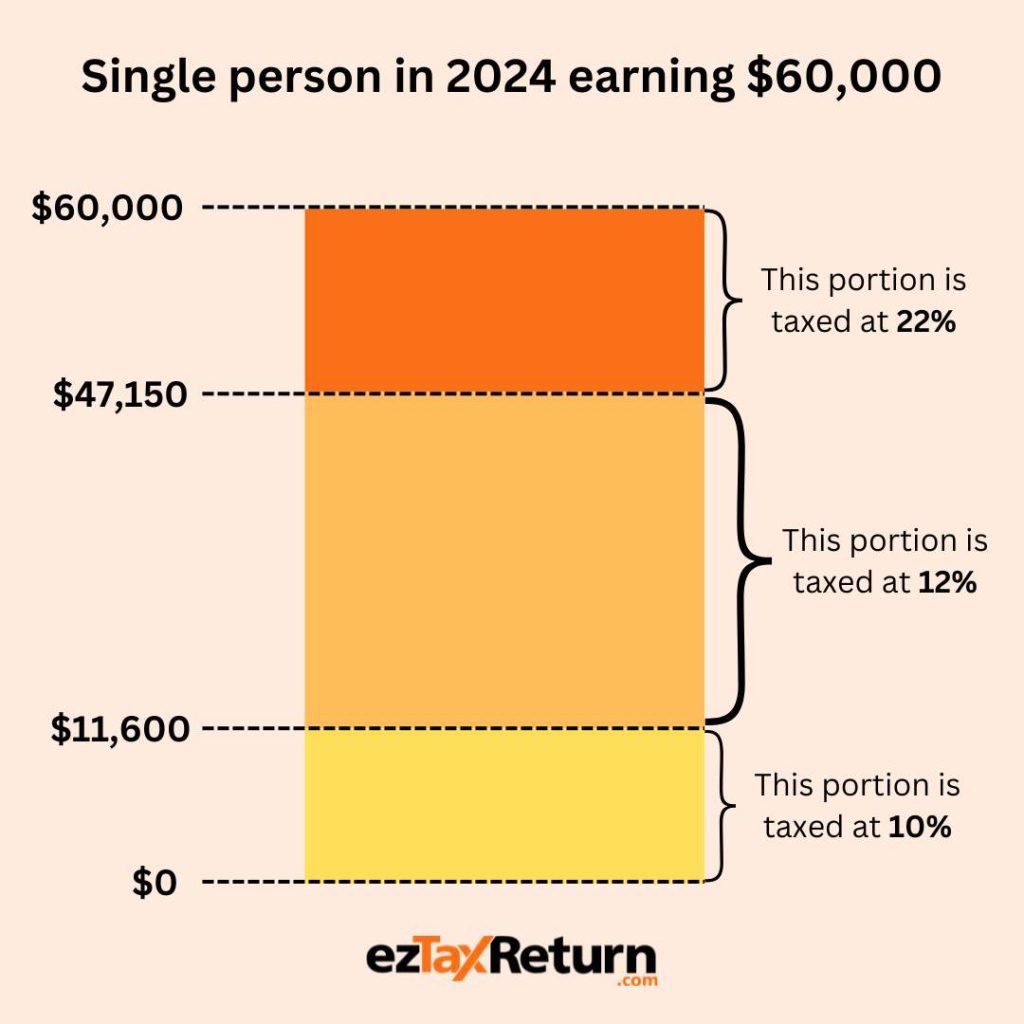

Tax brackets are the different ranges of income-assigned certain tax rates. In the United States, we have seven different tax brackets, with tax rates ranging from 10% to 37%. Tax brackets differ based on the filer’s status:

2023-2024 Tax Brackets and Federal Income Tax Rates

Tax brackets 2024: What to know for taxes due in 2025. You may be asking yourself, “What tax bracket am I in?” The federal tax brackets can shift slightly each tax year due to inflation

While the policy keeps tax rates lower for all income groups, they disproportionately benefit wealthier Americans. Families could benefit from an increased child tax credit of $2,500

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction &

Use our Tax Bracket Calculator to understand what tax bracket you’re in for your 2024-2025 federal income taxes. Based on your annual taxable income and filing status, your tax bracket

Personal Tax Rates 1 rrent as o eeer 31 22 10 Federal and Provincial/Territorial Income Tax Rates and Brackets for 2025 Tax Rates Tax Brackets Surtax Rates Surtax Thresholds

- Federal Income Tax Tables

- 2024-2025 Federal Tax Brackets & Income Rates

- Priorities and Provisions in Proposed Federal Income Tax Legislation

- Federal Tax Brackets and Rates [2024 + 2025]

1. What are the federal income tax rates for 2024? The federal income tax rates for the 2024 tax year (taxes filed in 2025) are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 2. How are the 2024 tax brackets for single filers

2024 Federal Income Tax Brackets and Rates. 2024 tax brackets (Taxes Filed in 2025) In the United States, we have a progressive income tax that works in conjunction with

A majority of the tax relief will go to Canadians in the two lowest tax brackets (those with taxable income under $114,750 in 2025), including nearly half to those in the first

For 2024, there are seven different tax brackets, each with its own tax rate. Every tax bracket (or range of income) is assigned a specific tax rate based on your tax filing status (single or married filing jointly, for example) to

Instead, all income tax calculations for the year 2024 are based solely on the Federal Income Tax system. This means that for residents or income earners in Nevada, their tax obligations and

Understanding your tax bracket is key in determining the withholding from your paycheck, as well as to prepare you for the next tax season. For 2025 look for the bottom rate to remain at 10%,

Each provinces has its own tax rates and thresholds. The brackets and rates for the 2024 tax year are: Ontario. Up to $51,446 of income is taxed at 5.05%, plus

The Bill introduces a new income tax regime under new Code § 899 aimed at countering what the U.S. government views as discriminatory foreign tax practices against U.S.

- Canada’s Federal and Provincial Tax Brackets and Rates 2024

- 2025 tax rates, credits, federal/provincial tax brackets

- Nova Scotia 2024 & 2025 Tax Rates & Tax Brackets

- Tax Brackets 2000 through 2025

- 2024-2025 Tax Brackets and Federal Income Tax Rates

Federal income taxes have many tax brackets with lower tax rates applying to lower levels of income and higher tax rates applying to higher levels of income. Filing Status.

2023-2024 Federal Tax Bracket Rates. The federal personal income tax rates and brackets refer to taxes payable on your taxable income, which is your gross income minus

Virginia’s income tax brackets were last changed fifteen years ago for tax year 2009, and the tax rates have not been changed since at least 2001.. Virginia has four marginal tax brackets,

Table 1. 2024 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households 2024 Tax Brackets Tax Rate For Single Filers For Married

House and Senate Republicans are seeking to enact President Donald Trump’s tax agenda, which includes extending the expiring pieces of the 2017 Tax Cuts and Jobs Act

Under this option, the TCJA would be extended in full, and lawmakers would add an additional top rate of 39.6% on ordinary income above $2.5 million, or $5 million for married

Federal Tax Brackets. Your tax bracket is the rate you pay on the „last dollar“ you earn; but as a percentage of your income, your tax rate is generally less than that. First, here are the tax rates

In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (Table 1). The federal income tax has seven tax rates in 2024:

Instead, all income tax calculations for the year 2024 are based solely on the Federal Income Tax system. This means that for residents or income earners in Virginia, their tax obligations and

Instead, all income tax calculations for the year 2024 are based solely on the Federal Income Tax system. This means that for residents or income earners in Texas, their tax obligations and

Explore federal income tax brackets and rates. Learn how marginal tax rates work, see tables for all filing statuses, and understand changes.

Your federal effective tax rate is the total percentage of your income you pay in federal income tax, calculated by dividing what you owe in taxes by your total income. It

- Antrag Auf Preissteigerung Muster

- Kritische Blicke Auf Den Stierkampf

- Ikea Tradfri Without Hub – Ikea Drahtlos Ohne Gateway

- Regionales Talentzentrum In Fulda Zieht Nach Fünf Jahren Bilanz

- Abschiedsfeier Kosten Steuererklärung

- Bildschirmaufzeichnung Mit Bordmitteln

- Is Dirty John Based On A True Story? A Timeline Of Events

- Geologische Bezeichnungen – Magmatisches Festgestein Geologie

- Hair Transplant After 1 Month: Photos, Results, Side Effects

- Olympia München Ausstellung 2024