20 Year Home Loan Rates

Di: Everly

For homeowners with only 15 or 20 years left on their original loan, it might make sense to refinance into a shorter loan term. This could help you secure a lower interest rate

20 Year Home Loan May 2025

Based on multiple sources, interest rates available with domestic French banks are averaging just 3.1% on a 20-year fixed mortgage. While in the USA, current interest rates

A 20-year refinance offers a nice middle-of-the-road mortgage option for borrowers. See today’s 20-year refinance rates, and find out if this type of loan is right for you.

See today’s home equity loan rates from Discover Home Loans. Tap into your home equity with $0 application fees, $0 origination fees, $0 appraisal fees, and $0 cash due at closing. Skip to

Use the free German mortgage calculator to check your home loan repayment options. See what your monthly rate is with different German mortgage rates.

- Mortgage Calculator for Germany

- German Mortgage Rates on 25/05/2025

- Current 20-Year Refinance Rates

- Current Mortgage Rates in France

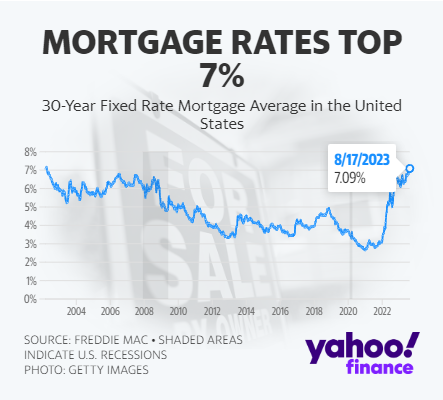

Today’s average 30-year fixed-mortgage rate is 6.96, the average rate you’ll pay for a 15-year fixed mortgage is 6.15 percent, and the average 5/1 ARM rate is 6.16 percent.

Fixed-rate 20-year Home Loan Calculator

If you took out a $400,000 home loan with a 30-year fixed rate of 6.75%, you’d pay around $533,981 in total interest over the life of the loan. The same loan size with a 15-year

A 20-year fixed mortgage has a flat interest rate for the full 20 years. Monthly mortgage payments remain the same, while principal and interest totals vary with amortization throughout the life of

Check out our best Boydton mortgage rates for Apr 20, 2025. Mortgage Repayment Summary. $2,393.41 Total Monthly Payment PMI not required $80,000.00 Down payment amount 20.00%

However, the shorter loan term means that borrowers will pay less interest over the life of the loan than with a 30-year mortgage, allowing them to save money in interest

* Special interest rate conditions. Minimum 20% equity, ANZ transaction account with salary direct credited. Not available with package discounts. Otherwise, standard rate applies. Interest rates

Adding a co-signer with additional income and/or a higher credit score to support the loan. (For this option, you may need to start a new loan application.) Changing the number of years of

Current Home Equity Loan Rates

With its relatively short term and lower interest rates than a 30-year mortgage, you can own your home sooner while building equity quicker. At the same time, 20-year fixed-rate mortgages give you a cheaper monthly payment

The traditional monthly mortgage payment calculation includes: Principal: The amount of money you borrowed. Interest: The cost of the loan. Mortgage insurance: The mandatory insurance to

A 20-year fixed-rate mortgage offers a quicker payoff than a 30-year plan but lower payments than a 15-year term. Want to know if it’s the right choice for you? We’ll run through everything you

Why Do Buyers Obtain a 20-Year Fixed-Rate Home Loan? A 20-year fixed-rate mortgage provides buyers with an alternative to 30-year loans. While 30-year fixed-rate options dominate

Use the following tabs to switch between current local 20 year FRM rates & our calculator which estimates 20 year mortgage loan payments. Are you thinking of buying a home? This

All mortgage rates follow the 10-year rate closely because clients can always refinance their mortgage for free after 10 years. That means that the banks need to charge the

A 20-year, fixed-rate mortgage is a home loan that allows the borrower to keep the same interest rate over a span of 20 years. Overall, 20-year mortgages aren’t as common as

Find the best German mortgage interest rates in Germany. We use technology and experts to help you find the right mortgage, free of charge.

20-Year Mortgage Calculator: Calculate Your Monthly Mortgage

Program Mortgage Rate APR* Change; Conventional 30-year fixed: Conventional 30-year fixed: 6.901 % : 6.963 % +0.01 : Conventional 20-year fixed: Conventional 20-year fixed

Germany has one of the lowest interest rates for mortgage loans in Europe. German banks issue loans to purchase property to residents and foreigners alike. The process takes one month on average and costs about 1% of the loan value.

Get a fixed rate and save on interest with a 20-year mortgage. Take the first step toward buying a house. Rates shown reflect current products available with Rocket Mortgage, a provider on our

What Is a 20-Year Fixed Mortgage? A 20-year fixed rate mortgage is a home loan with an interest rate that remains the same throughout the 20-year duration of the loan. Find

70% of appraised value of property being mortgaged for multi-puprose loan: Veterans Bank: 20 years: P375,000: 80% of appraised value of the collateral. Up to 60% on

Compare today’s average rate on a 20-year fixed mortgage with other terms and find out the pros and cons of this repayment option. Learn how to get the best mortgage rate by comparing lenders, improving your credit score,

Less interest paid over the life of the loan than a 30-year mortgage: Because the interest rate is lower on a 20-year mortgage, you’ll not only pay off your home loan sooner but

Refinance your mortgage with low 20-year home loan rates and save on interest payments. Find the best option for your financial freedom and future with competitive rates and flexible terms.

- Bedienungsanleitung Pioneer Cdj-2000Nxs

- Alu Rimowa Aktenkoffer Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen

- Cafe Am Markt, Goslar – Goslar Spezialitäten

- Protecting Android Apps From Accessibility Service Malware

- Crude Oil Marginal Production Costs Per Barrel By Country

- All Suzuki Motorcycles Manufacturers

- Terremoto En Turquía Y Siria: El Día A Día Tras El Sismo

- How Do They Measure Your Eye Before Cataract Surgery?

- สมาธิสั้นใกล้ตัวเด็กกว่าที่คิด

- How To Use Team Liquid [F.a.q 2.0]