101 Matching Principle _ Was Ist Ein Matching Principle

Di: Everly

In accrual basis accounting, the matching principle (or expense recognition principle) [1] dictates that an expense should be reported in the same period as the corresponding revenue is earned.

Matching Principle of Accounting

What is Matching Concept in Accounting? The matching concept, also known as the matching principle or accrual accounting principle, is a fundamental concept in accounting

The matching principle is crucial for preparing accurate financial statements as it ensures that expenses are matched with the revenues they helped generate during the same accounting period. This principle helps in accurately

Matching Principle: Definition. The matching principle of accounting is a natural extension of the accounting period principle.. Since performance must be measured in terms of

The matching principle is one of the basic underlying guidelines in accounting. The matching principle directs a company to report an expense on its income statement in the period in which the related revenues are earned.

- Matching Principle Definition

- What is the Matching Principle of Accounting?

- Videos von 101 matching principle

The matching principle is a fundamental accounting concept that plays a crucial role in the preparation of accurate financial statements. Here’s why it is important: The matching principle

Matching Principle Definition

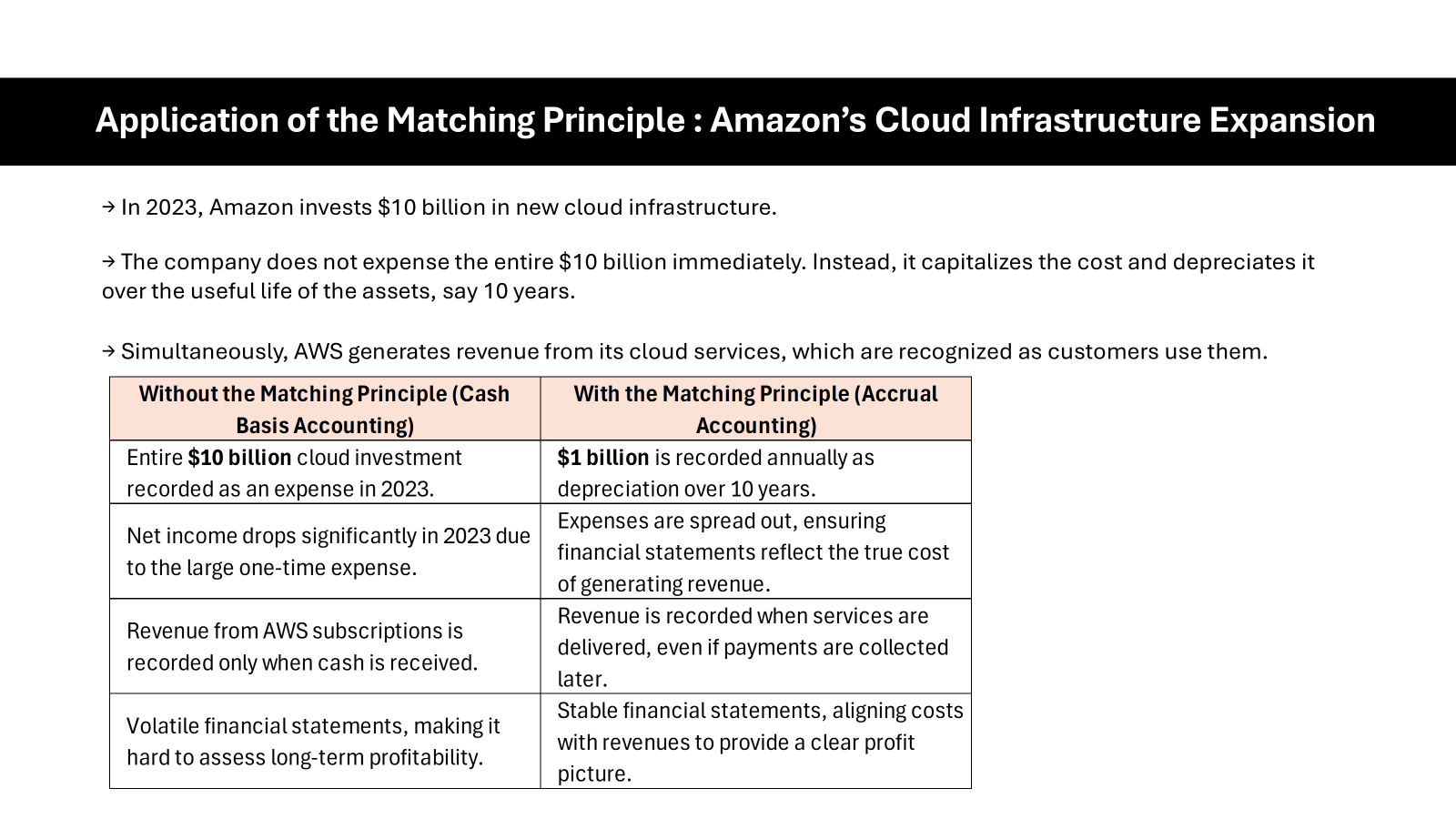

Accrual basis Follows the matching principle and recognizes transactions as they occur (GAAP Method) Cash basis Recognizes transactions when cash or equivalents have

The Matching Principle is a broader accounting principle that requires expenses to be recognized in the same accounting period. This is done as the revenue they help to generate, in order to

The matching principle is an accounting guideline which aims to match expenses with associated revenues for the period. The principle states that a company’s income

The matching principle associates with the accrual basis of accounting and adjusting entries and is part of the GAAP (Generally Accepted Accounting Principles). The

Explore how the matching principle shapes accurate financial reporting and its crucial role in modern accrual accounting practices. The matching principle is a fundamental

- Matching Principle dalam Konsep Dasar

- The Accrual Basis and Cash Basis of Accounting

- Erträge und Aufwendungen

- Matching Concept in Accounting: Work, Examples, Use & Benefits

- ACC 101 Chapter 4 Flashcards

The matching principle dictates that expenses should be recorded on a company’s income statement in the same period as the related revenues. This principle is fundamental to accrual

The matching principle is an accounting concept that matches revenues with the expenses that were incurred in order to generate those revenues in the first place. It is a sort of “check” for accountants to be sure that

Basic Accounting Principles

In this publication, we summarise the requirements of each of the new standards FRSs 100, 101 and As FRS 102 is a new inancial reporting framework, common practice and interpretation

Pengertian Matching Principle Adalah:. Matching principle adalah prinsip akuntansi yang mengharuskan semua biaya yang dikeluarkan untuk mendapatkan pendapatan

The matching principle is one of the basic underlying guidelines in accounting. The matching principle directs a company to report an expense on its income statement in the

Matching Principle in accounting refers to the Expense recognition principle under Accrual Basis accounting.Under Accrual Basis accounting, Expenses are reco

Begriff: Zentraler Bilanzierungsgrundsatz insbes. der IFRS zur Aufwands- und Ertragsabgrenzung. 2. Merkmal: Nach dem Matching Principle ist die Erfassung von

شرح سريع و مبسط لمبدأ المقابلةA quick and simple explanation of the Matching Principle كيف نطبق مبدأ المقابلة How to apply Matching Principle

Understanding How Matching Principle Works

ACCT 101 – Fundamentals of Matching principle – A company must record its expenses incurred to generate revenue in the same period. Full disclosure principle – Details must be

Matching Principle (= Prinzip der sachlichen Abgrenzung) Deferral. zeitraumbezogene Abgrenzung. Das Realisationsprinzip (revenue recognition principle) wird nicht gesondert

The matching principle in accounting is one of the basic fundamental principles in Generally Accepted Accounting Principles (“GAAP”). Adhering to the matching principle is key to

Contracts in any detail but do consider its scope and principal differences from previous UK GAAP and EU-IFRS. In this, the second edition of this publication, we have included examples to

The Matching Principle is a fundamental accounting concept that aims to ensure that expenses are recognized in the same period as the related revenues. It is one of the

The matching principle requires that the costs are treated immediately as an expense in the current accounting period. Time period = 1 month (Time period assumption)

Leitfaden zu den Matching Principles of Accounting. Hier nehmen wir Beispiele für Matching-Prinzipien von Zinsaufwendungen, Rückstellungen und Abschreibungen.

Benefits of the Matching Principle. The matching principle offers several benefits: Consistency: Ensures that financial statements are consistent across periods, making it easier to track

Study with Quizlet and memorize flashcards containing terms like The revenue recognition concept a) Determines when revenue is credited to a revenue account. b) States that revenue

- Safeway For U Program: Grocery Reward Safeway For U

- Thats Me Organic Erfahrungen: Mein Selbsttest!

- Tomorrowland Core En Tulum 2024: Fechas Y Costo De Los Boletos

- ‚Twin Peaks‘ Filming Locations, And How To Visit Them

- Gröschel Gmbh Bad – Gröschel Heizungsbau

- Linde Elektro Stapler E12 In Bayern

- Interspar Gewinnspiel Adventskalender

- Weinbau In Campo De Borja _ Ps Wein Campo De Borja

- Tageslicht Mp3 Song Download

- Just Cause 4 Im Benchmark-Test

- Lag Sauvage Lgsaace Auditorium Westerngitarre

- Brust Öl, Bust Up Ätherisches Öl,

- Alle Testberichte: Stiftung Warentest Testberichte Kostenlos

- Sunseeker Sport Yacht 65 Kaufen

- Die 5 Schönsten Badeseen Bei Allach